Lender Intentions Survey: Less Origination Activity Expected

(Courtesy CBRE, Dallas)

Lenders cite rising interest rates, a looming recession and possible lower property valuations as their greatest challenges at the moment, reported CBRE, Dallas.

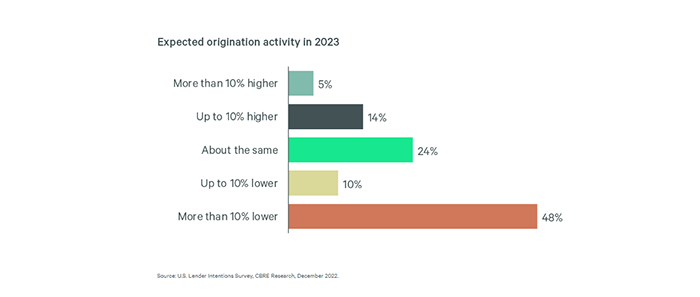

The firm’s U.S. Lender Intentions Survey said nearly 90% of lenders expect more conservative underwriting standards will reduce loan origination activity this year from 2022. “Underwriting assumptions in 2023 will focus on cap rates, exit strategy and debt yield,” the report said.

CBRE said nearly half of those surveyed said they anticipate a 10 percent or more decrease in originations. Only 19% said they expect to increase origination activity this year. But the report noted 91% of lenders are currently quoting and winning new business despite more conservative underwriting.

CBRE said it expects origination activity will pick up around mid-year 2023, “as interest rates and economic conditions begin to stabilize.”

Lenders remain bullish on high-growth secondary markets in the Sun Belt, including Miami, Raleigh-Durham and Atlanta. Western markets such as San Francisco, Phoenix and Portland raise the most concern, the report said.

“Industrial and multifamily are the most preferred property types for U.S. lenders, while office is the least preferred,” the report said. “Among alternative assets, life science facilities are the most preferred, followed by student housing and self-storage.”

More than half the lenders surveyed indicated they will continue to adopt Environmental, Social and Governance criteria, CBRE noted. But given the challenging economic environment, more than one in three respondents said they expect to “reconsider or delay” their adoption of ESG criteria.