HUD Report Assesses ‘Limited Supply’ of Small Mortgage Lending; Issues RFI

HUD on Tuesday issued a report assessing factors that limit supply of small mortgage loans and the impact to affordable homeownership for those interested in lower-priced homes.

The report, “Financing Lower-Priced Homes: Small Mortgage Loans,” was submitted in response to a request from Congress to (1) “identify barriers or impediments to supporting, facilitating, and making available mortgage insurance for mortgage loans having an original principal obligation of $70,000 or less, (2) identify administrative actions that HUD could take to remove barriers and impediments, and (3) describe the effect of such actions on the solvency of the Mutual Mortgage Insurance Fund.”

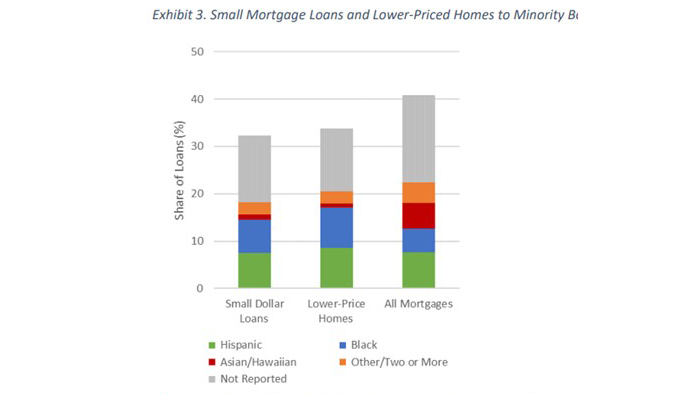

The report highlights challenges facing borrowers who need loans to purchase lower-priced homes. Among its principal findings, the report notes:

• Mortgage loans with an original principal obligation of $70,000 or less are a small portion of the mortgage lending market, constituting less than 3.5 percent of home purchase originations in 2020. Many of these low balance mortgage loans secure properties valued at more than $70,000, indicating that the purchases included substantial down payments. Future reviews many want to focus on a different cut-off point.

• Federal Housing Administration programs do not impose minimum loan amounts, nor do FHA’s policies intentionally discriminate against small mortgage loans. FHA disproportionately insures loans for lower-priced homes compared to the rest of the mortgage market. FHA also has loan insurance programs for financing property improvements and manufactured homes that are particularly targeted to lower loan amounts.

• A significant barrier to small mortgage lending are fixed costs of loan origination and servicing, which makes smaller loans less profitable and may require additional incentivization for lenders.

Separately, FHA on Tuesday issued a Request for Information in the Federal Register seeking input on ways it can facilitate increased access to smaller balance mortgages through its Single-Family mortgage insurance programs. FHA Commissioner Julia Gordon said the RFI will assist FHA as it explores opportunities to offer safe and sustainable mortgage credit to aspiring homeowners who live where houses may be less expensive.

“The input we receive through this RFI will help us better understand how FHA can make small mortgages more broadly available and affordable for those who need them,” Gordon said. “The RFI responses will help drive our programmatic work to increase access to homeownership and to close the racial homeownership gap.”

Specifically, the RFI asks questions concerning the current availability of small mortgage financing, barriers and disincentives to small mortgage lending transactions, changes to policies or processes that would encourage origination of more FHA-insured small balance mortgages, and considerations regarding liquidity provided through securitization.

Instructions for submitting comments, which are requested by December 5, can be found in the RFI.