Dealmaker: JLL Arranges $253M for Industrial Portfolio, Multifamily

(South Point Business Park, Charlotte, N.C.)

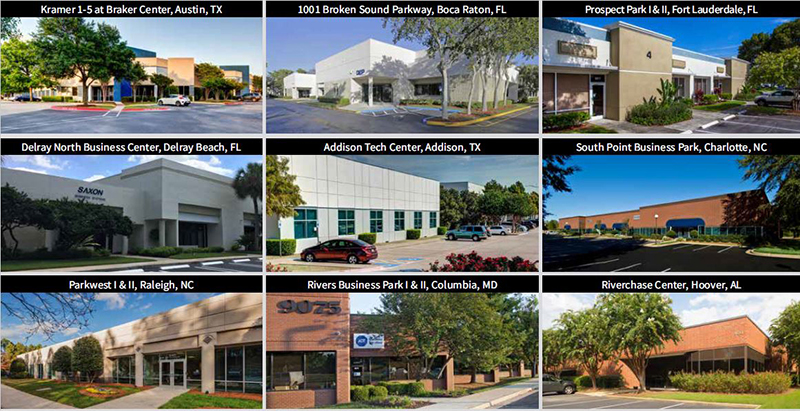

JLL Capital Markets arranged $193 million in permanent financing for a nine-property light industrial portfolio totaling 1.7 million square feet located in infill locations in South Florida, Texas, North Carolina, Alabama and Maryland.

JLL also arranged $59.75 million for a luxury apartment complex in Overland Park, Kan.

Located within high-growth markets in the Sunbelt and Mid-Atlantic, the portfolio comprises 145 tenants across 17 different industry categories, including technology/IT, medical supplies, healthcare, aeronautics, consumer goods and construction/materials. Constructed between 1981 and 2001, the assets maintain above-market occupancies and consistently outperform the local competition. The portfolio properties’ optimal infill locations, which provide direct access to transportation and infrastructure, added to the strong lender interest in the financing opportunity.

The assets were leased to 145 separate tenants at the time of financing. The properties included:

• Riverchase Center in Hoover, Ala.

• 1001 Broken Sound Parkway in Boca Raton, Fla.

• Prospect Park I & II in Fort Lauderdale, Fla.

• Delray North Business Center in Delray Beach, Fla.

• Rivers Business Park I & II in Columbia, Md.

• South Point Business Park in Charlotte, N.C.

• Parkwest I & II in Raleigh, N.C.

• Addison Tech Center in Addison, Texas

• Kramer 1-5 at Braker Center in Austin, Texas

JLL worked exclusively on behalf of the borrower, Adler Real Estate Partners, to place the five-year, fixed-rate, non-recourse loan with TIAA Bank. The JLL Capital Markets Debt Placement team representing the borrower was led by Senior Managing Director Chris Drew, Managing Director Melissa Rose and Vice President Christopher Gathman.

“The ability to secure accretive financing in this turbulent capital markets environment is a testament to Adler Real Estate Partners brand name as well as the quality of the assets included in the collateral,” Drew said.

“TIAA Bank provided a seamless execution on a large loan at a time when $100 million and up, single-source capital has become scarce,” added Rose.

JLL Capital Markets also closed $59.75 million in construction takeout refinancing for The Residences at Galleria, a newly constructed, Class-A, 322-unit, luxury apartment community in Overland Park, near Kansas City.

JLL represented the borrower, Block Real Estate Services, to secure the financing through Eagle Realty Group.

Completed in 2022, the five-story The Residences at Galleria features one-, two- and three-bedroom units with large private patios, oversized closets, full-size washers and dryers, quartz countertops, efficient appliances, high-tech smart home features, luxury finishes and an average unit size of 942 square feet. Amenities include a fitness center with yoga and cycle studios, on-site community coworking space, a day spa with a massage room, sundeck with private cabanas, a city view courtyard, a resort-style pool and hot tub and a media lounge.

The apartment community is part of the Galleria 115 masterplan, a 37-acre, ~$350 million mixed-use development that will feature 350,000 square feet of office space, over 105,000 square feet of retail and 678 apartment units upon completion. Located at 11201 Outlook Street, the property is set south of Interstate 435 and one block south of College Boulevard, an office and employment corridor. Within one mile of the community is 11.3 million square feet of office space and 34,600 daytime employees. Major employers within walking distance include Mariner Wealth Advisors, Netsmart, Children’s Mercy Hospital, Menorah Medical Center and the Sheraton Overland Park Hotel and Convention Center. In addition to the retail within Galleria 115, residents will also be proximate to Town Center Plaza, Camelot Court and Hawthorne Plaza, in addition to a Whole Foods and Trader Joe’s.

The JLL Capital Markets Debt Advisory team was led by President Jody Thornton and Managing Directors Mark Erland and Tony Nargi.