Housing Starts Finish 2022 at 6-Month Low

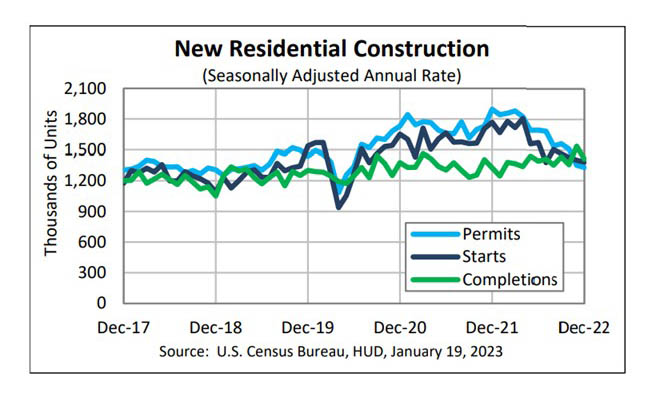

Housing starts ended 2022 down for the second straight month to their lowest level since last July, HUD and the Census Bureau reported Thursday.

The report said privately owned housing starts in December fell to a seasonally adjusted annual rate of 1,382,000, 1.4 percent lower than the revised November estimate of 1,401,000 and 21.8 percent lower than a year ago (1,768,000). While single‐family housing starts in December rose to 909,000 units, 11.3 percent higher than the revised November figure of 817,000, the December rate for units in buildings with five units or more fell to 463,000, down by nearly 19 percent from November and by 16.3 percent from a year ago.

An estimated 1,553,300 housing units started in 2022, 3.0 percent (±2.4 percent) below the 2021 figure of 1,601,000, the first annual decline since 2009.

Regionally, a huge increase in the Northeast was not enough to offset declines in the South, West and Midwest. In the Northeast, starts jumped by 135.6 percent in December to 212,000 units, seasonally annually adjusted, from 90,000 units in November and increased by 50.4 percent from a year ago.

In the South, starts fell by 4 percent in December to 717,000 units, seasonally annually adjusted, from 747,000 units in November and fell by 20.4 percent from a year ago. In the West, starts fell by 9.5 percent in December to 324,000 units from 358,000 units in November and fell by 17.1 percent from a year ago. In the Midwest, starts fell by 37.4 percent in December to 129,000 units from 206,000 units in November and fell by 61.5 percent from a year ago.

Analysts noted, however, that the December decrease was milder than market consensus.

“December’s upside surprise comes off of a downward revision to November starts which indicates that starts declined by a sharper 1.8% during the month,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “The unexpected monthly gain in single-family starts can likely be owed to unseasonably warm weather and improved building material availability, factors which allowed more projects to get underway during the month.”

But Dougherty also noted improvement in single-family starts “is likely more noise than signal and another drop in permits suggests more weakness in residential construction is ahead.”

“While the number of single-family homes under construction is stabilizing as builders cut production, multi-family construction continues to hit new records,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Starts are exceeding completions and there are a record 926,000 multi-family units under construction. More multi-family supply may ultimately put some downward pressure on rents over the next year or so.”

Kushi noted in the new-home market, builder incentives such as price cuts, paying points and providing mortgage rate buy-downs are being used to bolster sales. “In many instances, these efforts are paying off and buyers are being enticed back,” she said. “While groundbreaking on new single-family homes has slowed, new-home inventory has been on the rise. From 2000 until the pandemic, new homes on average made up approximately 11% of total inventory. Today, that share has skyrocketed to 29% as existing homeowners stay put, while new-home inventory rises.”

Kushi added builders still have a large backlog of single-family homes under construction. “Builders will likely continue to focus on completing these existing projects, rather than starting new ones, until there is a meaningful and sustained increase in demand,” she said. “The housing market remains fundamentally underbuilt and as demand rises, it will be important to boost supply in order for price growth to continue to adjust to more sustainable levels. While builders can’t make existing homeowners move, they can add new homes to the stock.”

“While Q4 came in higher than expected, we continue to forecast a decline in starts over the coming quarters as elevated mortgage rates and a broader economic slowdown weigh on demand,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Still, there is some upside risk to our forecast as mortgage rates have pulled back in recent weeks and the prices for many construction inputs have retreated from pandemic highs, potentially allowing builders to offer deeper price concessions to spur sales while still maintaining profit margins.”

Building Permits

The report said privately owned housing units authorized by building permits in December fell to a seasonally adjusted annual rate of 1,330,000, 1.6 percent below the revised November rate of 1,351,000 and 29.9 percent lower than a year ago. Single‐family authorizations in December fell to 730,000, 6.5 percent below the revised November figure of 781,000. Authorizations of units in buildings with five units or more rose to 555,000 in December, up by 7.1 percent from November (518,000) but down by nearly 22 percent from a year ago.

The report estimated 1,649,400 housing units authorized by building permits in 2022, 5 percent below the 2021 figure of 1,737,000.

Housing Completions

Privately owned housing completions in December fell to a seasonally adjusted annual rate of 1,411,000, 8.4 percent lower than the revised November estimate of 1,540,000, but is 6.4 percent higher than a year ago. Single‐family housing completions in December fell to 1,005,000, 8 percent lower than the revised November rate of 1,092,000. The December rate for units in buildings with five units or more fell to 385,000, down by 12.1 percent from November (438,000) but up by nearly 26 percent from a year ago.

The report estimated 1,392,300 housing units completed in 2022, 3.8 percent higher than 2021 (1,341,000).