Black Knight: Mortgage Locks Edge Lower in June; Credit Availability Continues to Tighten

(Courtesy Black Knight)

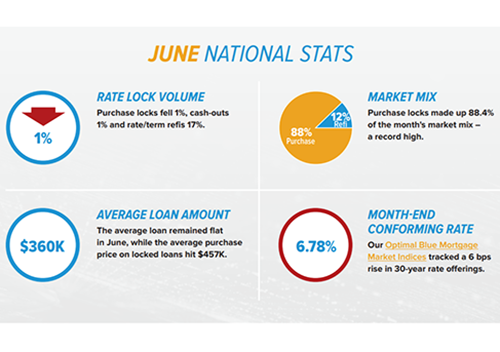

Black Knight, Jacksonville, Fla., reported overall rate lock volumes were down 1% month-over-month in June, with conforming loans gaining share mainly at the expense of non-conforming loan products.

The firm’s Originations Market Monitor report said purchase lock counts were down 31% year-over-year and 29% compared to pre-pandemic levels in 2019 as higher interest rates and low inventories continued to have a chilling effect on demand.

Though purchase lending remains constrained, it still drives the overwhelming majority of volume, accounting for more than 88% of June rate locks – a record high, Black Knight said.

“As May gave way to June, we saw banks lose some of their appetite for jumbo loans,” said Andy Walden, vice president of enterprise research and strategy at Black Knight. “Purchase loans continue to claim a larger share of a shrinking origination pipeline, as refinance opportunities remain scarce. Indeed, we saw the purchase lending share of June’s locks hit another all-time high. But keep in mind: it is a dominant share of a very constrained market.”

Black Knight reported the month’s pipeline data showed rate lock activity fell across the board, edging lower by 1% overall on a month-to-month basis, with purchase locks down a scant 0.6%, cash-out refinances falling 1.4% and rate/term refinance locks off by almost 17%. Purchase locks accounted for 88.4% of locks in June, the highest share on record. Even so, purchase lock counts were down 31% year over year and 29% compared with pre-pandemic levels in 2019.

“The housing market has been reheating as we approach the traditional tail end of the homebuying season,” Walden said. “What’s clear is that continued economic uncertainty, tightening credit and affordability concerns have all helped to skew the market toward higher-credit borrowers. In fact, the average credit score among purchase locks hit a record high in June. Likewise, the average purchase price rising for the seventh straight month while the average loan amount remained flat suggests lower loan-to-value ratios as well.”