September Housing Starts Down 8%

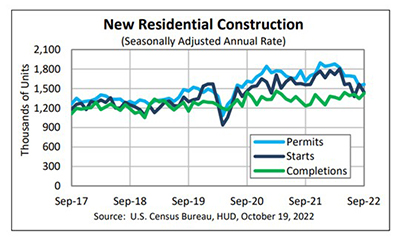

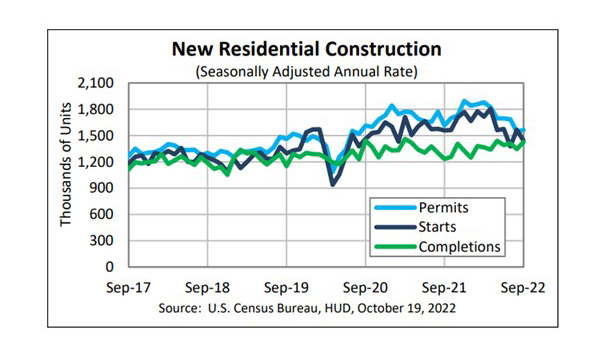

September housing starts took back the temporary momentum it gained in August, falling by more than 8 percent, HUD and the Census Bureau reported Wednesday.

The report said privately owned housing starts in September fell to a seasonally adjusted annual rate of 1,439,000, 8.1 percent lower than the revised August estimate of 1,566,000 and 7.7 percent lower than a year ago (1,559,000). Single‐family housing starts in September fell to a rate of 892,000, 4.7 percent lower than the revised August figure of 936,000. The September rate for units in buildings with five units or more fell to 530,000, down by 13.1 percent from 610,000 units in August but up by 16.5 percent from a year ago.

Every region but the West saw monthly declines; starts in the West rose by 4.5 percent in September to 372,000 units, seasonally annually adjusted, from 356,000 units in August but fell by 11.2 percent from a year ago.

In the South, starts fell by 13.7 percent in September to 738,000 units, seasonally annually adjusted, from 855,000 units in August and fell by 8.8 percent from a year ago. In the Midwest, starts fell by 2.7 percent in September to 182,000 units from 187,000 units in August and fell by nearly 11 percent from a year ago. In the Northeast, starts fell by 12.5 percent in September to 147,000 units from 168,000 units in August but improved by nearly 16 percent from a year ago.

“Housing starts missed consensus expectations in September as unrelenting and rapid rise in mortgage rates, ongoing supply-side challenges and hurricane Ian spooked builders,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The new-home market is very rate-sensitive and builders will respond to the decline in affordability and cooling demand by building less. While there remains a structural and long-term shortage of housing, the pullback in demand and ongoing supply-side headwinds has builders spooked.”

“The unexpected respite seen in housing starts during August proved to be temporary,” said Sam Bullard, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Home builders continue to have a difficult time with rising mortgage rates and sky-high construction costs.”

Bullard noted homes under construction edged up to a seasonally adjusted 1.710 million-units. “This number is at a record high, in part, as labor and building material shortages have lengthened the time it takes to build a home,” he said. “Single-family homes under construction remain near a 16-year-high, and in order to sell these homes builders may have to consider reducing prices or offering incentives. With profit margins under pressure, home builders should continue to scale back on new single-family construction.”

“We anticipate a continued drift downward in new home construction as mortgage rates have continued to rise,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Given how dramatically housing demand has fallen due to the rapid run-up in mortgage rates, we expect builders to begin offering more aggressive incentives to move their now-growing inventory of completed homes for sale. If true, we believe this dynamic would likely cause new home sales to be resilient relative to existing home sales in the near-term.”

Permits rose. The report said privately owned housing units authorized by building permits in September rose to a seasonally adjusted annual rate of 1,564,000, 1.4 percent higher than the revised August rate of 1,542,000, but 3.2 percent below a year ago (1,615,000). Single‐family authorizations in September fell to 872,000, 3.1 percent below the revised August figure of 900,000. Authorizations of units in buildings with five units or more rose to 644,000 in September, up by 8.2 percent from 595,000 in August and up by 25.5 percent from a year ago.

The report said privately owned housing completions in September rose to a seasonally adjusted annual rate of 1,427,000, 6.1 percent higher than the revised August estimate of 1,345,000 and 15.7 percent higher than a year ago (1,233,000). Single‐family housing completions in September rose to 1,049,000, 3.2 percent higher than the revised August rate of 1,016,000. The September rate for units in buildings with five units or more rose to 376,000, up by nearly 17 percent from August (322,000) and up by 33.3 percent from a year ago.