BREAKING NEWS

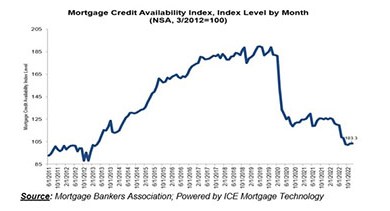

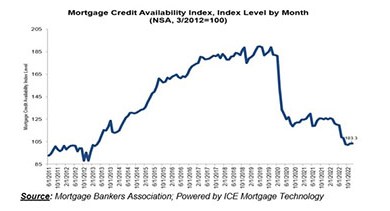

MBA Mortgage Credit Availability Index Down Slightly; MISMO Releases 2022 Annual Report

Mortgage credit availability fell by just 0.1 percent in December, the Mortgage Bankers Association reported Tuesday.

DELRAY BEACH, Fla.--MISMO®, the real estate finance industry's standards organization, today released its 2022 Annual Report here at its Winter Summit.

Here’s a summary of recent housing/economics articles that came across the MBA NewsLink desk:

The global real estate market should start to stabilize by mid-2023, said Colliers, Toronto.

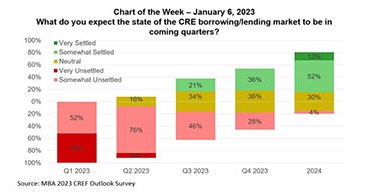

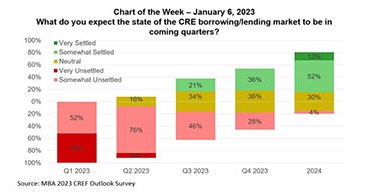

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

Institutional Property Advisors, Calabasas, Calif., sold The Shops @ Rockvale, a 581,462-square-foot regional outlet center in Lancaster, Pa., for $30.5 million.

The MBA NewsLink 2023 Tech All-Star Awards nomination period is underway. Nominations will be accepted through Friday, Jan. 20.

In their cyclical fashion, most lenders are dusting off some antiquated home equity programs, most having spent no energy to prepare for this market opportunity. Given the past few years of overflowing refi pipelines, that is not surprising. Why plant corn if the market price for soybeans is breaking records? Conversely, multiple vendors have set themselves up to help lenders and credit unions successfully market, process, service and trade home equity loans and HELOCs.

A year that started out on a high from record-breaking originations, has now come to a close with the industry taking a long look at how to press forward. At first blush, the next two years are likely to be challenging, but I lean more towards the optimistic view and see this time period as one filled with opportunity.

Here are three key takeaways that mortgage companies should know to help meet compliance requirements and protect borrowers and their organizations in the process.

The reality is that market has been very strong for so long that many originators took for granted that they could do the same things and still produce the same results. But as they’re now finding out, that was never going to be the case.

Academics, consultants, and vendors advocate for “data-driven” enterprises underpinned by augmented analytics, adaptative AI/ML, digital ethics, consumer privacy, and AI security. Yet, as the pace of innovation rises across financial markets and consumer models, the organizational capabilities of leveraging data are declining. What is wrong with this picture?