Typical Homebuyer’s Mortgage Payment Up 15% Since Mid-August

Talk about a wallop to the wallet: the typical homebuyer’s monthly mortgage payment has climbed $337 (15%) over the past six weeks, according to a report from Redfin, Seattle.

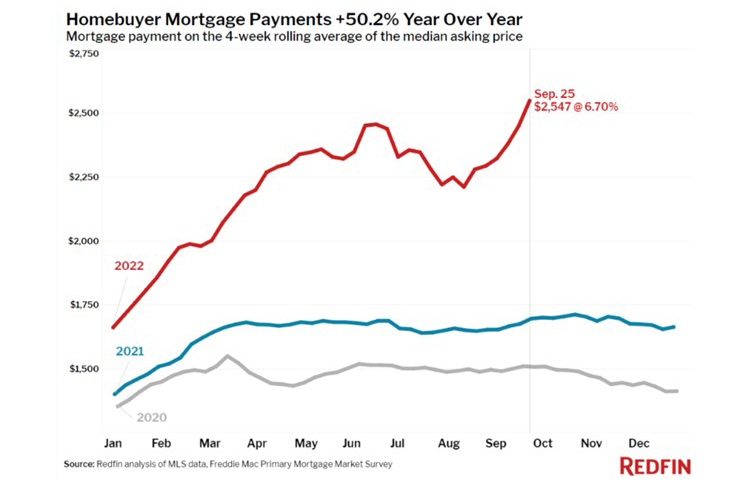

Redfin reported the monthly mortgage payment on the median asking price home climbed to a record high $2,547 at the current 6.7% mortgage rate, up 50% from $1,698 a year earlier, when mortgage rates were 3.01% and up from a recent low of $2,210 during the four-week period ending August 14.

The sticker shock has had a ripple effect on housing; Redfin reported extreme market volatility and the recent surge in mortgage rates has caused many potential homebuyers to delay or cancel their plans to purchase a home altogether. Pending sales dropped to their lowest level since January, while the share of homes sold above list price fell to its lowest level in over two years.

“Homeowners are increasingly reluctant to enter the market as mortgage rates approach 7%,” the report said. “Even though new listings are down to their lowest level since February, months of supply (active listings divided by closed sales—the lower the level, the stronger the seller’s market) has been growing quickly, reaching three months for the first time since July 2020. This means that more homes are lingering on the market because they are undesirable and/or overpriced, so it’s no surprise that the share of home sellers dropping their price reached its highest level on record, at least since 2015.”

“It’s important to remember that much of the housing market data and neighborhood comparables being reported are based on home purchases that were agreed to a month or more ago when mortgage rates were a point and a half lower,” said Redfin Deputy Chief Economist Taylor Marr. “Sellers should anticipate that buyers are unwilling or unable to pay a price similar to what their neighbor’s home sold for a month ago, and buyers should connect with their lenders to find ways to mitigate the impact of rising rates. This could include paying upfront to lock in a rate, switching to an ARM and tightening your budget so you don’t end up with a monthly mortgage payment that’s a stretch to afford in the months to come.”

Redfin reported fewer people searched for “homes for sale” on Google; searches during the week ending September 24 were down 33% from a year earlier. Touring activity as of September 25 was down 18% from the start of the year, compared to an 8% increase at the same time last year, according to home tour technology company ShowingTime.

In addition to the 21 percent drop in pending sales, Redfin reported new listings of homes for sale fell bu 14% from a year earlier. Active listings (the number of homes listed for sale at any point during the period) fell 0.8% from the prior four-week period. On a year-over-year basis, they rose 6%.