Mark P. Dangelo: Digital Transformation’s Hidden and Growing Corporate Liabilities

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Across banking and financial services, the efficiency goals of digital transformation are now embraced across leadership teams with many organizational cultures ascertaining that it is a core competency. Moreover, well over 85% of Millennials and Gen-Z customers seek out BFSI firms that offer digital only products and services—this driver is materially contributing to the closure of 5 to 10 physical branch locations every day (>2,000 per year during the past decade). Also of note is that over 70% of BFSI leadership states they do a good to excellent job of achieving their digital project measurements.

The rationale for being a “digital BFSI leader” extends well beyond the customer, yet consumer focus and innovative relevance has been a consistent integration theme for the 13,500 FinTech firms all fighting for increasingly smaller venture capital rounds across commoditized solutions. Additionally, the implications driven by the “digitally disruptive” innovation rationale—e.g., process streamlining, AI decision making, compliance and auditability, cross-industry data integrations—require transformations of organizational culture, restructuring internal boundaries to eliminate transactional mindsets, and most importantly, unwinding BFSI IT to be adaptable and iterative.

However, with this digital acceptance and acceleration of multi-state data, comes a bifurcation—who “owns” the data used across our digital transformations, and where does the customer data and privacy ownership end and the BFSI’s begin? How will we manage the transitory states of customer information extrapolated from the original sources—and is this a material factor why machine learning and artificial intelligence have become biased? What risks as part of progressive digital transformations is our organization embedding and how will we assess them? And finally, why are leadership teams failing to anticipate the complex (and legal / regulator actionable) data risks that come with (cascading) digital inferences, extrapolations and conclusions (e.g., approve loan, create exceptions, shared with third-party)?

The old axioms of data management within the enterprise (driven by automated “paper based” transactional mindsets) will not hold up to the increasingly robust digital ecosystem demands that are part of a greater financial services supply chain. The technical progression of robust data sciences incorporated with new BFSI “citizen developers” using no-code/low-code offerings (e.g., @Mendix) are excellent extensions of traditional IT. But the outcomes, the auditability, the (unintentional) cascading digital usage incorporates untested checks and balances once common in transactional systems—not rapid-cycle solution set offerings increasingly common today.

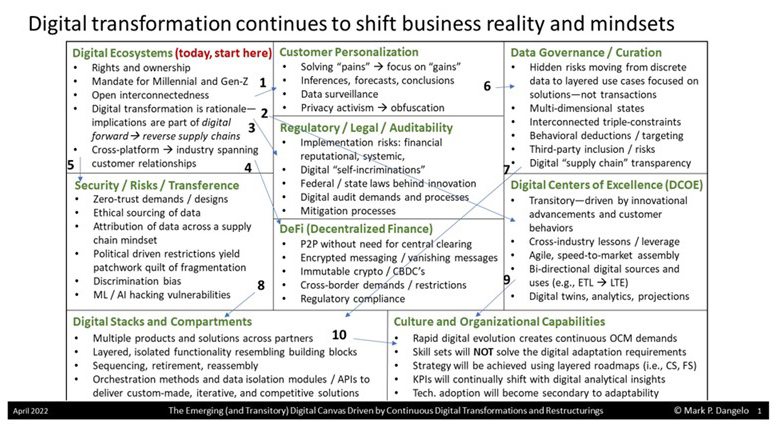

An illustration and decomposition of these mindset changes and the implications that need to be addresses is shown in the following diagram. Utilizing an extrapolation of a Business Model Canvas by Strategizer, the starting point of a BFSI digital ecosystem impacts numerous functional categories.

The traditional customer demographic models and operating channels have been, across digital solution sets, replaced with ecosystems and cross-industry integrations. As the above diagram shows, the risks and implications hidden within the rush to implement digital transformations fail to accept that the actions pushed by these initiatives are part of a much larger customer supply chain which must adjust existing culture and organizational boundaries if they are to leverage the changes.

Digital transformation outcomes are often viewed as a “one-and-done” corporate initiative. Either driven by vendors, consultants, or internal staff, the use of digital transformation requires a fundamental shift in the business model being developed and deployed—they are no longer static supporting BFSI transactional mindsets. Additionally, as banking and lending increasingly use open, commoditized software the differentiation will be created on how deep and broad BFSI products and services “play well with others” that are outside the industry verticals.

Meaning, while prior models and M&A events focused on scale of operations, the embrace by consumers of digital ecosystems requires BFSI operations to move beyond their silos and into cross-platform integrations that may be less about finance and more about experiences. Digital innovation has also brought into consumer and regulatory consciousness that transactional banking data belongs to the BFSI—but can the same be said of the extrapolations, the inferences, and the end-state projections? This may seem counterintuitive, yet how would BFSI practices be ruled acceptable for digital data use scenarios when tech giants such as Google, Amazon and various agencies are struggling with emerging case and country laws for their digital behaviors?

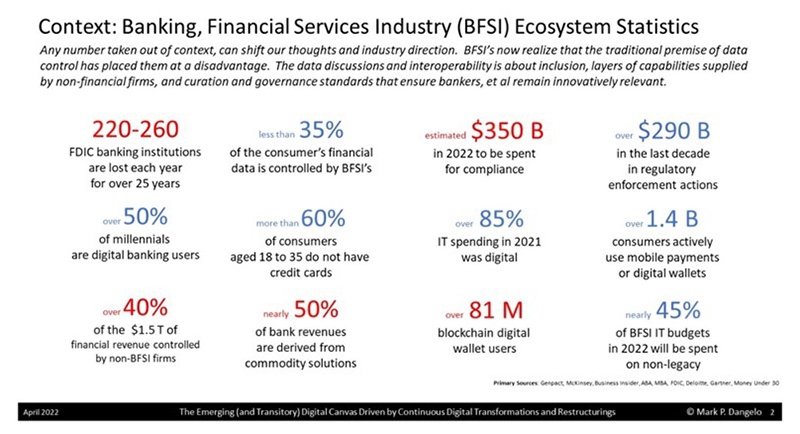

To reinforce the ecosystems BFSI leadership must account for in 2022-2024, with their continuous strategy of digital transformation, the context of industry and consumer statistics is beneficial (see below).

In summary, if we objectively examine the implications of our digital transformation initiatives, we can no longer treat these as information technology initiatives run by or managed through a program office. Digital transformation is about treating our customers and homeowners as part of a financial experience that requires a non-traditional supply chain mindset and organizational capabilities that transcend the digital event.

In the end, BFSI leadership needs to embrace that the roadmap of being digital moving forward is increasingly less important on the innovations. In the end, the who, what, where, why and how of digital transformation is less about control and more about interoperability and compartmentalization. In the end, there are risks being encapsulated within the digital transformation efforts that with existing cultures and organizational boundaries. In the end, digital transformation shifts the business demands and customer needs atypical for transactional mindsets that believed in innovation end-states.

For BFSI leaders, they must embrace their digital ecosystems with the aggressiveness that non-traditional competitors such as Walmart and neobanks. A failure to embrace the upstream and downstream implications of their financial supply chains will likely place their enterprise as a historical footnote. Digital transformation is the entry fee to maintain the status quo—but the risks and mitigation solutions needed to address these complex layers of non-tractional solutions is where their customers digital demands are just beginning.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)