Construction Spending Posts Biggest Drop in 18 Months

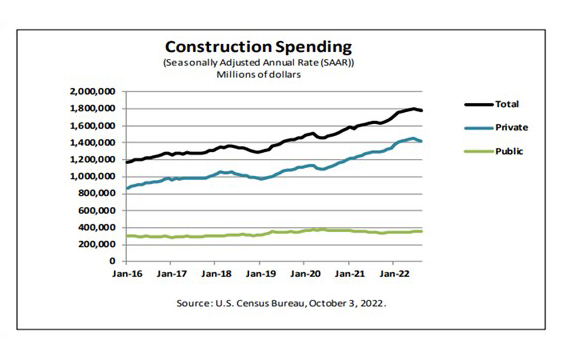

Construction spending fell by 0.7 percent in August, the Commerce Department reported Monday, the second consecutive decline and the biggest drop since February 2021.

The report estimated August construction spending at a seasonally adjusted annual rate of $1,781.3 billion, 0.7 percent lower than the revised July estimate of $1,793.5 billion. From a year ago, however, the August figure is 8.5 percent higher ($1,641.6 billion). During the first eight months of this year, construction spending rose to $1,183.8 billion, 10.9 higher than $1,067.4 billion for the same period in 2021.

Spending fell across the board, with both private (-1.0 percent) and public (-0.4 percent) construction reporting higher-than-expected declines.

Spending on private construction fell to a seasonally adjusted annual rate of $1,426.0 billion, 0.6 percent lower than the revised July estimate of $1,435.2 billion. Residential construction fell to a seasonally adjusted annual rate of $912.9 billion in August, 0.9 percent lower than the revised July estimate of $921.6 billion. Nonresidential construction fell to a seasonally adjusted annual rate of $513.1 billion in August, 0.1 percent lower than the revised July estimate of $513.6 billion.

Commerce estimated the seasonally adjusted annual rate of public construction spending in August at $355.3 billion, 0.8 percent lower than the revised July estimate of $358.3 billion. Educational construction fell to a seasonally adjusted annual rate of $77.6 billion, 0.4 percent lower than the revised July estimate of $78.0 billion. Highway construction fell to a seasonally adjusted annual rate of$102.0 billion, 1.4 percent lower than the revised July estimate of $103.4 billion.

“The drop in residential spending was owed entirely to a 2.9% fall in single-family spending,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “This year’s spike in mortgage rates has weighed heavily on new home sales, and builders are now scaling back production in response. Multifamily and home improvement outlays expanded during the month, rising 0.4% and 1.0%, respectively. Declining purchase affordability has been a tailwind for both of these categories; however, higher interest rates and inflation are likely to slow activity moving forward.”

Dougherty said higher financing costs are likely to further weigh on construction activity moving forward. “That noted, the pipeline of new nonresidential projects looks to be holding up amid heightened economic uncertainty,” he said. “The Architecture Billings Index improved to 53.3 in August, the 19th straight month above the 50 mark which indicates expansion in billings at architecture firms.”