Nearly 1/3 of Homes Bought All-Cash as Buyers Gain Upper Hand

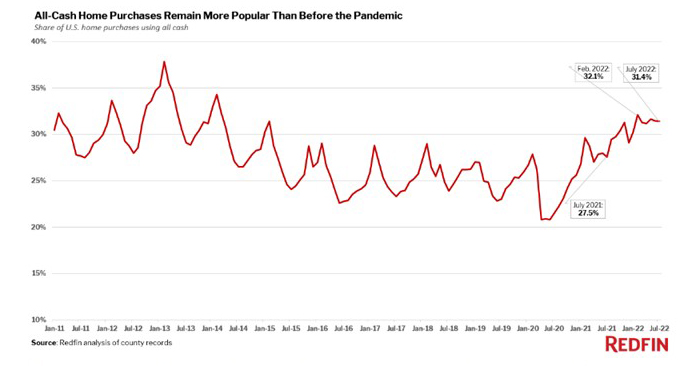

Redfin, Seattle, reported nearly one-third (31.4%) of U.S. home purchases were paid for with all cash in July, near the eight-year high reached in February and up from 27.5% a year earlier. In a separate report, Redfin said higher interest rates have given home buyers the upper hand after several years of a “sellers’ market.”

Redfin said the share of all-cash purchases jumped in early 2021 during the pandemic-driven homebuying frenzy and has remained elevated since then. The report said all-cash purchases have gained favor with affluent buyers, largely because mortgage rates have doubled from a year ago, reaching 6% in mid-September. Buyers who don’t use loans avoid high interest payments that exacerbate home prices, which remain near record highs even as the housing market slows.

Redfin said all-cash purchases jumped in popularity last year because they allowed buyers to stand out among fierce competition: Bidding-war rates reached record highs in early 2021 due to sub-3% mortgage rates and remote work driving homebuyer demand. Remote work has also given more Americans the option to use all cash, as it allowed a record share of homebuyers to relocate, often from expensive to affordable parts of the country.

Additionally, U.S. home values have skyrocketed since the start of the pandemic, which means Americans who sell a home in a pricey place such as San Francisco could use equity to pay cash in a more affordable area such as Las Vegas.

Investors are also contributing to the all-cash boom. Real estate investors bought up a record share of the U.S. housing stock in the fourth quarter of last year, and their share has remained above pre-pandemic levels since then. About three-quarters of investor home purchases are made with cash.

Three of the five metro areas with the highest share of all-cash purchases are in Florida, partly because the state is home to a lot of affluent buyers. But Long Island, N.Y.–which includes the Hamptons–is home to the highest share of cash buyers, with two-thirds (66.5%) of home purchases made in cash in July. Next come West Palm Beach (56.4%), Jacksonville (45.5%), Milwaukee (45.3%) and Fort Lauderdale (43.3%).

A trio of expensive West Coast markets have the lowest share of all-cash purchases, partly because high prices make it more challenging to pay in cash: Oakland, Calif. (15.1%), San Jose, Calif.(16%) and Seattle (16.7%). Washington, D.C. (17.5%) and Pittsburgh (17.8%) round out the bottom five.

The report said FHA loans are somewhat more popular than they were at the height of the market, but less prevalent than before the pandemic.

Even though all-cash purchases are at an eight-year high, most home purchases use loans. Conventional loans are by far the most common type, followed by Federal Housing Administration and Veterans Affairs loans. More than eight in 10 (81.3%) of home sales that used a mortgage in July took out a conventional loan, down slightly from 81.9% a year earlier and down from the record high of 83.8% set in April.

Roughly 12% of home sales that used a mortgage in July took out an FHA loan, flat from a year earlier but up from the all-time low of 10.4% in the spring. And 6.8% used a VA loan, up slightly from 6.2% a year earlier but up from the record low of 5.4% in spring 2021.

But FHA loans are still much less prevalent than they were pre-pandemic; about 17% of mortgaged purchases used them in 2019. That’s partly because even though the market has cooled and FHA buyers are less likely to face competition, homes are still quite expensive: The typical U.S. home that sold in July cost about 8% more than a year earlier. That means a lot of the people who would use an FHA loan–lower-income, first-time homebuyers–are priced out of the market.

VA purchases are about as popular as before the pandemic; roughly 7% of mortgaged purchases used them in 2019.

Separately, Redfin reported the housing market is becoming more balanced, but at a great cost to both buyers, who are footing the bill of high monthly mortgage payments, and sellers, whose stronghold on the market has slipped away as mortgage rates doubled this year.

Redfin reported 2.9 months of home supply during the four weeks ending September 11, up from 1 month from a year ago and the highest level since June 2020.

Redfin Deputy Chief Economist Taylor Marr said the rapid climb in months of supply shows how quickly sellers lost their grip on the market as mortgage rates shot up to 6%, making homes unaffordable to many buyers. Potential sellers are reluctant to list their homes in this environment, which is why inventory is falling. But it’s hard to say with conviction that buyers have a true upper hand, either.

“Homebuyers have more power than they’ve had since the ‘before times,’” Marr said. “Unfortunately, it’s increasingly hard for buyers to make use of their newfound power thanks to the affordability pressures of rising mortgage rates and a dearth of homes being listed for sale.”

Marr said a true buyers market would have more homes for sale than there are buyers, with a wide variety of homes for sale by style, price and location so when a buyer finds the home that matches their preferences they face little competition and can offer under asking price with healthy inspection and financing contingencies in place. “Today’s average buyer is paying less than the list price, but they continue to struggle to find a home that meets their criteria and budget,” he said.