Black Knight Reports Mortgage Rate Lock Activity Falls Again

(Courtesy Black Knight)

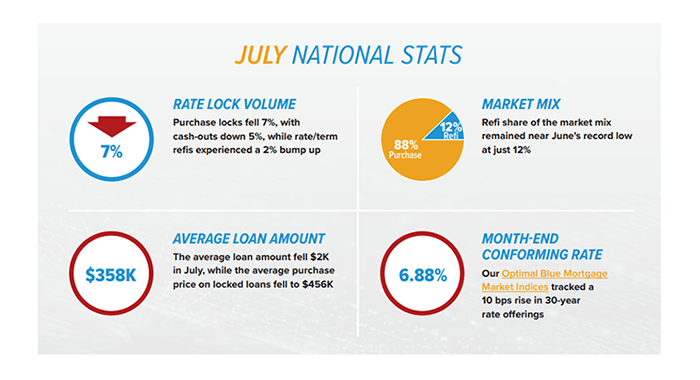

Black Knight, Jacksonville, Fla., said mortgage rate lock activity fell for the second consecutive month in July, dropping 7% overall.

“While they moved around a bit in July, there was no escaping the fact that conforming 30-year rates topped 7% in July for the first time since they spiked last fall,” said Andy Walden, vice president of enterprise research and strategy at Black Knight. “On both a practical and psychological level, that put further downward pressure on mortgage demand.”

Walden noted purchase loans continue to dominate the origination pipeline. Purchase locks, which accounted for 88% of all July activity, fell 7.4% from June. Purchase lock counts are down 27% year over year and down 35% from 2019 pre-pandemic levels.

Cash-out refinances also declined (-5.4%) and are hovering close to 60% below where they were in July 2022 when interest rates averaged in the mid- to high 5% range, Black Knight’s Originations Market Monitor report found.

Rate/term refis increased by a modest 1.9% in July but remained down more than 31% year over year from an extremely low ceiling; July 2022 itself had marked a 93% year-over-year decline. Locks on such products will likely remain constrained for some time to come; just 3% of existing mortgage holders have first-lien rates at or above today’s levels, the report said.

“With home prices hitting new peaks across many parts of the country, and no end in sight to the for-sale inventory shortage, the housing market continues to reheat,” Walden said. “It’s worth noting, however, that – in a ‘normal’ year – June typically marks the calendar peak of home prices on a non-adjusted basis, so you would normally expect to see a decreasing trend through year’s end and into February. That said, this year, and this market, have been anything but normal. Rising rates may be tamping demand for homes at such record high prices, as evidenced by rate lock activity, but they’ve still yet to overcome an even greater deficit of supply. As a result, the purchase market is in a stalemate.”