ANNOUNCEMENT

MBA Offices Will Be Closed on Monday, Jan. 16 in Observance of the Martin Luther King Jr. Holiday

Inflation—a highly regarded component of Federal Reserve policy—declined in December and slowed on an annual basis, the Bureau of Labor Statistics reported Thursday.

DEL RAY BEACH, Fla. – MISMO®, the real estate finance industry standards organization, introduced a redesigned product certification assessment program with enhanced functionality.

Redfin, Seattle, reported the median U.S. asking rent rose by just 4.8% year over year to $1,979 in December—the smallest increase since July 2021. Despite the slowing, the report said rents grew at more than three times that pace one year earlier.

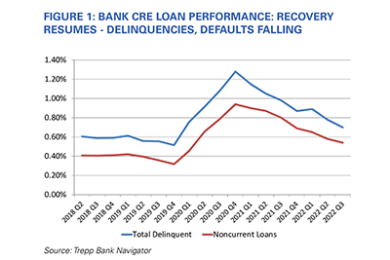

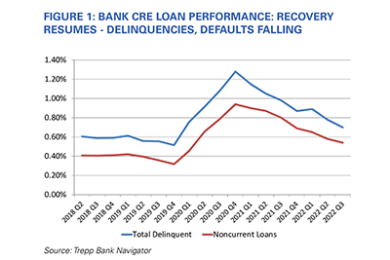

Trepp, New York, said delinquency rates for commercial real estate loans held by banks declined in third-quarter 2022 after increasing modestly earlier in the year.

iBorrow, Los Angeles, provided a $17.3 million refinance loan on two mid-renovation multifamily communities in southern California.

The MBA NewsLink 2023 Tech All-Star Awards nomination period is underway. Nominations will be accepted through Friday, Jan. 20.

Excerpted from a recent webinar featuring Tammy Richards of LendArch; Rob Chrisman of The Chrisman Commentary; and Augie Del Rio of Gallus Insights.

Collaborating closely with those teams who specialize in contacting and qualifying leads quickly is a valuable way towards reaching your conversion goals. Typically, only 5-15% of qualified leads convert. The good news: companies that automate their lead management processes can see up to a 10% increase in revenue in 6-9 months.

Servicing retention generates servicing fee income and helps servicers improve the customer experience. Modern loan servicing software automates investor reporting and compliance and creates a more efficient workflow, allowing servicers to effectively service loans in-house.

In their cyclical fashion, most lenders are dusting off some antiquated home equity programs, most having spent no energy to prepare for this market opportunity. Given the past few years of overflowing refi pipelines, that is not surprising. Why plant corn if the market price for soybeans is breaking records? Conversely, multiple vendors have set themselves up to help lenders and credit unions successfully market, process, service and trade home equity loans and HELOCs.

A year that started out on a high from record-breaking originations, has now come to a close with the industry taking a long look at how to press forward. At first blush, the next two years are likely to be challenging, but I lean more towards the optimistic view and see this time period as one filled with opportunity.