BREAKING NEWS

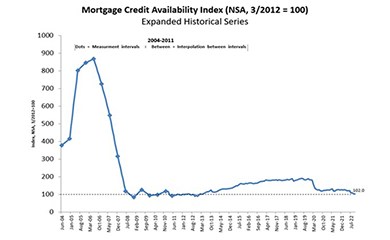

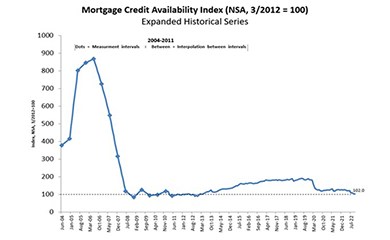

MBA Mortgage Credit Availability Index Falls for 8th Straight Month

Mortgage credit availability fell for the eighth straight month in October, remaining at a nine-year low, the Mortgage Bankers Association reported Tuesday.

CoreLogic, Irvine, Calif., said its National Mortgage Fraud Risk Index showed little change in the third quarter, although it noted a “significant” increase in risk levels for multifamily purchases.

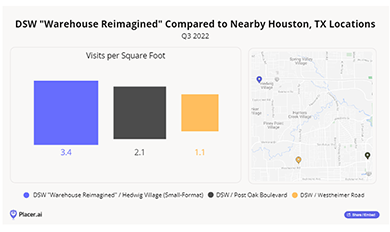

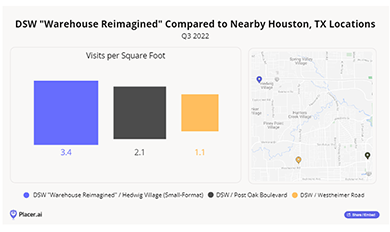

More retailers are now incorporating small-format stores into their portfolios, reported Placer.ai, Los Altos, Calif.

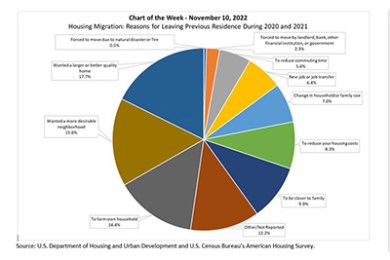

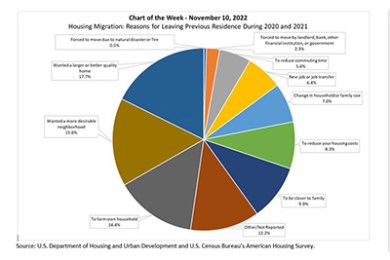

This week’s MBA Chart of the Week shows the reasons for leaving one’s previous residence. The three main reasons in the 2021 AHS are wanting a larger or better-quality home (17.7%), wanting a more desirable neighborhood (15.6%) and forming their own household (14.4%).

Excelsa Properties, Bethesda, Md., closed its $78-million purchase of Columbia Pointe, a 325-unit multifamily in downtown Columbia, Md.

Using telco, pay TV and utilities insights to help create greater homeownership opportunities for millions of U.S. mortgage applicants.

When faced with two or more similar options, consumers often choose based on which option is better suited to fit their lifestyle. For lenders wanting to ensure their spot at the top of the rankings, providing a superior closing experience is an essential part of the game plan, of which remote online notarization is a key element.

There’s been a lot of research done on the impact Millennials and single women are having on the housing market. Yet there’s not a lot of solid advice on how to attract and engage these audiences, which is a shame considering how important they are to an originator’s business. But there are effective ways to get your message across if you’re willing to rethink your current marketing strategy.

Why does innovation and technology ROIs continue to disappoint? ROI efficacy has become the symptom of the problem as the bullseye of measure is no longer fixed on the application, the cloud solution, or the innovation delivered. The rise of digital ecosystems has permanently altered the ROI discussions and evaluations—and the investment strategies deployed.

A few mortgage executives are embracing a more holistic strategy that goes beyond these all-too-familiar and destructive tactics—cost transformation. But what is it, exactly? More importantly, how can it help lenders operate more efficiently regardless of market shifts?

What follows are the findings of a semi-annual survey of senior mortgage banking executives. The surveys, which were conducted in mid-October, were of mortgage veterans at 33 different mortgage companies -- 17 financial intermediaries, largely commercial banks; and 16 non-banks, independent mortgage banks or IMBs.