Office Market Closes 2022 with Rising Vacancies, Declining Sales

The office sector remains unsettled even nearly three years after the COVID-19 pandemic broke out, reported CommercialEdge, Santa Barbara, Calif.

“Even as some firms become more forceful in bringing workers back into the office, many have fully committed to hybrid and remote work policies,” CommercialEdge Analyst Eliza Theiss said in the CommercialEdge National Office Report. She noted the firm anticipates this year will bring more uncertainty and change in the office sector as it moves toward a post-pandemic status quo.

“Higher interest rates are expected to hamper the new supply pipeline as well as transactional activity in 2023,” the report said. “Some buildings in attractive locations will break ground, but many projects will be paused or altogether canceled. Higher rates will lead not only to fewer office sales but also to lower prices for properties that do trade.”

CommercialEdge said the recent tenant “flight to quality” trend will likely continue. “Businesses that want employees in the office more often, but do not want to use a heavy-handed approach, are looking for high-quality amenitized space to entice workers to come in, embracing smaller footprints in premium locations,” the report said.

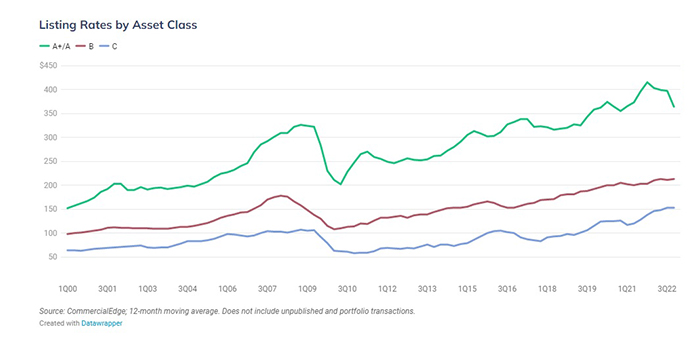

As a result, many developers now focus on building Class A offices. Class A and A+ office space under construction totaled nearly 126 million square feet nationally at year-end, while Class B space accounted for less than 10 million, the report said.

“As the flight-to-quality continues, we will be watching to see how much of a role space reduction plays in these leasing decisions, and to what degree co-working becomes an option as a high-quality landing spot,” said Peter Kolaczynski, Senior Manager with CommercialEdge.

CommercialEdge reported December’s average full-service equivalent listing rate dipped 0.7% year-over-year to $38.19. The national vacancy rate equaled 16.5% in December, up 90 basis points from a year before.

“While U.S. office vacancy rates have risen steadily over the last few years, average listing rates have yet to fall in response,” the report said. “This is because average rates reflect both the quality of space listed as well as underlying fundamentals. With plenty of high-quality space hitting the market in recent years, not only through direct vacancies but subleases as well, average listing rates have managed to hold fairly steady so far.”