BREAKING NEWS

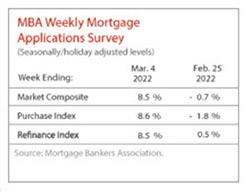

Mortgage Applications Jump in MBA Weekly Survey

Mortgage applications jumped last week as interest rates fell for the first time since December, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending March 4.

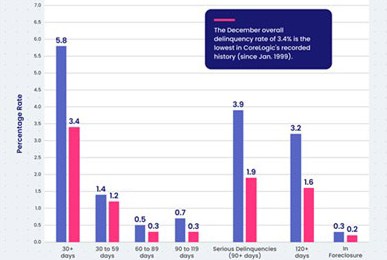

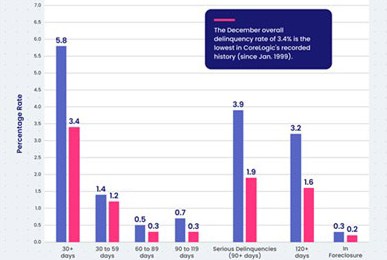

CoreLogic, Irvine, Calif., said overall mortgage delinquencies fell to their lowest point yet amid improved employment and growing home equity.

Redfin, Seattle, said low housing inventories, rising mortgage rates and double-digit home price increases have homebuyers willing to pay up—and up and up.

JLL, Chicago, said real estate investment trusts show renewed optimism, driven by a total return of 43 percent for the year, and outpacing the S&P 500 by 14 percent.

Dwight Capital, New York, closed $92.1 million in financings for multifamily assets in Nevada and California.

It’s no secret that our industry has an age problem. More and more of our leadership is aging out and retiring…while more and more students graduate from college with debt, a degree and no real plan forward after the cap and gown ceremony. This is a great opportunity to grab the attention of young, ambitious talent that needs guidance in not only financial education but also career development - specifically in the real estate and finance market.

David Leopold, Senior Vice President and Head of Affordable Housing at Berkadia, manages all facets of Berkadia Affordable Housing, an integrated business that includes mortgage banking, investment and sales advisory services and tax credit syndication. He joined Berkadia in 2019 to lead integration of Berkadia’s Affordable Housing platform.

In this ongoing article series, we report on mortgage and credit union vendor marketplace vendors, events and trends and share our viewpoints. Today’s article focuses on two vendors that have spent ample time meticulously building platforms and offerings for the servicing and secondary market conditions we are swiftly migrating toward.

It’s no big secret that there has been an increasing number of mergers and acquisitions in the mortgage technology space over the past couple of years, and it should be no surprise why. The mortgage process remains costly, slow, deeply rooted in manual processes and much of it still involves paper documents instead of digital data.

Mark Walser is President of Incenter Appraisal Management, Charlotte, N.C., a national AMC and creator of the RemoteVal remote/desktop appraisal technology platform.

As part of our 2022 State of Marketing Compliance Report, we surveyed mortgage compliance leaders on their organizations’ marketing compliance practices for insights into trend information on the depth of compliance programs, concerns and challenges. Here are the top trends and stats that mortgage companies should know in 2022.

The Mortgage Bankers Association's State and Local Workshop 2022 takes place Apr. 25-26 at the Renaissance Downtown Hotel in Washington, D.C., just ahead of the MBA National Advocacy Conference.