BREAKING NEWS

1Q Commercial/Multifamily Borrowing Jumps 72%

Commercial and multifamily mortgage loan originations increased by 72 percent in the first quarter from a year ago, the Mortgage Bankers Association reported Thursday.

ATTOM, Irvine, Calif., reported 44.9 percent of mortgaged residential properties in the United States were considered equity-rich in the first quarter, up by more than 15 percent from just a year ago.

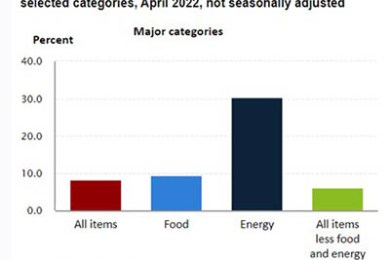

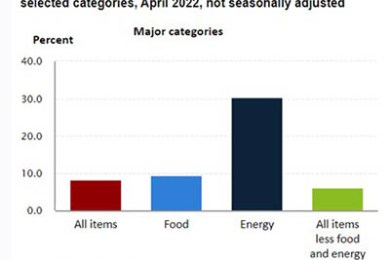

Inflation fell in April, relatively speaking, the Bureau of Labor Statistics reported Wednesday.

Seemingly little things can have big consequences. For the insurance industry, said TransUnion, Chicago, the delay in Millennial homeownership has had ripple effects that insurance providers are feeling now.

MISMO®, the real estate finance industry standards organization, announced availability of the Commercial Financial Operational Statement Dataset Standard.

The Mortgage Action Alliance's Action Week is a national, industry-wide campaign dedicated to helping real estate finance professionals learn how to become more engaged in political advocacy that supports our industry.

Planet Home Lending LLC, Meriden, Conn., entered into a definitive agreement to acquire certain assets of the delegated correspondent channel of Home Point Financial Corp., a mortgage originator and servicer and a subsidiary of Homepoint Capital Inc.

Northmarq arranged more than $50 million in financing for multifamily properties in Arizona and Oregon.

The virtually untapped and growing market of Limited English Proficiency borrowers deserves consideration and investment, and promises real potential for lenders which do.

Mortgage servicing rights are a natural hedge to those who primarily focus on the origination side of the business. However, retaining servicing rights is not an easy business, not to mention properly valuing them, especially when the current volatile interest rate movement makes hedging a task only to the most sophisticated mind.

The secret to success in the CRA/LMI marketplace isn’t a formula. It isn’t banging your head on the proverbial brick wall hoping for a breakthrough. And it isn’t trying the same old tactics in the hope that something sticks. It’s a combination of knowledge and becoming a part of the community you serve.

As economic and political impacts shift in 2022, underpinning it all is a silent reality crater exposing audit and systemic risks as digital transformations continuously evolve.

The Mortgage Bankers Association's annual Legal Issues and Regulatory Compliance Conference takes place May 22-25 at the Intercontinental Miami.