(Mortgage M&A Trends) Garth Graham of STRATMOR Group: Matching Buyers and Sellers

STRATMOR Group Senior Partner Garth Graham heads the company’s mergers and acquisitions activities, providing strategies for independent and bank-owned mortgage lenders. He has more than 25 years of experience in mortgage banking, ranging from Fortune 500 companies to successful startups, including management of two of the most successful e-commerce platforms. For more information, visit www.stratmorgroup.com or garth.graham@stratmorgroup.com.

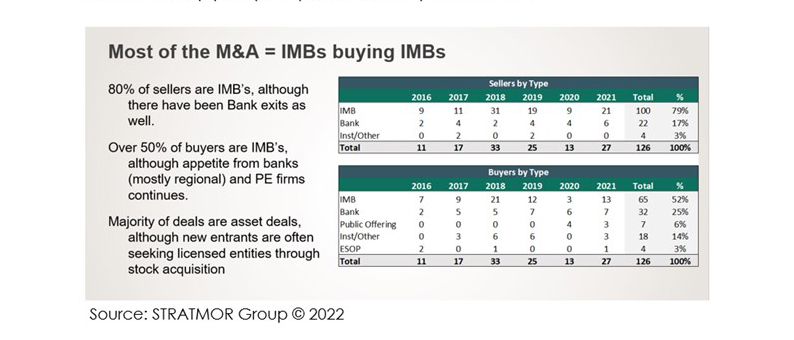

There’s no doubt that last year was a big year for mergers and acquisitions (M&A) in the mortgage lending industry. According to our data, there was a total of 27 deals between mortgage lenders in 2021, the highest number since 2018, when there were 33 transactions. Last year was largely a case of IMB consolidation as 80% of the sellers, or 21, were IMBs exiting.

Buyers were a bit more diverse, with IMBs still at the top of the list, representing 13 of the 27 buyers, followed by banks with seven purchases. Public Offerings and Institutional accounted for three acquisitions and a very significant employee stock ownership plan (ESOP) deal was completed as well.

I expect the consolidation to continue in 2022 for a number of reasons:

Aging industry leadership. As company owners are nearing retirement, I expect more lenders to seek exit strategies. Selling a company is an excellent path to retirement, especially when you can get an upfront premium on top of the large earnings generated in the past year of profits.

Capital gains taxes. There will be new tax implications in buying or selling a business during the coming years. While the exact situation is not yet clear, many are certain that taxes will increase and are therefore seeking to sell sooner rather than later.

Lower profits. An expected decrease in mortgage lender profitability will be one of the biggest drivers of M&A activity in 2022. Over the years, I’ve noticed an interesting pattern in M&A activity: There is a direct correlation between the number of M&A deals that occur each year and the average pretax net income of mortgage lenders. When profitability is low, there is more M&A activity.

Taking a look at M&A activity over the past five years bears this out. In 2018, the industry only made an average of13 basis points of net income. There were 33 deals that year, well above the average of 20 deals over the last six years. M&A activity continued at a high pace early in 2019 and then fell off as origination profits increased dramatically in the second half of the year. In total, 25 deals were completed in 2019.

In 2020, which was the most profitable year for mortgage originators in decades at over 160 basis points in net income, M&A activity fell to less than half of 2018’s numbers, with only 13 deals closed. While profitability in 2021 was still high from a historical perspective at 90 to 100 basis points, it was far below what lenders earned in 2020, and the increase in deals last year reflected the decrease in earnings and the fear of the market in future years.

Change from refi to purchase market. If net income is a driver of M&A activity, it follows that the purchase-refinance mix of originations will also be a factor. Lenders saw high profits during the refinance boom of 2020 and much of 2021. However, purchase money lending is more complex, time-consuming and costly. The Mortgage Bankers Association (MBA) is predicting that refinances will fall steadily this year to about 26 percent of total loan volume by the end 2022. That means lenders will be spending more to originate purchase loans and their pre-tax incomes will fall, which will likely spark more M&A activity.

Whether a deal is successful or not depends on a number of critical factors.

Cultural Compatibility

If the cultures of the buyer and seller don’t mesh, the likelihood the deal will succeed fall dramatically. According to research by McKinsey & Company, 95% of executives describe cultural fit as critical to the success of integrating two companies. Meanwhile, 25% cite a lack of cultural cohesion and alignment as the primary reason integration efforts fail.

How can this be avoided? At its core, culture is all about how effective a company’s leadership is at managing human capital. When STRATMOR assesses company cultures, we look at corporate values, leadership styles, management effectiveness, communications and strategic direction. Of course, no two company cultures will be exactly alike, but they must be compatible. The mortgage industry has far too many examples of failed transactions due to culture clashes. Many could have been avoided if the buyers and sellers’ companies made culture compatibility a higher priority.

Accurate Valuations

When the owners of a mortgage company decide to put their companies up for sale, getting an accurate company valuation is extremely important. I recommend finding a good advisor who closely tracks the market and can provide the sales price of recent transactions as well as the various bids placed before a winning bid was accepted. Having this information makes it far easier to determine where your company’s value should be placed.

At STRATMOR, we look at many factors, including historical, current and projected operating and financial performance as well as business mix, balance sheet structure and the company’s performance versus peers. We also consider risk management controls, geographical footprint, and comparable sales (both public and private).

I should note that custom benchmarking by a third party can be done without formally putting a company on the market for sale. Valuating a company this way gives management an opportunity to compare current performance with their peers and provides them with an independent view into their company’s strengths and weaknesses.

Sellers that attempt to place a value on their company on their own will find it a very difficult process. Usually, there are only a small number of deals to compare, and it’s unlikely that those deals will be similar to the seller’s company. Using an experienced M&A advisor gives both sellers and buyers access to not only the sales prices of other transactions but also the various bids placed before one was accepted. That’s vital information to have when making such a major decision.

Management Skill and Duration

Over the years, we’ve found a correlation between management effectiveness and tenure and the financial performance of a company. Management effectiveness should be assessed in terms of leadership, strategic planning, employee satisfaction, accountability and communications. Does the subject company bring a history of adapting to change, innovation, creative utilization of technology, dependable management reporting and cost controls? Mortgage banking is a people business where 80% of expenses are related to compensation. Management’s ability to leverage its human capital is therefore an indispensable skill.

Model Match

Model match refers to each company’s fundamental style of doing business — its branch composition, originator compensation structure, types of products offered and mortgage banking disciplines.

A Successful Match

So, what does a successful M&A deal look like?

In the fourth quarter of 2020, Guild Mortgage, approached us because they were looking for a potential new target to position the company for continued growth in 2021. The company was no stranger to M&A, and CEO Mary Ann McGarry and her team wanted to a seller that would further leverage Guild’s investments in technology and operations.

Because we knew the company was looking to expand in the Northeast, we identified Portland, Maine-based independent mortgage banker Residential Mortgage Services Holdings (RMS) as an ideal [potential] target. Like Guild, RMS specialized in conventional and government lending. Since 2010, RMS had achieved a compounded annual growth rate of 26%.

We made introductions and the deal was announced in May 2021. Said McGarry at the time of the announcement: “Our close cultural alignment and commitment to strong values across both organizations, combined with a retail and purchase market focus provide us with confidence that this acquisition will contribute to our ongoing success.”

The acquisition was the largest in Guild’s history and was completed on July 1, 2021. And indeed, it has been a success. Why? In addition to finding cultural alignment and similar business focus, Guild went into the acquisition well-prepared, and had an experienced advisor in its corner. Whether you plan to buy or sell a company in 2021, these factors can greatly increase your chances of success, too.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)