September Job Openings Surge; Construction up 0.2%

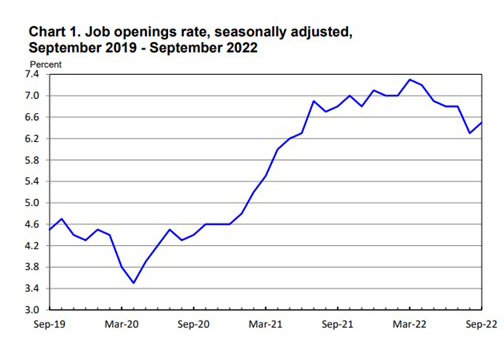

Job openings in September jumped by more than a half-million from August, showing there are 1.9 job openings for every available worker, the Bureau of Labor Statistics said Tuesday in the first of four major jobs reports this week.

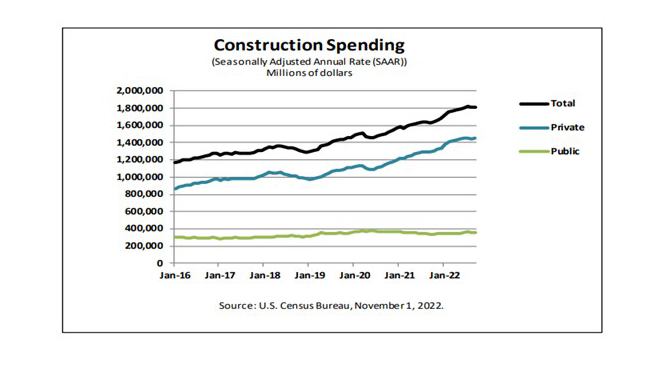

Separately, the Census Bureau on Tuesday reported an 0.2% increase in construction spending following a decrease in August.

The BLS Job Openings and Labor Turnover Survey—known as JOLTS—reported an increase in employment openings to 10.72 million as of the end of September. Hirings fell to 6.1 million, while total separations fell to 5.7 million.

The rate of job openings was little changes, BLS said, but was nearly a percentage point lower than its peak in March. Food services led openings (215,000), followed by health assistance (115,000); openings decreased in wholesale trade, finance and insurance. The hiring rate was unchanged at 4 percent.

Separations decreased to 5.7 million (-370,000) and 3.7 percent, respectively. The number of quits changed little at 4.1 million, and the rate was 2.7 percent for the third month in a row. Layoffs and discharges edged down to 1.3 million; the rate changed little at 0.9 percent. Other separations decreased in September to 299,000 (-84,000).

This morning, ADP releases its National Employment Report; on Thursday, the Labor Department releases its weekly Initial Claims report; and on Friday, BLS issues its Employment Situation report. Mortgage Bankers Association Chief Economist Mike Fratantoni will provide commentary and analysis on the Friday jobs report in the Monday, Nov. 7 edition of MBA NewsLink.

Meanwhile, the Census Bureau estimated construction spending during September at a seasonally adjusted annual rate of $1,811.1 billion, 0.2 percent above the revised August estimate of $1,807.0 billion and nearly 11 percent higher than a year ago ($1,632.9 billion). During the first nine months of this year, construction spending rose to $1,353.7 billion, 11.4 percent higher than the $1,215.6 billion for the same period in 2021.

Spending on private construction rose to a seasonally adjusted annual rate of $1,450.3 billion, 0.4 percent higher than the revised August estimate of $1,444.9 billion. Residential construction was unchanged at a seasonally adjusted annual rate of $918.0 billion in September. Nonresidential construction rose to a seasonally adjusted annual rate of $532.3 billion in September, 1.0 percent higher than the revised August estimate of $526.9 billion.

Census estimated the seasonally adjusted annual rate of public construction spending at $360.9 billion, 0.4 percent lower than the revised August estimate of $362.1 billion. Educational construction was unchanged at a seasonally adjusted annual rate of $78.2 billion. Highway construction was rose to a seasonally adjusted annual rate of $108.4 billion, 1.7 percent higher the revised August estimate of $106.6 billion.

“September’s upside surprise was helped by stabilization in residential spending, which was unchanged after falling the previous three months,” said Sam Bullard, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “That said, single-family spending slid for the fourth straight month, dropping 2.6%. The slack in single-family spending was offset by a 0.3% increase in multifamily spending, and most notably a 2.9% jump in home improvement spending.”

Bullard noted the home improvement share of total private residential spending grew to 42.8% in September, up from 34.5% a year ago. “Some of the rise in renovation spending can likely be attributed to declining home purchase affordability as mortgage rates continue to rip higher,” he said. “In the face of higher financing costs, homeowners have increasingly elected to stay put.”

Looking ahead, Bullard said, ongoing increases in financing costs should continue to weigh on construction activity. “Moreover, if the U.S. economy is heading toward recession in 2023 as we project, we would anticipate businesses to become even more cautious and pare back expansion and renovation plans in the coming year,” he said.