iEmergent CEO Laird Nossuli: It’s High Time We Invite Everyone Back Into the Pool!

iEmergent CEO Laird Nossuli has dedicated her career to helping lenders execute opportunity-driven lending strategies that support equitable lending in racially and ethnically diverse communities. Her passion for housing equity, novel use of market intelligence and collaboration with housing workgroups have made her an influential speaker on serving diverse markets.

Today, fewer Americans are able to join the Homeowner Dream Club that my father, market intelligence pioneer Dennis Hedlund, wrote about in MBA’s Mortgage Banking magazine 11 years ago.

This “club” is the culmination of the American Dream, where members swim and splash in the waning days of summer. It seems idyllic. So why are so few jumping in? It would seem some hesitate to apply for membership to the homeownership club having been turned down before. Others find the initiation fee to be a barrier or simply have lost their desire to join. While still others fear an unforeseen event could cancel their membership or the club could go belly up.

Compounding the Demand Factor

Since the fall of the refi boom, the housing market has been sluggish, to say the least. The Federal Reserve has raised its benchmark interest rate 11 times since March 2022 in an effort to curb relentless inflation. These economic factors, exacerbating affordability for potential homebuyers, have caused many qualified, would-be homebuyers to stop short of jumping into the housing pool.

This is not the first time the mortgage industry has struggled with demand. More than a decade ago, my dad’s study of post-recession mortgage market challenges explained how and why housing supply was outweighing demand.

The current situation is both eerily similar and completely different.

In 2011, lenders struggled to reconcile low-interest rates and inflated housing inventories with a dearth of qualified, mortgage-ready borrowers. Today, there is an abundance of qualified, mortgage-ready borrowers, but a dearth of inventory and higher interest rates.

So what do these two scenarios have in common?

What my dad wrote back in 2011 still holds true: “Houses can’t buy themselves. Low interest rates can’t shop for homes to buy. Available credit won’t spontaneously buy homes. Low housing prices don’t buy homes. Secondary markets by themselves don’t incent people to buy homes. Big inventories can’t write a check for the mortgage. Households buy homes.”

Homeownership continues to lag because the gaps in trust, education and credit are just as wide as they were decades ago.

Jumping Back In

Despite fragile economic conditions, there still is opportunity for many consumers to purchase a home.

To make homeownership a truly achievable goal for more families in 2023, mortgage stakeholders must first understand its current composition and how it is evolving.

With a forecast of the size, density, growth rate and distribution of future home-buying opportunities for several years, lenders can protect their organization’s bottom lines during market downturns and ensure organizational longevity.

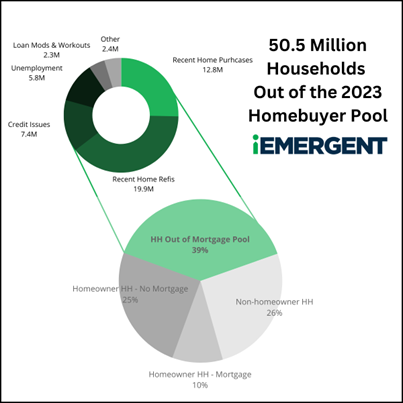

According to current market analyses, the overall size and depth of the pool of U.S. non-homeowner households, homeowner households with mortgages and homeowner households without mortgages who may buy a home is 129.4 million. While that’s the total potential pool, however, the actual homeownership pool is 78.9 million households after more than 50 million households are excluded due to recent home purchases, credit issues, unemployment and more.

The size and profiles of available household pools are unique for every market and household segment. That is why homebuying demand is inherently unique from market to market. Using data is the best way to pinpoint where growth will be, to which borrowers, and of what loan types.

Serving Low-to-Moderate Income Buyers

Income distribution has always been a primary driver of mortgage demand as economic conditions change. The income gap has actually widened over the past several decades, causing severe financial stress in American low-income communities. In fact, as of the second quarter of 2023, Statista reported that 69 percent of the total wealth in the United States was owned by the top 10 percent of earners. In comparison, the lowest 50 percent of earners only owned 2.5 percent of the total wealth.

Homeownership prospects of young households are also stunted, even though they make up the fastest-growing homebuyer market. More young people than ever are saddled with student loan debt, with EducationData.org reporting that the average student’s federal loan debt balance currently sits at $37,338.

What’s Being Done to Expand the Housing Pool?

Inflation has spurred the Central banks to increase their interest rates, which influences interest rates charged by commercial banks for mortgages. These rates may be slowing some borrowers from entering the purchase market but here’s how to put that into perspective. Although interest rates on 30-year FRM are higher than in the recent past, mortgage rates are still within average levels over the last 30 years. Few may remember but in October 1981, the 30-year fixed mortgage rate reached 18.4%, according to Freddie Mac.

Industry groups, including the MBA, are advocating to policymakers that interest rates need to stabilize or better yet start to tick down in 2024 to make homeownership appealing once more. “We’re taking this message to leaders in Washington every day. And right now, the most important battle we’re fighting is on interest rates,” MBA President and CEO Bob Broeksmit, CMB, told members gathered for the group’s annual meeting in October 2023.

Rate hikes are not the only tactic being used by the government to curb widespread home affordability challenges caused by inflation. On Oct. 16, 2023, the White House announced a series of new initiatives designed to boost U.S. homeownership, particularly for low-to-moderate income (LMI) and historically underserved communities. These initiatives include allowing homebuyers to leverage income from accessory dwelling units, expanding mortgage finance opportunities for Native Americans and launching a USDA pilot for alternative eligibility criteria and additional home retention assistance programs for U.S. Veterans.

It’s evident that until challenges like insufficient savings, widespread debt, damaged credit scores and consumer financial education are properly addressed, a huge portion of American consumers either cannot or will not buy a home. What’s worse, any available supply will go unoccupied or get bought up by an institutional investor to be rented or sold for an even higher price.

So, what more can the mortgage industry do to address the many roadblocks to affordable, equitable homeownership?

Rethinking What It Truly Means to be “Mortgage Ready”

To effectively open up the club and its housing pool to previously underserved LMI and minority markets, the mortgage industry must focus on preparing more people to become mortgage-ready and bridging trust gaps.

Opening homeownership to underserved markets requires focusing on three goals: preparing people to be mortgage-ready and bridging education and trust gaps.

In today’s mortgage market, there is ample homebuyer opportunity. Lenders need market intelligence and forecasting tools, using “zoomed-in” housing market data for effective community-specific service.

Whether or not you agree with our mortgage opportunity forecasting model‘s outputs, this market analysis framework provides a reliable way for decision-makers to measure the current uncertainty in the market and prepare for the most probable outcomes. Once the market turns back around, lenders that leverage community data to determine eligible housing pools in their service region will be the best equipped to engage and serve prospective homebuyers.