Mark P. Dangelo: The Path to 2024 Growth–A Sea Change of AI Transformations and Upskilling

Mark P. Dangelo currently serves as an independent innovation practitioner and advisor to private equity and VC funded firms. He has led diverse restructurings, MAD and transformations in more than 20 countries advising hundreds of firms ranging from Fortune 50 to startups. He is also Associate Director for Client Engagement with xLabs, adjunct professor with Case Western Reserve University, and author of five books on M&A and transformative innovation.

The mortgage and financial industries are looking forward to 2024 seeking out operational efficiencies, a relief from regulatory oversight, and a rebalancing of interest rates to spur demand (e.g., origination, refinancing). The markets continue to consolidate favoring large providers as the number of financial institutions shrink creating a void of middle-sized institutions. Additionally, with M&A projected to rebound in 2024 with an estimated $35 trillion of untapped acquisition cash, those firms struggling within BFSI hoping to ride out the chaos may find themselves the targets of reinvigorated private equity firms. IMB models of operation could themselves target casualties of FinTech’s capabilities.

However, while the macroeconomic conditions continue to rebalance and demand hits its likely lows, the innovative opportunities for those within the BFSI and mortgage worlds have never been greater. As 2023 witnessed a watershed event for generative AI (e.g., Chat GPT), the progression across the AI spectrum will accelerate even more as software designs are coded into hardware chips (e.g., Microsoft), generative AI becomes generalized AI (e.g., Q* from Open AI), and the need for domain individuals to be trained to deploy innovative building blocks becomes even more pronounced.

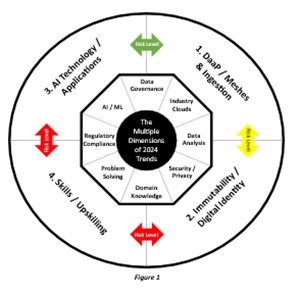

For 2024 there will be four categories (see Figure 1) that will dominate board room discussions, investor demands, and personnel fear. Unlike prior IT and management trends, what will be witnessed in 2024 will be a complex web of capabilities interconnecting many dimensions. The implementation paths of one-off’s (e.g., SaaS, Gen AI) that are a core focus will be deployed moving forward as interconnected innovations to achieve the greatest growth.

Expanding Data Meshes and Delivering on DaaP

Data meshes first burst onto the IT and data radars back in 2019 and 2020. Numerous BFSI’s have already used these advanced data science architectures to create adaptable digital ingestion solutions that provide robust auditability—they foot back to the original system-of-record (SOR). Additionally, since AI is at its foundation a data-driven, algorithmic solution—both for large and small language models, LLM’s and SLM’s—their importance has been escalated and become central to creating, training, and adapting AI solutions.

In 2024, data mesh implementations are being elevated as their ability to incorporate “synthetic” data into their operational designs was greatly enhanced in 2023. From vendors such as K2, the definition and deployment of both the mesh and the data have reached scale, and when incorporated into industry clouds (rising at over 70% per year) the ability to capitalize on AI solutions will grow even further. For BFSI, where only 45% of the data they use originates within their application silos, the cost and quality of data inclusion / ingestion has significantly increased year-over-year cloud budget costs and complexity.

While larger software vendors continue to rely on standards to normalize data relationships, more innovative FinTech providers have leveraged data conformance into decision-making capabilities. Traditional application vendors are seeking to leverage their investment, whereas data meshes move beyond the vendor lock-ins common within BFSI and mortgage platforms. Yet, the missing element is no longer the technology, robust data and metadata governance, or even the availability of hardware (i.e., IaaS, PaaS), but the skills that must be woven into a fabric of data delivery capabilities, skills, and reusable data-as-a-product (DaaP) designs.

DaaP represents the prerequisite foundation for future SaaS solutions. DaaP, sometimes referred to as data isolation modules (DIM’s), utilize the metrics and definition of standards into reusable components that drive down costs, improve data quality, and most importantly, leads to consistent decisions across all aspects—customer identification, origination, closing, servicing, and even securitization. DaaP has surfaced as THE primary ideation for next-gen applications compared to the traditional system ideation design (i.e., process first, data second).

However, data meshes and DaaP require a corresponding set of capabilities that are interconnected with other trends for 2024—starting with immutability and digital identity.

The Active Design and Integration of Immutability and Digital Identity

The second key trend for inclusion in 2024 (as shown in Figure 1) concentrates around data immutability. The ability to from the start, understand the lineage of the data sources and uses are paramount to improving margins, reducing errors, and promoting DaaP reusability. Outside of BFSI, the push for active data governance across the lifecycle of data is rising at over 40% per year with new products, services, and expertise.

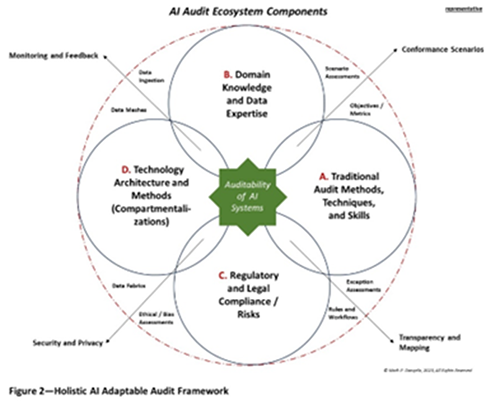

For BFSI, their SORs while using standardized data often has many copies, undergone extensive ETL manipulation, and been replicated across data lakes, warehouses, and oceans. It has been easier to extract than to deal with the source of the data problem. Today, those historical decisions have been laid bare in a market designed for volume—not designed for an AI adaptation. Figure 2 represents the ideation of transparent immutability that removes risks and uncertainty while providing a common design for digital identity. If the data assets are “virtually” linked to the original SOR’s, then both industry and consumer personnel have trust in the outcomes and the data that is training AI systems.

This key trend represents the “danger” below the surface. While vendors hype advancements and leaders seek margin improvements, the ability to understand and cross-link AI solution sets remains an opaque set of risks that will likely become a critical set of focus for regulators. While 2023 witnessed the mitigation of AI bias, when AI systems grow and are crosslinked, the management complexities explode nonlinearly. Without a framework (see Figure 2) to deal with immutability and identities, the cascading impacts of AI will result in an uncontrollable outcome that will be nearly impossible to trace.

The Traditional Starting Point–AI Technology and Applications

This trend is as broad as it is deep. It represents one of the most covered topics in the industry for the last 12 months. Yet, beyond the capabilities of generative AI solutions, resides the fundamental changes it introduces for system ideated processes resident within existing applications as compared to data ideated, data-driven solutions.

Key areas include:

• Ensemble AI

• Error identification and correction—beyond the AI system boundaries

• General AI (e.g., Q*)

• Quantum AI (AI using quantum computing)

• Natural language processing (NLP)

• Deep and machine learning

• Model definition, adoption, and adaptability

Yet for all the investment and attention, the core 2024 trend of “humans-in-the-loop” and the skills they need to provide and deliver BFSI domain expertise often is assumed to be “taken care of when we deploy AI solutions.” This fallacy is a material factor to the failure of ROI, NPV, IRR, and many financial projections–skills outside of definition and implementation are viewed as a “should-have” priority, and not a “must-have” demand.

It All Comes Down to Skills—and Upskilling

As 2024 emerges, the demand for ML / AI skills to augment traditional industry approaches coupled with emerging AI technologies has a resemblance to the prior talent rush to secure data scientists. AI’s productivity explosion driven by data represents very material opportunities—yet firms cannot ignore the other dimensions of skills necessary for success.

However where are the decision points between AI skills, personnel potential, and cultural fit for firms seeking leading edge generative and ensemble solutions? Where does hype meet reality? Can a skill in the ecosystems of AI categories (see Figures 1 and 2) transform the complexities of delivery for consumers, for BFSI, and more importantly, for society? How will these categories be woven into a fabric of capabilities that leverages human involvement, industry knowledge, and technology advancements?

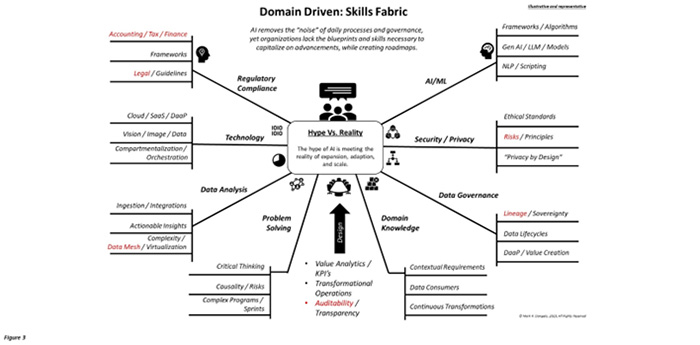

Below is a framework for integrating the prior three trends into a cohesive model for training, education, and upskills.

Reinforcing the premise of complex skills challenges (in Figure 3), Swami Sivasubramanian, Amazon’s Vice President of data and AI was quoted as saying, “(AI) is going to be the most transformative technology we encounter, but it won’t reach its full potential unless we really have the workforce ready to embrace it and turbocharge it in a big way.”[i] To reinforce their supposition, Amazon has launched “AI Ready” with the goal to upskill 2 million workers by the start of 2025—all for free. Microsoft, investor in Open AI Chat GPT, and IBM have similar programs.

However, reviewing prior approaches to next-gen skills—cloud, data, security—booking results is elusive, and sustaining them complex. What lessons learned should be applied for these emerging AI solutions? How can leaders weave together discrete capabilities against the larger, domain requirements when recent surveys indicate that those with the most industry knowledge (> 50 YO) indicated retirement preference against the push to return to office and radically changing AI enabled industry workflows and processes? What framework might be deployed across these AI, domain defined ecosystems?

For BFSI leaders and their application vendors of choice, the market size may increase, volumes will rebound, but the number of firms continues to shrink. The investment required to change the ideation to meet a digital consumer armed with their own AI solutions, identity protections, and even alternative financial providers is growing weekly.

In summary, if we view Figure 2 as a decomposition of Figure 1, we can comprehend and strategize what need to be created in 2024 as AI progresses and explodes with new offerings. It begins with data, it concentrates on the value and source of the data, it leverages innovative technology, and it all requires vast skill set additions that will come from hiring and upskilling. As we examine Figure 3, we note that without the skills fabric, AI solutions will advance, but organizational ability to leverage will be hampered.

In 2024, while many budgets will reflect significant investments in AI technology, we will not likely see a similar investment in skills. Similar to prior projections including Web 3, big data, and cloud solutions, we can spend capital commensurate with hype, or we can leverage unique domain expertise and data-driven capabilities by designing humans-in-the-loop. Until Q* moves from drama to solution, the skills factor will remain the most-important demand for an AI, digital BFSI ecosystem.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to NewsLink Editor Michael Tucker at mtucker@mba.org or Editorial Manager Anneliese Mahoney at amahoney@mba.org.)

[i] “Amazon Launches Free AI Classes in Bid to Win Talent Arms Race”, Sebastian Herrera, Wall Street Journal, November 20, 2023