First American’s Mark Fleming: Why Higher Mortgage Rates Don’t Always Lead to Declining House Prices

Mark Fleming is Chief Economist for First American Financial Corp., Santa Ana, Calif., and leads First American’s Decision Sciences team.

In April, housing affordability improved relative to one month ago, as two of the three key drivers of the Real House Price Index, income and mortgage rates boosted house-buying power by 2.3 percent. Median household incomes increased by 0.1 percent compared with March while mortgage rates dipped by 0.2 percentage points. Nominal house price growth was up 0.4 percent compared with one month ago, but it was not enough to offset the affordability boost from rising incomes and falling rates. Nominal house price growth has re-accelerated in recent months and even reached a new peak in April.

Do Rising Mortgage Rates Always Slow Nominal House Price Appreciation?

Since 2021, the housing market has slowed by design as the Federal Reserve tightened monetary policy to tame inflation, which has, in turn, cooled the housing market. Yet, house prices have remained resilient, even in the face of fast-rising mortgage rates. That’s because the relationship between rising mortgage rates and home prices may not be as straightforward as many believe.

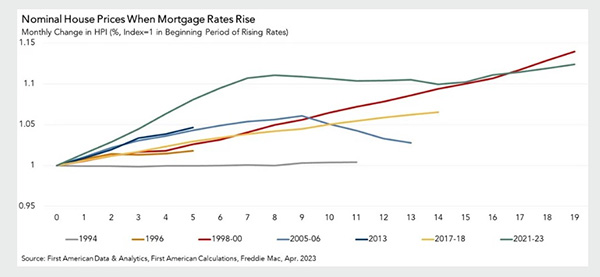

The graph below shows unadjusted house prices in seven rising mortgage rate eras over the past three decades. It quickly becomes apparent that house prices seem to be resistant to rising mortgage rates. Apart from the 1994 rising-rate period, when house prices declined slightly and briefly, house prices have often continued to rise, albeit more slowly, when rates have increased. The other exception is the 2005-2006 period, during the U.S. housing bubble, when house prices peaked in early 2006 and subsequently declined.

In one of the longest rising mortgage rate eras, 1998-2000, nominal house prices remained elevated as the economy continued to recover from the previous recession. This period was defined by tight labor markets, low inflation, and an increase in the minimum wage, all contributing to a healthy housing market. During this era, house prices increased 14 percent nationally in just over a year and a half. In the 2017-2018 rising mortgage rate era, nominal house prices increased approximately 7 percent in 15 weeks.

In today’s housing market, nominal house prices declined in the second half of 2022, but have since re-accelerated. Since the start of this rising mortgage rate era, house prices have increased by over 12 percent nationally. Nominal house prices need to adjust to the reality of higher mortgage rates to allow for the housing market to become more affordable and balanced, but a fundamental housing supply shortage is keeping a floor on how low house prices can go.

Where are Nominal House Prices Headed?

The takeaway is that, historically, house prices are resilient to rising mortgage rates, but just how resilient depends on the economic environment. House prices are generally ‘downside sticky,’ as home sellers would rather withdraw from the market than sell at lower prices. Additionally, housing supply remains so restricted that any uptick in demand will put upward pressure on prices. Even as the Federal Reserve continues to fight inflation with restrictive monetary policy, which will keep upward pressure on mortgage rates, don’t expect house prices to decline dramatically. History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to NewsLink Editor Michael Tucker at mtucker@mba.org or Editorial Manager Anneliese Mahoney at amahoney@mba.org.)