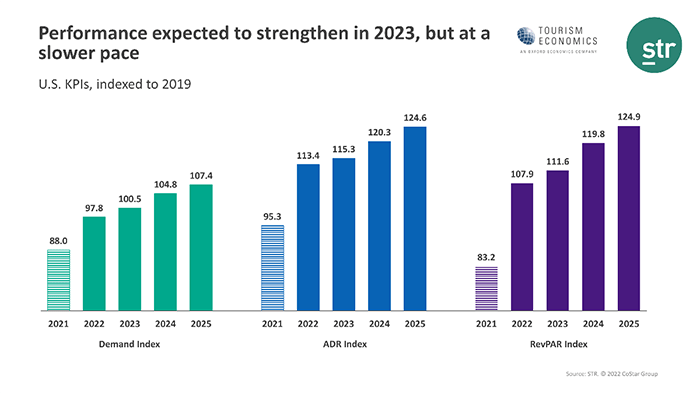

Hotel Analysts Lower Occupancy Forecast, Maintain Revenue Projections

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., lowered their hotel occupancy forecast slightly but maintained previous projections for revenue per available room and average daily room rates.

The firms said hotel RevPAR remains on track for full recovery this year on a nominal basis but not until 2025 when adjusted for inflation.

The updated forecast lowered hotel occupancy by less than a percentage point for this year.

“As expected, group business travel has been much more aligned with pre-pandemic patterns, specifically in October when group demand hit a pandemic-era high,” STR President Amanda Hite said. “Leisure travel has maintained its strength since our previous forecast update, and we expect these strong demand trends in both group and leisure to continue through the fourth quarter. Bottom-line performance has also persisted, with our most recent data showing strong profit margins due to lower employment levels and reduced services.”

Hite noted labor challenges continue to plague the hotel sector; labor costs on a per-available-room basis now exceed pre-pandemic 2019 levels. “We continue to take inflation and the likely recession into consideration, but the hotel industry has continued to show resilience through these tougher times, thus the steadiness of our updated forecast,” she said.

Aran Ryan, Director of Industry Studies with Tourism Economics, noted many analysts anticipate a mild recession in early 2023 as higher interest rates and inflation curtail real consumer spending and business investment. “Weaker economic momentum will temper the travel recovery, but we anticipate the rebuilding of business travel and the ongoing prioritization of leisure travel will support continued lodging demand growth next year,” he said.