Veros Forecast Sees Western Housing Markets Struggle; Further East Markets Shine

(Courtesy Veros, Santa Ana, Calif.)

Veros Real Estate Solutions, Santa Ana, Calif. anticipates a strengthening housing market for the next year.

“Home prices, on average, are expected to increase 1.7% over the next 12 months compared to a flat forecast last quarter – signaling a possible light at the end of the tunnel,” Veros said in its second quarter VeroForecast report.

While Western U.S. markets–once the darlings of the real estate world–display signs of weakness, the Midwest and Eastern states have emerged as hotspots for homebuyers seeking affordability and economic stability, Veros said.

The VeroFORECAST evaluates home prices in more than three hundred of the nation’s largest housing markets.

“The housing market is trapped in a state of low supply as many homeowners are keeping a tight grip on their rock-bottom mortgage rates,” the report said. “With the Federal Reserve pausing interest rate hikes due to receding inflation, mortgage rates are projected to hover around 6.5% to 7%. Some buyers have started to warm up to these rates and are returning to the market, driving prices higher. However, buyers are still seeking affordability.”

The report noted some Western markets, such as San Francisco and Seattle, are still priced very high despite the recent decline. “San Francisco is losing residents, and with the job losses in the hallowed halls of the technology sector, it is no wonder that its once-sizzling real estate market is predicted to remain weak,” Veros said. “Austin, Texas, and other former top-performing metros in Utah and Idaho are also expected to stay cool in the coming year.”

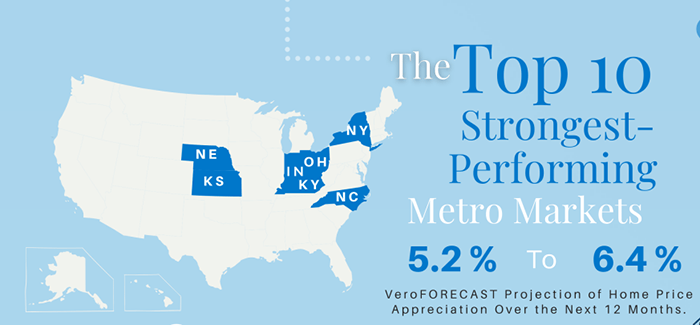

The ten strongest-performing markets in the forecast are expected to appreciate between 5% and 6.5% over the next 12 months.

Some cities, including Rochester, N.Y., Lincoln, Neb., and Cincinnati have seen thriving economies, diverse industries, and a lower cost of living, making them attractive destinations for individuals and families looking to establish roots. Other top-performing markets are in North Carolina, Ohio, and Kansas, Veros said. The Veros forecast said the ten least-performing markets will likely witness a modest depreciation of between -2.5% and -4%.

This list included three Texas markets, Austin, Brownsville, and Victoria; several expensive metros including Seattle and San Francisco; and the relocation destinations of the pandemic, including St. George, Provo-Orem, and Salt Lake City in Utah, as well as Boise, Idaho. “The rate of depreciation has softened for these markets compared to the previous quarter, as supply has dwindled, and prospective buyers are slowly returning to the market,” the report said.