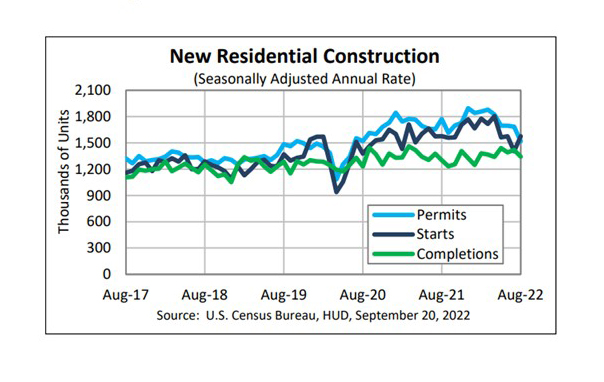

August Housing Starts Rise; Drop in Permits Casts Shadow

The good news: August housing starts beat expectations, rising by more than 12 percent from July. The bad news: housing permits fell just as dramatically, lending uncertainty to an already volatile 2022 housing market.

HUD and the Census Bureau on Tuesday reported privately owned housing starts in August jumped to a seasonally adjusted annual rate of 1,575,000, 12.2 percent higher than the revised July estimate of 1,404,000, but 0.1 percent lower than a year ago (1,576,000). Single‐family housing starts in August came in at 935,000; 3.4 percent higher than the revised July figure of 904,000. The August rate for units in buildings with five units or more jumped to 621,000, up by nearly 29 percent from July and by 31 percent from a year ago.

Regionally, starts were largely positive. In the South starts jumped by 24.5 percent to 885,000 units in August, seasonally annually adjusted, from 711,000 units in July. From a year ago, however, starts fell by 0.3 percent. In the West, starts rose by 1.1 percent in August to 361,000 units from 357,000 units in July and rose by nearly 11 percent from a year ago.

In the Midwest, starts improved by 19.3 percent in August to 167,000 units, seasonally annually adjusted, from 140,000 units in July but fell by nearly 15 percent from a year ago. Only the Northeast saw a monthly decline in August, falling by 17.3 percent to 162,000 units from 196,000 units in July; from a year ago, starts in the Northeast fell by 2.4 percent.

However, the positive housing starts news was offset somewhat by housing permits, which fell in August to a seasonally adjusted annual rate of 1,517,000, 10.0 percent below the revised July rate of 1,685,000 and 14.4 percent lower than a year ago. Single‐family authorizations in August fell to 899,000; 3.5 percent below the revised July figure of 932,000. Authorizations of units in buildings with five units or more fell to 571,000, in August, 18.5 percent below the July rate (701,000) and 14.5 percent lower than a year ago.

“Housing starts were expected to move up to an annual pace of 1.45 million in August, but came in above expectations at 1.58 million,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The increase was mostly driven by multi-family starts. The pace of single-family housing completions, which represents new supply added to the housing stock, increased modestly from month over month, and 6.5% from August 2021. Multi-family completions were down on both a month-over-month and year-over year basis. Supply chain disruptions continue to hamper the pace of new-home completions.”

Kushi said the decline in permits shows that builders are responding to the decline in affordability and cooling demand in the purchase market by building fewer single-family homes. “A slowdown in new construction is concerning in the long-run because there remains a structural and long-term national shortage in the housing market,” she said. “Millennials aging into their prime home-buying years and a lack of existing-home inventory, as rate-locked in homeowners see little incentive to list their homes for sale, mean that new-home construction is essential in meeting future shelter demand.”

“The unexpected increase in single family starts during the month was likely owed to increased building material availability allowing builders to begin projects further along in the planning stages,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “The surprising gain in total starts is a welcome reprieve from the onslaught of negative housing data received recently. That said, August’s sharp decline in permits is a reminder that builders and developers are likely to continue scaling back production in response to retreating demand and higher financing costs.”

The report said privately owned housing completions in August fell to a seasonally adjusted annual rate of 1,342,000, 5.4 percent lower than the revised July estimate of 1,419,000, but 3.1 percent higher than a year ago (1,302,000). Single‐family housing completions in August rose to 1,017,000; 0.4 percent higher than the revised July rate of 1,013,000. The August rate for units in buildings with five units or more fell to 318,000, down by nearly 21 percent from July and by 6.7 percent from a year ago.