ULI, PwC: Property Markets Normalizing, But Some Pandemic-Related Changes Endure

The real estate market is bifurcating, the Urban Land Institute and PwC US reported. Some aspects are reverting to pre-covid patterns while others have permanently shifted to the post-pandemic new normal.

“As we enter 2023, the pandemic-driven factors that upended the global economy for more than two years are starting to fade,” said Anita Kramer, Senior Vice President of ULI’s Center for Real Estate Economics and Capital Markets. “At the same time, structural changes like the widespread adoption of remote work will likely continue to inform investor behavior.”

Kramer noted a series of long-term factors including the rising cost of housing, increased climate risk and declining socioeconomic mobility pose continued uncertainty for the private and public sectors alike. “[But] there are also opportunities–the increase in federal infrastructure spending provides the chance to create greener and more equitable communities that can adapt to these challenges,” she said.

The ULI and PwC US Emerging Trends in Real Estate 2023 report also highlighted the real estate industry’s move to look beyond cyclical headwinds and focus on a long-term approach to real estate assets. “In an environment with rising interest rates, declining GDP and minimized deal activity, the industry is opting to ride out the slump and position itself for sustained growth and strong returns,” the report said.

Byron Carlock, U.S. Real Estate Leader for PwC, called the past few years “historic territory” for the real estate industry. “The pandemic has permanently changed how and where we use different types of properties,” he said. “There are several factors at play determining both the near and long-term future of the industry. Although real estate capital markets are constricting, they are still open for business, investors are still buying high-quality properties, lenders will continue to lend and companies should move forward with cautious optimism through this current cycle and prepare to adapt to quick market changes.” He urged the industry to work closely with stakeholders to ensure they are addressing demands and shifting sentiments while building trust.

Companies need to reassess their office space needs as hybrid work grows more popular, the report said. “As employers and employees settle on their work preferences, many firms are keeping their offices in case of potential future use or due to leasing contracts. While more firms are downsizing, terminating their leases at renewal or turning to sublets as a temporary solution, a mass departure from office buildings is unlikely,” ULI and PwC said. “Unique spaces still attract people, and therefore companies need to reassess their spaces to determine they are relevant to their operational needs and play a role in securing and retaining talent.”

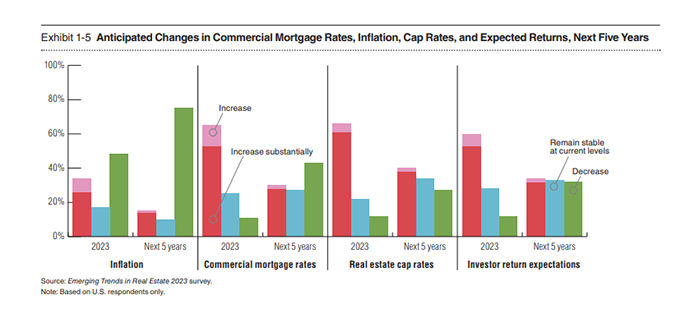

ULI and PwC noted investor demand for real estate has cooled since last year as many investors focus on other types of assets such as equities and bonds. “Rising interest rates are increasing costs around acquisition and construction debt, and the continued dynamic of housing costs outpacing income means buyers are seeking price breaks or pulling out altogether,” the report said. “Uncertainties around pricing are currently the strongest headwind to closing deals as buyers are concerned about overpaying and sellers don’t want to sell their assets short.”

Available capital will likely decline in the near term as many investors wait to see how long the Federal Reserve will keep raising interest rates. “Investors and developers are looking beyond the short-term turbulence and focusing on long-term opportunities that will generate strong returns,” the report said.