Mark P. Dangelo: In the ‘Year of the Rabbit,’ Data is a Slow Tortoise (Part 1)

Mark Dangelo currently serves as an innovation officer to private equity and VC funded firms spearheading digital fabrics, data sovereignty, MAD data science and decentralized finance. He is also a country leader for Dataswift.io and a graduate professor of innovation and entrepreneurship at John Carroll University. He is author of five books on innovation and a frequent writer for MBA NewsLink.

The inventor of the World Wide Web, Tim Berners-Lee, passionately believes that data continues to drive future Internet capabilities, while changing consumer behaviors. Moreover, he says, “Data is a precious thing and will last longer than the systems themselves.[i]” Indeed, we know that this axiom regardless of the innovations, apps, or cloud offerings deployed continues to be proven true despite the revolutionary advancements of computers, digitization, clouds, and network technologies spanning the past four decades.

Layer on a decade of digital transformations and billions in initiatives designed to move paper-based processes to digital solutions, and we can understand the priority surrounding data—and leadership’s belief that when it comes to data-driven capabilities, “they have it covered.” However, data continues to be created at an exponential rate, but over 60% of what is stored and captured is never accessed. With the focus on systems to deliver data-driven decisioning, the “questions asked” are changing and the data required for these evolving use cases age quickly, underpinned by transformative digital products, services, and consumer demands. With so much data available, why aren’t we making better decisions?

Economic and Data Questions

As 2023 gets underway, cascading impacts of interest rates continue to drag markets negative. Moreover, lending volumes are less than one-half of their $4.1 trillion peak in 2021, and profitability once defined by volume continues to decline. Factor in the political and economic challenges already in the headlines, and it is easy to anticipate that regulatory compliance demands will consume larger portions of budgets during the next two years. What many FSI leaders and mortgage organizations now understand, is that when it comes to data-driven decisioning, analysis, and especially in lending, being “adequate” will no longer provide returns or customer for-life relationships.

The questions moving forward come into focus as the financial services and mortgage industries are reimaged against global economic pressures and central bank tightening:

- How can the organization leverage existing investments in people, processes, and technologies?

- What partnerships will be valuable as part of a mosaic of solutions?

- Who are the outsourcing or cooperative enterprises that can reduce costs, while delivering quality of services?

- Where should strategies be adjusted, divestures made, and innovation adopted?

- Why are the data-driven investments failing to return positive results after a decade of transformations?

Moving forward, FSI and mortgage operations must execute their data-driven strategies across digital ecosystems, which are fast moving and continuously morphing. To make the goal more elusive, execution challenges are made increasingly difficult by the explosion of data availability and the quality of its content. It is within this context, and operating frameworks that personnel find themselves encased—creating business science and technology stacks that are easily assembled and disassembled.

Why is it Difficult? Putting “Data-Driven” Organizational Challenges into Context

We live our lives and run our businesses utilizing layers of cloud and local solutions. Current generational consumers (i.e., #GenZ and #Millennials) demand digitally native experiences compared to traditional industry designs, which were designed around physical touchpoints (e.g., branches) and paper documents. Moreover in 2023, the trend of utilizing cloud solutions—public, private, hybrid—will continue to accelerate at a year-over-year growth over 25% strengthened by anything-as-a-service (#XaaS) offerings.

Yet, as cloud solutions and portability continue their 15-year advancements in capabilities, digital information has skyrocketed doubling every 2.0 to 2.4 years. How will our organizations find precise information within oceans of data? What techniques and methods will yield the insights and outcomes desired? Additionally, as primitive digital transformations (DT) yield to continuous improvement and cross-functional DT programs, how will vast, evolving systems—cloud or internal—weave together the data?

Contextually, the volumes of data, financial and mortgage, are so great that it they’re hard to comprehend without familiar references. There is an estimated 352,670,000,000,000,000,000[ii] gallons of water in the world—creeks, rivers, seas, and oceans. If each of those gallons was a byte, that would represent approximately 352.7 exabytes (which is 1 followed by 18 zeros).

Data created and stored in 2023 will represent over 400% more than all the gallons of water in the world (i.e., >3.5 quintillion bytes or 3,500,000 terabytes of data is created per day), and by 2030 generate over 200 zettabytes per year (zettabyte = 1,000 exabytes or 1,000,000,000 terabytes). And it is worth noting of those 200 zettabytes, over one-half will be machine generated (e.g., #IoT) and consumed without a human ever validating the information.

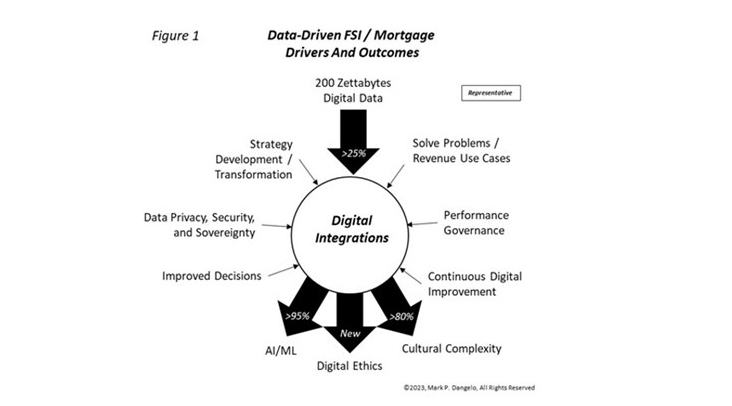

Furthermore, factor in advanced privacy regulations, such as #CCPA and #GDPR, linked with exploding data sovereignty demands, and the ability to holistically weave together disparate, virtualized sources represents skills and strategies foreign to most enterprises. Figure 1 is a representation of the numerous drivers and emerging outcomes impacting the implementation of a data-driven enterprise.

Moreover, consultants and their research groups demonstrated the value of #FinTech and #RegTech creating volume capabilities which satisfied market demands. A consequence of these technology solutions were interoperability and scalability challenges to increasingly multi-faceted data-driven requirements. As digital demands grow, what is being spotlighted is a failure of IT systems to adapt quickly. The implication is a new “lock-in” with legacy FinTech and RegTech vendors defined by fragmentation that limits the value of virtualized or #ETL data.

Finally, against the compounded data volumes, are additional barriers to data-driven adoption—organizational culture, data trust and “rehoming,” siloed data meshes, digital ethics, and business science skill sets. The digital framework against the industry reimaging is forcing a holistic reassessment of what, how, who will define and deliver data-driven improvements during significant crisis requirements.

The Demands of Digitized Data—the Evolutionary Challenges

FSI solutions since 2010 have paved the “cow paths” rather than anticipate the current and future native digital ecosystems @scale. Moreover, organizations have spent heavily on digital solutions and transformations since 2010, but these expenditures were the price of “admission” for continued market participation. And while the outcomes of these vast innovational implementations resulted in higher quality data and (loan) products, the sustainable differentiation when compared to competitors was brief.

Traditionally, organizations invested in data-driven solutions such as adaptative analytics to stay ahead of competitive forces. However, these expensive pathfinder initiatives were not always comprehensively aligned to consumer standards or evolving market behaviors, let alone the internal capabilities necessary to sustain or leverage digital innovations. These initiatives panned with lofty expectations failed to achieve data-driven efficacy beyond the silos in which they were implemented. Why?

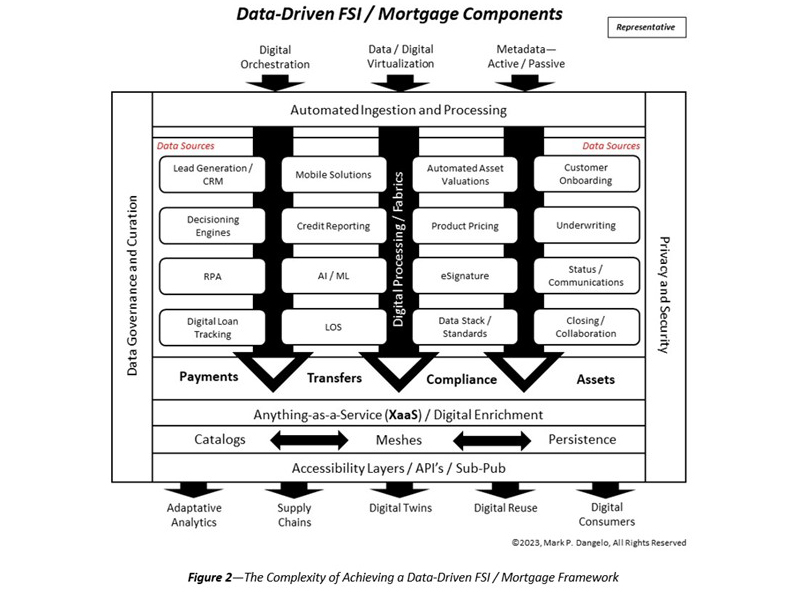

The data landscape is growing more complex, demanding additional facets, including changing technologies, and most importantly, adopting evolving (and iterative) business models to serve new customer demands and behaviors. Figure 2 provides a representative model for understanding the varied facets of organizational data-driven building blocks and the underlying fabrics necessary to leverage rapid-cycle business changes.

As illustrated in Figure 2, the 70% historical failure rate to achieve data-driven capabilities and expand on their initial results fundamentally resides in holistically mapping out the interoperability demands against the potential for successful implementation. Additionally, enterprises focus too often on the technology and the systems—not the data and the skill sets necessary to facilitate the continual digital metamorphosis now required across FSI and mortgage front and back-office processes.

To achieve adaptable, data-driven solutions enterprises will require personnel who have IT and data science expertise (50%) and industry business experiences (50%) as part of evolutionary internal roles necessary to achieve results. While nearly 70% of FSI companies have hired Chief Data Officers (#CDO) during the last decade, those roles are firmly within the “science” of systems. However, these specialized teams lack the industry knowledge and depth to deal with complex customer and regulatory challenges. The evolution of these CDO’s and their teams will morph into the data-driven “business science” #FTE’s—again an unfamiliar demand for achieving data-driven capabilities.

As we reach the end of Part 1, it is easier to understand that the greatest challenge faced by FSI and mortgage leaders striving for data-driven decisioning begins with the organizational culture—an impediment that contributes to over 90% of failures. It is also, when examined beyond the silos of functional thoughts, easy to see the multi-faceted drivers and complexities inhibiting data-driven solutions represented in Figures 1 and 2. It is also easy to see that the decade of focus on the science of data was a good starting point—but its value has proven limited without deep, industry knowledge or experiential learning to provide the innovative relevance.

As data continues to explode and reaches 200 Zettabytes, the ability to find the relevant elements, trends, and feeds will be a continuous, adaptable process that demands building blocks of innovation and orchestrated layers of virtualized data. In the end (and starting in Part 2), FSI and mortgage leaders will be able to weave data into “fabrics” of data-driven relationships that move beyond the hype of cloud computing, digital conversions, and industry standards.

FSI and mortgage firms will experience 2023-2024 seeking a “magic button” that can deliver their operations and margins from market-forced industry reimaging. As engineers know using their crawl, walk, run axiom, data-driven solutions across native digital designs for FSI and mortgage operations are moving from crawl to walk. Ask yourself, how many of the failed industry firms in 2022 and coming in 2023 thought they “had data-driven decisions or regulatory compliance covered” and were sprinting along before the ground disappeared beneath their feet? A crypto analogy comes to mind …

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)

[i] “How much data is generated every day in 2022?”, Jason Wise, Earthweb

[ii] 352.7 quintillion gallons or 352,700 trillion gallons