MBA Advocacy Update Sept. 19, 2022

On Tuesday, MBA led a coalition of real estate trade groups in a letter to the White House National Economic Council urging it to support reduction of mortgage insurance premiums for FHA loans. On Wednesday, the House advanced VA loan appraisal modernization legislation strongly supported by MBA. Also last week, FHA announced a delay of the mandatory effective date for its electronic appraisal delivery module.

Nearly 1/3 of Homes Bought All-Cash as Buyers Gain Upper Hand

Redfin, Seattle, reported nearly one-third (31.4%) of U.S. home purchases were paid for with all cash in July, near the eight-year high reached in February and up from 27.5% a year earlier. In a separate report, Redfin said higher interest rates have given home buyers the upper hand after several years of a “sellers’ market.”

Closing the Racial Capital Gap

Enterprise Community Partners, Columbia, Md., said access to capital remains the biggest hurdle facing small-scale Black, Indigenous and other people of color real estate developers--and it suggests some solutions.

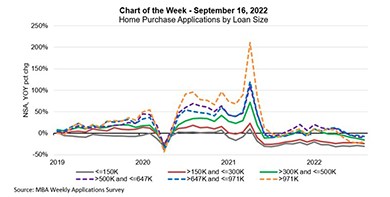

MBA Chart of the Week, Sept. 16, 2022: Home Purchase Applications by Loan Size

The housing market continues to face challenges from economic uncertainty, high home-price growth and volatile mortgage rates. MBA’s Weekly Applications Survey data show that overall mortgage application activity continues to trend lower, as refinances have quickly dried up due to rates rising throughout the year and hitting the 6-percent mark for the first time since 2008.

MISMO Seeks Nominations for Standards Governance Committee Members

MISMO® seeks nominations for qualified industry professionals to serve on MISMO’s Standards Governance Committees for a two-year term beginning in January 2023. Positions are available on both the Residential and Commercial Standards Governance Committees.