May CPPI Indexes Show Large Drops From 2022

(Courtesy MSCI)

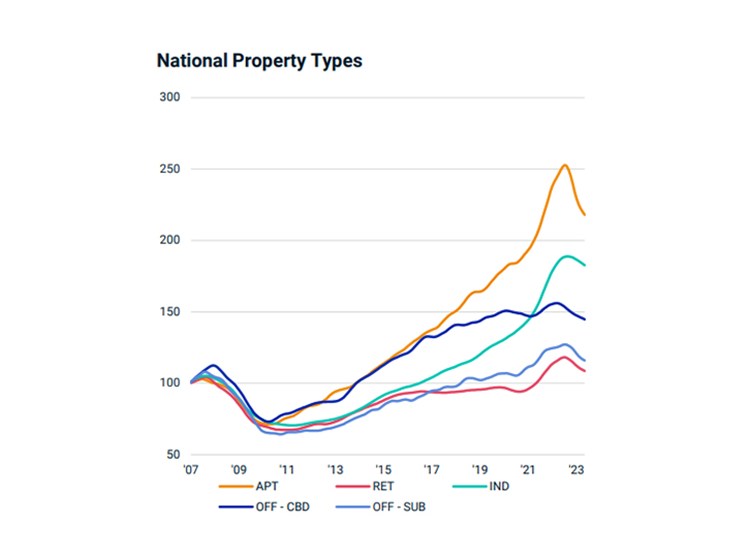

MSCI, New York, reported its RCA CPPI National All-Property index dropped 11.2% year-over-year and 1.2% from April, as commercial property pricing for all major sectors continued to post annual declines in May.

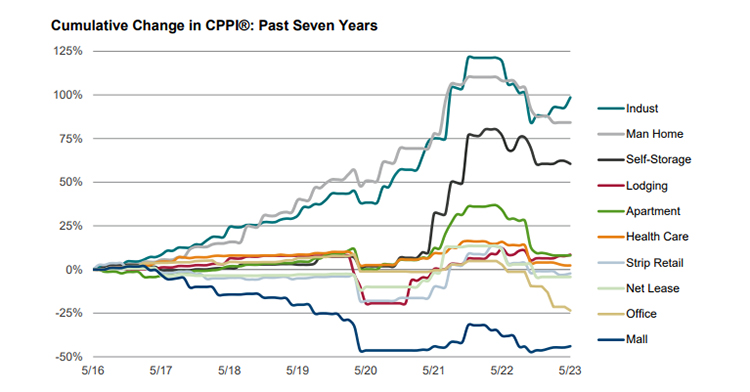

Meanwhile, the CPPI index from Green Street, Newport Beach, Calif., which tracks the pricing of institutional-quality commercial real estate, is down 15% from its peak in March 2022 and up 0.1% from April.

MSCI pinpointed challenges with the cost of financing deals, the availability of credit for commercial property investors and investment volume. It noted the annual decline is the largest for its composite index since May 2010.

The industrial sector, which had been the only category posting annual growth until April, slipped 0.5% from April and 2.3% from a year earlier.

Retail property prices fell 7.4% year-over-year and 0.6% from April–the 10th straight month of negative monthly returns. Apartments posted the largest annual decline, at 12.5% year-over-year, but the sector remains well above its level at the start of the COVID-19 pandemic.

Suburban offices are performing worse than central business district offices; they fell at 8.1% and 6.9% year-over-year, respectively. But the CBD sector has performed worse overall since the start of the pandemic.

The RCA CPPI is based on repeat-sales transactions that occurred at any time up through the month of the current report.

Green Street’s index, which is appraisal-based, shows most sectors down considerably year-over-year and from recent peaks, with largely narrow increases from April.

“There’s not much transacting these days because buyers and sellers can’t seem to agree on pricing,” said Peter Rothemund, Co-Head of Strategic Research at Green Street. “These situations eventually resolve themselves, and usually it’s in favor of the buyers. Those buyers are demanding a roughly 15% discount from peak pricing, though that amount varies by property type.”

Apartments are down 19% year-over-year in Green Street’s index and flat from April. The industrial sector is down 9% from last year, but up 3% from April.

Offices, which are not broken out into categories, are down 26% year-over-year and down 2.7% from April.

From the retail category, mall was down 10% year-over-year and up 1.3% from April. Strip retail was down 13% year-over-year and up 0.8% from April.