MBA Chart of the Week Aug. 7: Average Home Loan Size

Source: 2013-2022 Home Mortgage Disclosure Act (HMDA)

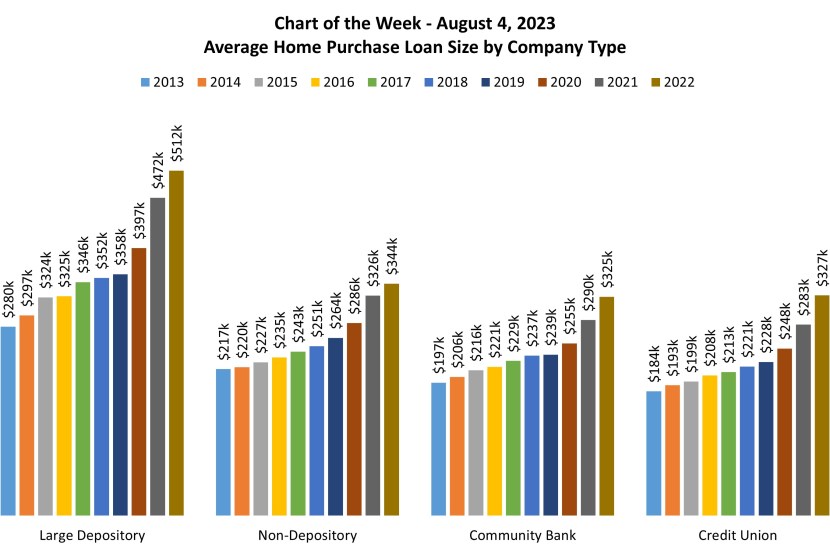

Loans originated for the purchase of a home grew to an average size of $371,000 in 2022, from $344,000 in 2021, according to MBA’s analyses of the Home Mortgage Disclosure Act (HMDA) dataset. This week’s Chart of the Week explores differences in average home purchase loan sizes by company type, where company types are defined by primary regulator and balance sheet assets (with large depositories holding assets of $10 billion or more).

Across all company types, the average purchase loan size was up 7.8% in 2022, a slowdown from 2021’s record-setting 14.2% year-over-year increase, and just below the 7.9% growth seen in 2020. This was the 11th consecutive yearly increase, driving up average purchase loan size to new highs for all company types: $512,000 for large depositories; $344,000 for non-depositories; $325,000 for community banks, and $327,000 for credit unions.

Large depositories’ average purchase loan size of $512,000 – which exceeds all other groups by over $165,000 – was undoubtedly bolstered by their jumbo production. Large depositories originated 56% of all conventional jumbo loans in 2022, and the average size of conventional jumbo loans for home purchase jumped $112,000 to $1.256 million in 2022, from $1.145 million in 2021.

Though non-depositories also originated their fair share of conventional jumbo loans (25%), they tend to focus on government production – specifically, in the FHA space. Non-depositories originated 87% of all FHA loans in 2022 which, on average, were smaller in size at $281,000 for home purchases, thus bringing down their overall purchase loan size.

Community banks and credit unions, unlike their large depository counterparts, originated smaller-than-average home purchase loans in 2022. Community banks originated a higher share of loans for rural housing – 15.1% of USDA loans compared to their 12.5% overall market share – which are the smallest in size on average for home purchases, at only $183,000. Credit unions, meanwhile, tend to focus on the conventional non-jumbo market, and those loans averaged $320,000 for home purchases in 2022.

MBA’s HMDA data analyses are limited to the following: 1-4 unit, closed-end (or exempt), 1st lien loans originated through the retail/consumer direct, broker wholesale, or non-delegated correspondent channels. They exclude home improvement loans and loans with “other” or “not applicable” purposes. Though earlier iterations of the HMDA data are published by the CFPB in spring and early summer, MBA waits to publish its own analyses until mid-summer, after scrubbing the dataset of errors and outliers and allowing reporters time to correct and resubmit their data.

Visit MBA’s HMDA webpage to view our suite of standard HMDA reports and explore custom reporting options. Our HMDA Residential Originations Databook (with 2022 data) is currently on sale at a $100 discount through August 15th and our HMDA Executive Databook is free for MBA members.