Mark P. Dangelo: Banking Lessons–‘Beware the Ides of March’

Mark Dangelo currently serves as an independent innovation practitioner and advisor to private equity and VC funded firms. He has led diverse restructurings, MAD and transformations in more than 20 countries advising hundreds of firms ranging from Fortune 50 to startups. He is also Associate Director for Client Engagement with xLabs, adjunct professor with Case Western Reserve University, and author of five books on M&A and transformative innovation.

It has taken a less than 30 days for regulators, bankers and consumers to finally recognize that the third age of Federal Reserve banking design (a post-1986 #S&L digital age replicating paper processes) with regulatory defined business models has abruptly ended. Its broad applicability was in question for years, but industry volumes and fragmented technologies (e.g., over 14,000 FinTech and nearly 800 RegTech solutions) kept broad transformations from comprehensively altering traditional practices.

A post-2016 emerging fourth age (representing native digital products, services, instruments, and currencies) has exposed the factures and failings across decades of financial designs across processes, ratios, cultures, and governance. The recent failures showcase a profound set of changes which will envelop traditional banking and lending principles driven by new rationale, and more importantly, implications of execution and delivery.

From the Aftermath, Power Shifts and Technological Adjustments are Expanding

Embracing the scenes of a Shakespearean play, the last month of internal corporate discussions, regulatory guidance, political retribution, and consumer behaviors are actively being recast to match market capabilities against traditional expectations of “how” markets should function—and behave. The banking leaders, the post-Great Recession panacea of living wills, and the focus on market breakers all failed to account for industry events and the speed of recent downfalls, which struck down a generation of robust governance strategies.

Never in the history of banking have regulators or consumers experienced a run on a bank that was spurred by social media news and apps—one that reportedly experienced customers attempt to move over $200 billion in assets in under 48 hours. The analysis of these recent failures (i.e., the second and third largest banking failures in U.S. history, @SVB and @SignatureBank respectively) will take many months if not years, but traditional adherence to process and bureaucracy will likely miss “what is next” due to the culture of setting policies and delivering enforcement.

Nonetheless, the numerous generational designs and implementations that have driven the financial services industry (#FSI) are losing their efficacy—and not just with accounting for unrealized losses. Taken in isolation—just as media headlines peddle interest rates being THE cause of the banking failures—it is easier to install blinders that link the cascading, complex components that ALL inflicted fatal damage.

Therefore, if we are to structurally adjust our thinking and our models of serving customers, we need to internalize: 1) the shifts already taking place, 2) the “ABCs” of an organizations digital maturity, and 3) the core competencies for the emerging fourth (native digital) banking revolution.

1) Generational Shifts Which are Actively Being Debated—and Implemented

The shifts that are taking place seem counterintuitive when compared to vendor statements, reinforced organizational culture implementations, and competitor positioning. With 30-year mortgage rates still double from a year prior coupled with Federal Reserve slowing their inflationary agenda, lenders are seeking a “next” model that will propel them forward, while improving margins and derisking capital investments. Yet, what should FSI and mortgage leaders be examining as their enablers—when compared against the familiar honed during the past 12 years?

The familiar, unbridled strategies and deployments of a) #cloudcomputing “first” solutions, b) replication of #data, #datawarehouses, and #datalakes, c) bolt-on “trendy” #innovative solutions linked to #influencers and retail #trendsetters, and d) third-party #storage and #aggregation of consumer information is rapidly coming to a “fork-in-the-road,” and in numerous #usecases, a halt. Their cycle of efficiency and disruptive value is diminishing as differentiation is lost as costs skyrocket. Indeed, innovative leaders across banking sectors are seeking leverage from these traditional implemented solutions, but they must pivot to what is coming in the face of what consumers and regulators will likely demand moving forward.

For FSI leaders, discussions surrounding 2023-2025 are concentrated on new discussions, unfamiliar ones that must shape not just their strategy, but how these changes will be achieved. This includes:

- #LLM’s, or large language modules now familiar as part of #generativeAI deployments integrated with industry specific cloud offerings and standards (comprising over 260 startups funded with over $30 billion in the last 24 months alone),

- #datameshes and enterprise #datafabrics underpinned by active #datagovernance (e.g., @IBM, @Informatica, @Ataccama),

- cross-platform data-as-a-product (#DaaP) integrations using data linked from (as examples) @Salesforce Financial Services Cloud, varied #LOS’s, servicing systems, and,

- the resurgence of private #securitizations demanding #immutable digital assets, granular transparency, and privacy-preserving data virtually linked to the original systems of record.

For leaders seeking to put into context the changes necessary to compete across a financial and lending supply chain, we use the analogy of edge computing—expanding from the edge of what is known and adding layers of functionality to what is existing.

Sometimes termed the “adjacent possible,” items 1 through 4 above take the familiar and leverage them into a newer operating model with greater capabilities, faster cycle times, and upside scalability. However, to participate in the next cycle of FSI and mortgage lending, leaders must assess and improve their digital maturity against the demands for the future—accepting the digital journey from strategy to implementation is not a single step or one-size prescription.

2) “ABCs” of Digital Maturity

In times of business reimaging, unchecked expectations often are led by headlines, and internal discussions are dominated by stylish innovational aspirations focused on the allocation of critical resources. Translation: find new revenue sources, improve margins and efficiencies, and make the “pain” go away!

However, in the thirst for innovative, digital solutions, leaders unaccustomed to emerging “ecosystem” demands and advancements believe that if they create a strategy, then the enterprise should quickly embrace action plans, which provide data-driven decision making and generative intelligence. They also direct their organizations, using action plans and budgets, to leverage advanced solutions that include machine learning, generative AI, and of course, cloud provisioning.

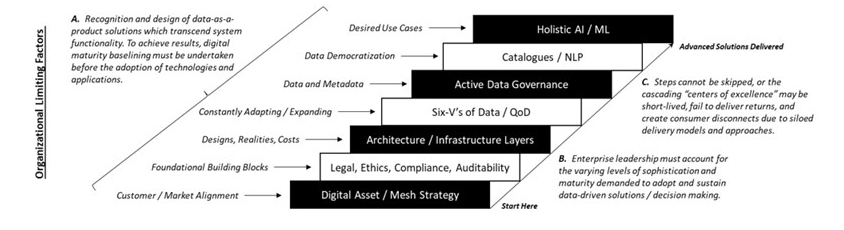

Yet, they forget (or misunderstand) the reality that their employees, outsourcers, and processes cannot leap from strategy to execution—it requires a digital maturity to adopt and adapt data-driven apps and technologies. Pressured by the changing business requirements and models, FSI leaders should review the “ABC” model below to assess their current capabilities against future needs—and the steps (which all need to be addressed) to arrive at the desired use cases.

Digital maturity is also not something that can be bolted on or piecemeal implemented. One of the key causes for ML / AI being abandoned within 12 months (>85% failure rate) is that enterprises lack the steps between the strategy and the desired end result. Enterprises and their leaders must recognize that each maturity level provides the foundation for not just adoption, but continued adaptation of solutions as the data evolves, grows, and transforms.

Indeed, the idea of digital maturity and the core competencies necessary for sustainability are new and emerging within FSI data ecosystems, but there are since 2021 (before the current crisis) noted institutions who have embraced and internalized the ABCs into their operations (e.g., @JPM, “A New Era of Data,” @SiliconAngle). The lessons learned center on the establishment of core digital competencies that are both active and robust.

3) Core Competencies for the Emerging Fourth Banking Revolution

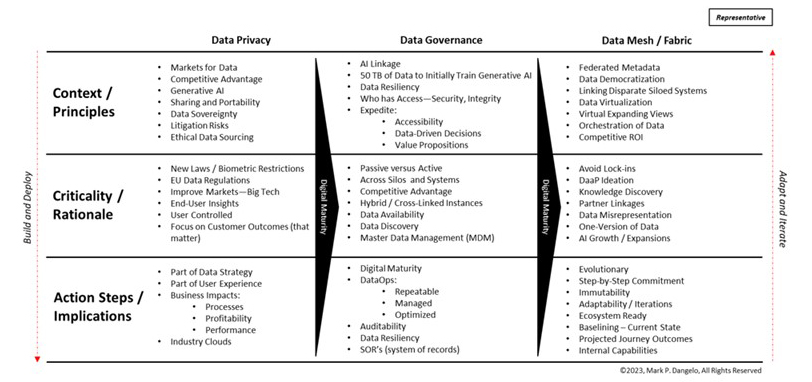

The challenge for many leaders and their organizational cultures are foundationally anchored in commodity products, services, and customer fulfillments that during times of volume mask the demands for change. However, during the period of artificially low lending rates (2010-2021), organizational practices failed to recognize that the shift from application centric implementations was rapidly transitioning towards data-driven building blocks. This artificial profitability honed efficiency focused FinTech and RegTech solutions, but failed to incorporate seismic shifts surrounding data privacy, data governance, and the use of data meshes and fabrics.

Already in 2023, there are six states which have passed bills into laws surrounding expanded consumer control of their digital assets with another dozen either drafting bills or under active debate. Barring federal regulations (during a time of increased state sovereignty demands), there will increasingly be a patchwork of regulatory governance delivering consumer rights over their “owned” immutable digital assets. Additionally, there are also state legislator bills on the use of biometric data implemented as a validation tool for application identification and authentication.

To understand how the progressive maturity of digital maturity pushes forward emerging data-driven solutions, characteristics, and behaviors against, a) context and principles, b) criticality and rationale, and c) action steps and implications, for specific alignment with internal capabilities and external partners. Starting top-down, principles will drive the rationale and lead to the action steps and implications. The results across the vertical columns of digital maturity then provide feedback and iteration designs leading to a full-cycle adaptation steps and sprints delivering traction and data transforming outcomes.

This approach is often termed a “thin layer orchestration” of products and services that can be created, reused, and refined without (as we have today in the industry) cost-consuming projects that only marginally add customer value and margin improvements.

In conclusion, analogous to the dramatized Shakespeare story of Julius Caesar and the aftermath of his demise, FSI leaders and regulators must pivot proactively towards data-as-a-product designs and solutions. If the industry continues to focus their huge resources to expand apps and system ideation as their go-to practice, their leadership will be marginalized against digitally native competitors who a) recognize the shifts underway and alter their delivery designs, b) internalize digital maturity requirements, training, education, and leverage, and c) create core competencies around data privacy, active governance, and digital fabrics.

And, as we have seen, enterprises that embrace new or even countercyclical strategies can watch their market power and size grow by x-factor multipliers (e.g., @FirstCitizensBancshares) in just a few years. In the end, it is what they do with the strategy, alignment with their capabilities, and an acceptance that the traditional ecosystems (and their participation in them) will continue to adapt.

However, like Shakespeare’s Julius Caesar tragedy, FSI leaders can strive to participate across the changing consumer and data-driven ecosystems now part of this fourth banking revolution—or they can resist and support a different narrative. There are lessons to be learned from history and storytelling from the Ides of March—it did not work out well for Caesar.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)