CBRE Projects Office Market Imbalance to Improve as Construction Cools

(Courtesy CBRE, Dallas)

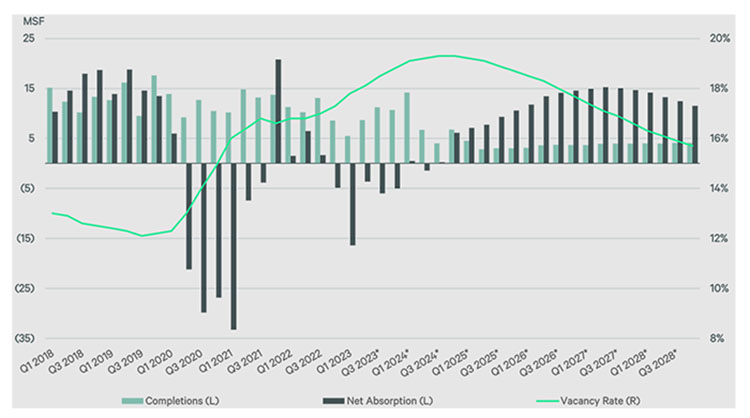

CBRE, Dallas, reported the supply and demand imbalance in the office market should begin to ease as the number of planned new office developments falls in the next few years.

CBRE said in a new report that construction activity is poised to cool due to factors including higher interest rates and less available financing; its Econometric Advisors division forecasted that construction completions will slow to a quarterly average of 4 million square feet from mid-2024 through 2028.

That contrasts with the current quarterly average of construction completions, which has increased since the start of the pandemic to a historically high 11.3 million square feet from a 10.7 million-square-foot 20-year average.

Office vacancy reached a 30-year high in the first quarter of 2023, at 17.8%. New buildings completed since Q1 2020 have a vacancy rate of 22.1%.

CBRE projected that U.S. office vacancy will peak between 19.3% and 21.4% in late 2024 and then gradually decline to about 16% by 2028.

Considering the demand side, CBRE’s Spring 2023 Office Occupier Sentiment Survey delved into trends in companies’ use and expectations regarding office space.

One major takeaway was that more companies are requiring employees in the office–at least some of the time–at 65% of respondents, with 38% anticipating increased office attendance through 2023.

However, over half of respondents did anticipate further reductions of office footprints to trim unoccupied space. More than half also reported a plan to relocate to better quality space.