First American: Equity Buffers Remain Robust Despite Home Price Declines

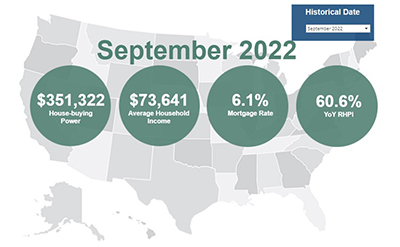

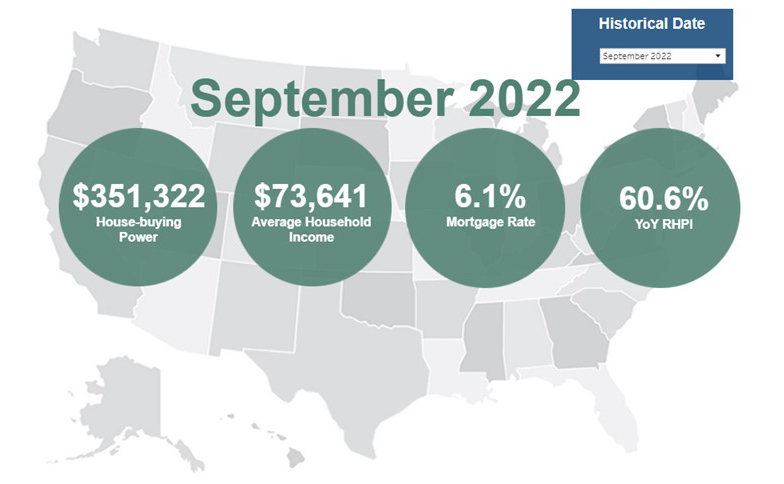

First American Financial Corp., Santa Ana, Calif., said house-buying power has declined by nearly $150,000 from a year ago, driven by higher interest rates.

However, the First American Real House Price Index showed in many markets, home equity buffers remain robust, indicating home buyers and sellers will likely weather current volatility.

First American reported real house prices increased by10.5 percent between August and September; annually, real house prices increased by 60.6 percent. But consumer house-buying power decreased by 8.9 percent between August and September and by 29.3 percent year over year.

Meanwhile, median household income increased by just 3.1 percent since September 2021 and 77 percent since January 2000. Real house prices are 38.1 percent more expensive than in January 2000. While unadjusted house prices are now 55.4 percent above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 2.5 percent below their 2006 housing boom peak.

“Even though household income increased 3.1 percent since September 2021 and boosted consumer house-buying power, it was not enough to offset the affordability loss from higher mortgage rates and fast-rising nominal prices,” said Mark Fleming, chief economist at First American. “As affordability wanes and prompts buyers to pull back from the market, nominal house price appreciation has slowed.”

But Fleming noted real estate is local. “There are markets where annual price growth isn’t just slowing, but prices are falling from recent peaks,” Fleming said. “Nominal house prices in many markets are poised to fall further as the hot sellers’ market of the pandemic turns in favor of buyers, but not all that was gained in the pandemic will necessarily be lost.”

Fleming said the pandemic housing market was ‘unprecedented in multiple ways.”

“The housing market was already strong prior to 2020, yet the pandemic redefined the role of a home, creating a surge in demand,” Fleming said. “As work-from-home became the new normal, a house was no longer just a dwelling or a vehicle for wealth creation, but also an office, a classroom, a daycare and even a gym. The broadening role of the home in American life, coupled with record-low mortgage rates and limited housing supply, powered the housing market to multiple records during this unprecedented time — the fastest annual house price appreciation, the lowest days on market in the history of record-keeping, and a near-record annualized pace of sales.”

But the pandemic housing market was the exception, not the norm, Fleming cautioned. “Double-digit house price growth was not sustainable in the long run,” he said. “As the saying goes, what goes up, must ‘eventually’ come down. Sellers may be anchored to yesterday’s prices, but buyers won’t buy unless sellers adjust prices down to meet the affordability-constraining reality of higher mortgages rates. Sellers are beginning to recognize this and price cuts are becoming more common.”

Affordability will likely remain a drag on the housing market until house-buying power recovers as house prices decline,” Fleming added. “House prices have already begun to adjust to the reality of higher mortgage rates in many markets, which will help bring more balance to the housing market heading into 2023,” he said. “Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

The report said states with the greatest year-over-year increases were Florida (+78.3), Georgia (+66.9), Arkansas (+65.8), South Carolina (+64.9 percent) and Alabama (+64.7 percent). No states saw a year-over-year decrease.

Among metros tracked by First American, markets with the greatest year-over-year increases were Miami (+82.5 percent), Tampa, Fla. (+73.4 percent), Indianapolis (+70.4 percent), Nashville, Tenn. (+69.6) and Orlando, Fla. (+69.3 percent). No markets saw a year-over-year decrease.