CBRE: Tech Industry Office Leasing Activity Slows, Remains Leading Force

CBRE, Dallas, said the tech industry’s share of U.S. office leasing slipped in first-half 2022 to its lowest figure in five years, though it remains a leading force in the sector.

In its annual Tech-30 report, CBRE noted the tech industry, which has long dominated the U.S. office market, is not immune to the current economic cycle. Facebook parent company Meta and Twitter have recently announced layoffs or layoff plans.

“Even with the decline, the tech industry is still a leading force, accounting for 16 percent of total office leasing activity, tied with two other sectors–Finance & Insurance and Professional & Business Services–for the largest share in this year’s first half,” the report said. That share fell from 21 percent share in 2021. The last time tech’s share was lower than its current level was in 2017 with 15.7 percent.

Despite large tech companies’ pullback in leasing this year, CBRE found that more than two-thirds of the top 30 North American tech markets registered office rent growth over the past two years. Seven of those increased by double-digit percentages.

During that span, several tech markets registered positive net absorption, meaning companies in those markets moved into more office space than they vacated. Half a dozen Tech-30 markets exceeded that threshold: Silicon Valley, Raleigh-Durham, Nashville, Vancouver, Austin and Salt Lake City. So did seven tech submarkets: Nashville’s Central Business District, Vancouver’s Broadway Corridor, Portland suburb Hillsboro, Raleigh-Durham’s Research Triangle Park/I-40 Corridor, Oakland/East End in Pittsburgh, Salt Lake City’s South Valley and Midtown Atlanta.

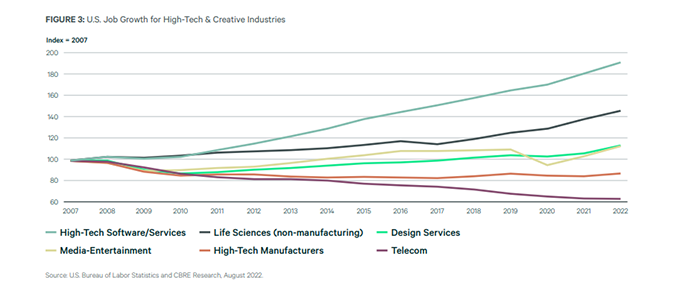

At the same time, U.S. tech job growth slowed to a 2.1 percent year-over-year gain in this year’s first half from a 4.5 percent pace in last year’s second half. Hiring momentum persisted in many markets, including a dozen top U.S. and Canadian tech hubs that registered double-digit percentage gains in tech employment in 2020 and 2021, led by Vancouver, Toronto, Austin, Seattle and Montreal.

“Even amid challenges of the past two years, the tech industry continues to add jobs and lease office space at a strong pace,” said Colin Yasukochi, CBRE Tech Insights Center Executive Director. “Since early 2020, tech has accounted for roughly one of every three office-using jobs created in the U.S. There is potential for pent-up demand to emerge once companies set their long-term hybrid work practices and economic growth picks up. Venture capital funding is on track for the second highest annual total on record after last year’s peak.”

The report also identified markets well positioned for resiliency and continued growth based on tech job growth and momentum, office market performance and demand recovery. Those include Vancouver, Silicon Valley, San Diego, Boston and Raleigh-Durham.