Mark P. Dangelo: In the ‘Year of the Rabbit,’ Data is a Slow Tortoise (Part 2)

Mark Dangelo currently serves as an innovation officer to private equity and VC funded firms spearheading digital fabrics, data sovereignty, MAD data science and decentralized finance. He is also a country leader for Dataswift.io and a graduate professor of innovation and entrepreneurship at John Carroll University. He is author of five books on innovation and a frequent writer for MBA NewsLink.

Across financial services and mortgage enterprises, there is near a 100% commitment to digital transformation and the functional and quality process improvements it brings to complex operations, while delivering sustainable customer experiences. Moreover, it is increasingly accepted that continuous digital transformations will occur as non-traditional competitors enter financial markets, embedded new-gen FinTech becomes the norm, and native, decentralized peer-to-peer data flows gain acceptance.

Yet, what limits the financial and mortgage industry when it comes to embracing changing business practices, offering new products or services, and streamlining the processes from consumer to investor? What is the success percentage of these multi-faceted, iterating organizational efforts? And how can organizations and linked operations deliver sustainable change during volume contractions squeezing budgets and capital commitments?

For mortgage and financial leaders, the phase-shift of how business is executed and data leveraged will be fundamentally different during 2023. The demand shifts across the mortgage supply chain (defined by endpoints of investors and consumers) will embolden those who embrace a host of unfamiliar trends including a) adaptative AI, b) industry data clouds, c) data meshes and fabrics, d) privacy preserving decentralized consumer digital assets, and of course, e) straight-through processing of the digital mortgage workflows.

Yet, for many experiencing the pain of a market correction, their belief in system solutions as their savior will likely hasten their exit—as traditional industry mindsets being reimaged fail to internalize native digital ecosystem implications. To push forth new revenue opportunities and achieve financial consumers for life, innovative enterprise leaders will rapidly embrace multi-faceted data architectures and virtualization methods to restructure their future business profitability. The transformation underway for financial products and services are not defined by the systems—they are progressively proven to be delivered by ethically sourced and sustainable data products.

The Mainstreaming of Data as THE Product is Already Underway

The answer for survival and prosperity may reside with the adoption of a mindset that views data as the product (#DaaP) of the mortgage and financial industries—not the systems or apps that typically receive the attention, excitement, and budgets.

With cloud costs now consuming over 35% for corporate IT spend (and rising), financial services leaders are critically examining the returns generated regardless of vendor hype. Moreover, innovative enterprises are finding that go to centralized #datalake and #warehouse #ETL replication practices are not the only answer to when it comes to powering adaptative analytics, process segmented AI capabilities, or customer-for-life revenue outcomes.

Recently, @Bain & Co disclosed during their recent acquisition of @EnterpriseBlueprints that success of exceedingly complex digital initiatives / transformations when measured against stated goals is less than 10%. Is this due to organizational change management (#OCM) requirements? Are business operations becoming more uncertain and less predictable? Are failures due to technology, strategy, or skills? Was it the wrong solution for the right time? Or was it due to curation and governance of digital ecosystems, which failed to support the decision-making processes necessary to achieve native digital products and services? Additionally, is the focus of creating digital data evolving into the product itself, as early efforts were defined by digitizing paper-based processes?

We have only scratched the surface of questions that must be asked and answered, especially when we consider the popular mainstreaming of AI (e.g., @ChatGPT) increasingly finding its way into data-driven decision making and common end-user productivity products (e.g., @Microsoft, @Google). Additionally, as data volumes explode (see Part 1 of this series), the chaos of sifting through the 60% of captured, but unused elements and values, becomes a quest of seeking a single needle across continents of haystacks comprised of siloed LOS, AVM, and underwriting systems. When locked inside of systems, replicated across platforms, and now spread using public, private, and hybrid clouds, where are the data elements that should be “trusted?” Are they secured? What is our liability of storing?

With the embrace of sovereign data asset principles underpinned by rapidly expanding state and federal privacy laws, the common system mindset of centralized or “rehomed” data assets is also under review. Supported by the last decades advancements of immutable decentralized digital assets and technologies (fueled by #cybercurrencies, central bank digital currencies or #CBDC’s, #COVID, and next-gen #FinTech investments), these non-enterprise-controlled documents, certifications, and immutable informational sources should not be “deposited” into corporate databases—without articulating the consequences that may include significant fines by aggressive agency enforcement.

Indeed, the data landscape is rapidly evolving and the traditional practices of data governance, stewardship, and even curation have less efficacy than once thought—as they were developed for centralized data stores governed by systems. The #paradigmshift underway is that productized data using ethical sourcing, virtualized data “pipelines,” and decentralized (and often P2P) exchanges creates new revenue streams that lessen the system-mindsets created by traditional volume market demands.

DaaP—It’s Not Your “Father’s” Data Governance and Curation

The concept of DaaP seems for many individuals and organizations steeped in tradition, a bridge too far. Yet how have other industries been disrupted and reimaged? Where were the icons of @Amazon, @Uber, @Airbnb, @Tesla, and even @Bitcoin one or two decades ago? Did Amazon reinvent retail because they began as a bookstore, or was it the launch of AWS and their cloud platforms? Did Tesla invent the electric car, or did they reimage the industry with adaptative business models and self-driving software? Time and again, traditional industries have been comprehensively disrupted by “outliers” using innovation, data, and customer demands to adapt to changing market conditions—or create new ones as they progressed.

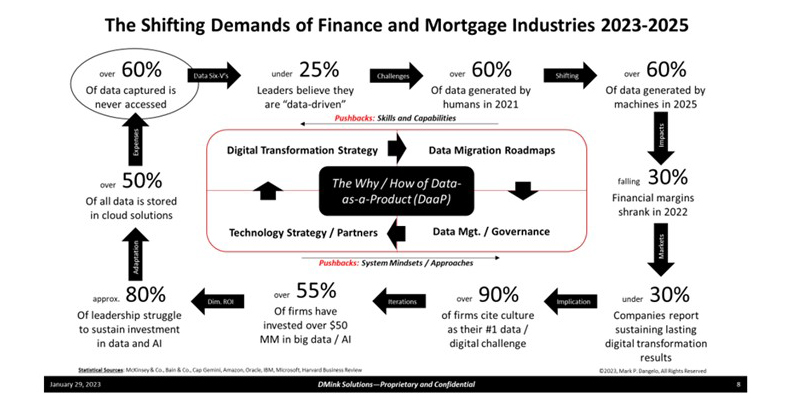

Therefore, when examining DaaP as part of iterative digital transformations, a current assessment of the rationale must be undertaken. In the figure below, the pressures of today’s markets and consumers are changing the approaches common since the #GreatRecession and the explosion of volume that sustained the finance and mortgage industry for the last 12 years. As the consumer reacts to rising rates and an assessment of the economic conditions, the maturing of cloud solutions is highlighting the new revenue opportunities. This data is hidden in plain sight spread out not only inside internal systems, but the 60% outside corporate control. Governed under the umbrellas of data sovereignty, decentralized consumer controlled digital assets, and state and federal privacy laws, DaaP is permanently changing the technology stacks common across industry IT controls and designs.

When the drivers of change and delivery results linked, we can extract the implications from the data transformation “board” above. In particular, the strategy, architecture, and implementation of DaaP data governance and curation of customer, product, and transactional data now requires layers of interconnected policies and procedures to guarantee informational integrity and security. With “edge” devices increasingly connected into the data meshes being created to span systems and cloud boundaries, the traditional practices of define and forget data management techniques no longer apply.

As system mindsets resist the change brough forth by DaaP capabilities, the other headwind will be individuals and the organizational change management (#OCM)—all contributing to the success and failure of automated governance necessary for data meshes within mature industries. For innovative leaders, the above model offers new revenue opportunities beyond the tradition of strategy destination-designed lift-and-shift from paper to digital processes.

Data as a Product—Revenue Pressure and Potential

With the decline of financial and mortgage volumes during the last year, executives and their investors are seeking out new revenue streams, profitability, and efficiencies. Made more challenging by uncertain economic conditions, the innovational disruptions demanded by consumers and vocal investors have changed the strategy playbooks of organic and acquisitional growth. Furthermore, binding these trends and realities together is research from @McKinsey & Co released in December 2022 that anticipates over “50% of all revenue during the next 5 years is expected to come from new businesses, products, and services.” Will system level mindsets and implementations deliver these needs for your current operations?

Whereas DaaP can deliver efficiencies and data leverage across system implementations (i.e., efficiencies to drive margins), DaaP can also provide new revenue generating business model channels, partnerships, and value creations previously unattainable. With greater asset concentration approaching 4 times the 2010 levels for the top 15 banks, the consolidation trend showcases a mature set of commoditized products and services that only with scale becomes profitable.

With DaaP, the ability for market disruptors to prosper and gain digital consumer acceptance is created from data leverage, privacy preserving rights, and a fabric of digital assets mitigate centralized controls. Financial disruption has repeatedly been defined by technology simplifying accepted processes. Yet, with the rise of data decentralization coupled with consumers seeking greater control over their data assets, the traditional IT, software, and clearing principles are aggressively being marginalized. At the foundation of these new revenue services are rigorous #DataOps solutions designed to minimize “data cloning,” deliver embedded security, and provide agile adaptability for business and market demands.

A few of the potential revenue opportunities and enhanced DaaP customer focused capabilities include:

| Privacy preserving, cross-linked customer information (internal and Reg. Comp.) | Digital wallet creation and integration across traditional products |

| Decentralized cross-selling of products, services beyond centralized data sinks | Householding of linked services both internally and by partners |

| Agnostic DaaP shared services across the supply chain | Privacy-preserving loyalty / cross-product programs |

| Anything as a Service (#XaaS) building blocks driving new innovations | AI adaptability and insights driving revenues, efficiencies, and sustainability |

When considering the demands of regulatory compliance and oversight, having cross-linked systems using data virtualization delivers one-version of the “truth” (i.e., trust) for disclosure thereby not just creating efficiencies, but also identifying customer needs that are not being met (e.g., #underrepresented, #non-banked). Finally, by approaching DaaP as a product rather than as a system subset, scale can be achieved non-linearly when compared to common centralized architectural designs and the growing expenses to deliver and maintain.

As we conclude this second article of the series, there are some in the industry who believe the contraction of financial and housing markets are part of a normal cycle that was last experienced in 2008-2010 during and after the Great Recession. Yet, that comparison is likely a gross-over simplification. What we are and may continue to experience during 2023 is more analogous to the 1980’s when interest rates spiked, and inflation impacted consumer confidence and behaviors.

It is also common across industry circles to discount the unfamiliar especially when considering the regulatory boundaries—if my competitors are not doing it, then why should I take the risks? For those enterprises embracing a Chief Data Officer (#CDO) during the last five years, the result has been to condition the organization for change, while developing the data maturity needed to span technology as well as create DaaP mindsets. For those leaders who are waiting looking for “real-world” implementations of these principles and discounting industry implementation practicality, @JPMorgan has already released their experiences utilizing AWS in a “new era of data”—19 months ago back in Q2 of 2021.

Regardless of the comparisons, the fundamental market shifts—in principle a digital ecosystem shift—is due to the rise of data capabilities, manipulation, and replication that lacks efficacy against traditional system solutions. The phase-shift of importance of data as a product (DaaP) offers untapped potential and markets for innovative leaders in the financial services sectors. For financial services and mortgage leaders under pressure, the strategy of DaaP, the efficiencies to be gained, and the revenue opportunities emerging, we have the opportunity to reimage products and services for the digital consumer and investors—it we act boldly and with design purpose.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)