Mind the Gap: What CONVERGENCE Columbus Can Teach Us About Increasing Black Homeownership

iEmergent CEO Laird Nossuli has dedicated her career to helping lenders execute opportunity-driven lending strategies that support equitable lending in racially and ethnically diverse communities. Her passion for housing equity, novel use of market intelligence and collaboration with housing workgroups have made her an influential speaker on serving diverse markets.

The homeownership gap between Black and white Americans is wider today than in 1960 when housing discrimination was legal. To look at the mechanisms behind this shocking stat in one community, CONVERGENCE Columbus surveyed local loan originators and real estate agents for their thoughts on how to increase Black homeownership. Our findings were enlightening and offer lenders everywhere four important lessons for supporting homeownership equity.

LESSON 1: Don’t make demographic assumptions

To address disparate homeownership outcomes, you need to know your market’s current homeownership distribution data and understand your ability to influence change. So, we tested Columbus housing professionals’ knowledge.

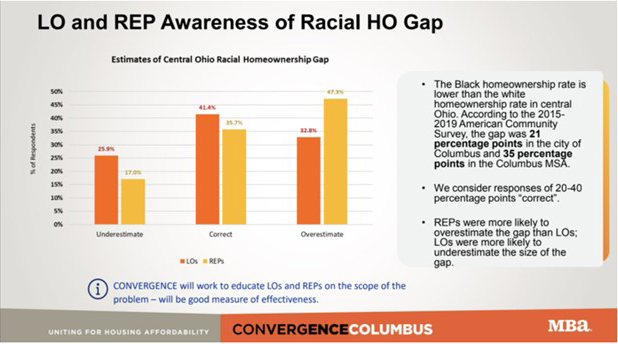

We found that most housing professionals surveyed recognized the importance of their role in reducing Columbus’ racial homeownership gap, with 68% of LOs and 77% of real estate professionals seeing their role as “important” or “very important.” In Columbus, the Black and white homeownership gap is 21% within city limits and 35% in the metro area. Most housing professionals had a fair understanding of the nature of the homeownership gap, with only 25% of LOs and 17% of agents underestimating the disparity.

A takeaway for mortgage lenders is that market homeownership demographic knowledge should never be assumed. Too often, housing professionals’ understanding of the local market comes from interactions with a self-selecting group of clientele who perceive themselves as homeownership ready. Columbus survey findings suggest agents are at least aware of self-selection bias, reporting that widespread lack of consumer understanding about the home financing process discouraged many families from pursuing homeownership.

While a strong grassroots presence is an important aspect of community lending, it is not a substitute for market data. Market intelligence solutions make it possible for housing professionals to identify racial homeownership disparities and minority households that could likely support homeownership. If such a tool were available to them, nearly 92% of survey respondents said they would use it.

LESSON 2: Spread affordable lending program awareness

Affordable lending programs are essential for providing more Black and LMI households with a pathway to homeownership. In Columbus, we noticed that LOs and agents held greatly differing sentiments about the availability of affordable loan products, with 84% of LOs and 52% of real estate professionals agreeing that affordability programs were sufficient to meet the needs of LMI homebuyers. This indicates a large knowledge gap among agents about the availability of affordable mortgage programs; it also brings to light a large opportunity for lenders to educate these key referral partners.

Our other survey findings further reinforce the importance of agent education. When asked how they learned about affordable lending programs, Columbus real estate agents identified lenders as their primary source of information. However, only 60% of real estate professionals felt familiar with LMI-focused products, citing the importance of industry collaboration to expanding awareness of affordable homeownership offerings.

Unfortunately, as a whole, many lenders don’t know about or have misconceptions around essential affordable financing tools such as down payment assistance, closing cost assistance and special purpose credit programs (SPCPs). The same is true for real estate agents. Yet, these and other affordability offerings are tools that can support homeownership for many Black homebuyers with high debt-to-income ratios or insufficient down payment and closing cost funds.

Lenders must educate themselves about homebuyer assistance programs available in their market and identify opportunities to develop SPCPs. They should then proactively pass that information to agents in their communities.

Since agents are typically a consumer’s first point of contact in the homebuying process, their knowledge of affordable financing options is important to bolstering Black homeownership. Also, lenders who help agents close deals with affordability programs are often rewarded with more referrals and a reputation as valuable community partners in the homeownership journey.

LESSON 3: Explore alternatives to credit scores

The survey also helped us identify opportunities for housing professionals to better support borrowers who have low credit scores. Only 65% of Columbus LOs indicated that their organization offered affordable options for borrowers with credit scores below 640.

Low credit scores have been a longstanding barrier to homeownership for people in many U.S. markets — particularly for minority households. To address homeownership inequity, lenders must explore ways to confront the racial credit score gap. Notably, the government-sponsored enterprises are onboarding more tools to underwrite borrowers with no credit and thin credit files. Innovative lenders are even adopting alternative underwriting assessments that enable them to safely finance homeownership for borrowers who can support the cost but may have little credit or a low credit score.

LESSON 4: Invest in community education

When it comes to launching an effective diverse homeownership initiative, we found that housing industry players all agree that knowledge is power. Both lending and real estate professionals identified educational support for homebuyers and industry professionals as a key action for reducing the homeownership gap. Financial classes, outreach events, educational marketing and training courses are effective resources for keeping mortgage professionals, agents and underserved buyers informed about affordable opportunities to achieve financial freedom through homeownership.

We found that the importance of a community-focused lending strategy also resonated among the survey respondents, with about two-thirds saying that partnering with Columbus nonprofit organizations has helped further their progress toward reducing the racial homeownership gap. Community engagement creates tangible value because it allows lenders to better understand unique borrower communities and what they need to succeed.

Beyond generating trust, a localized approach also helps lenders develop better operational strategies. Just as Columbus reflects different homeownership demographics and opportunities than other markets, nationwide housing data does not accurately reflect individual market characteristics. Layered, zoomed-in data paints a clearer picture of diverse homebuyer opportunities at the census tract level, giving industry professionals fast access to qualified leads in their respective markets.

A community-focused lending strategy also creates a memorable experience for borrowers. When lenders and agents make an effort to get to know their community, they show residents a commitment to furthering financial growth and personal success, leading to valuable repeat and referral business.

***

While the survey findings in this article are specific to Columbus and its goal of increasing Black homeownership, the insights they uncover are pertinent to all lenders pursuing affordable housing goals. The responses tell a clear story — that underserved markets can be a treasure trove for lenders and real estate agents everywhere with the right market strategy and intelligence. By taking a data-driven, community-focused approach to locate, engage, educate and serve Black community members, lenders can help tear down decades-old obstacles to racially equitable homeownership.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)