Housing Starts Give Spring Home Buying Season Early Momentum

These days, is there really a spring home buying season? Especially when every month feels like buyers are knocking down every available door? Even, so, the New Residential Construction report from HUD and the Census Bureau portends what could be an even busier period for the housing market.

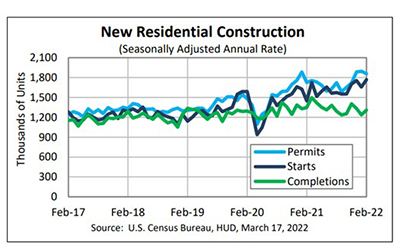

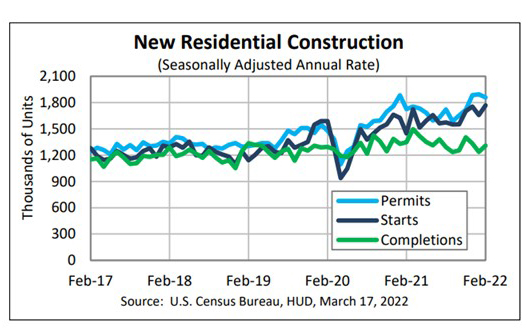

The report said privately owned housing starts in February rose to a seasonally adjusted annual rate of 1,769,000, 6.8 percent higher than the revised January estimate (1,657,000) and is 22.3 percent higher than a year ago. Single‐family housing starts rose to 1,215,000, 5.7 percent higher than the revised January figure of 1,150,000. The February rate for units in buildings with five units or more rose to 501,000, 0.8 percent higher than January (497,000) and 37.3 percent higher than a year ago.

Regionally, results were mixed. In the largest region, the South, housing starts rose by 11.4 percent in February to 1.017 million units, seasonally annually adjusted, from 913,000 units in January and improved by nearly 32 percent from a year earlier. In the Midwest, starts rose by 15.3 percent in February to 226,000 units from 196,000 units in January and improved by 66.2 percent from a year ago.

Starts also rose in the Northeast, rising by nearly 29 percent in February to 130,000 units, seasonally annually adjusted, from 101,000 units in January and improved by 19.3 percent from a year ago. Only the West saw a decline; starts there fell by 11.4 percent in February to 396,000 units from 447,000 units in January and fell by 8.1 percent from a year ago.

“The 1.77 million-unit pace is the strongest pace of new residential construction since the end of 2006,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “The stepped-up pace of production was mostly broad-based, with single-family and multifamily starts rising by 5.7% and 9.3%, respectively.”

Vitner noted the construction industry continues to contend with supply-side challenges posed by pervasive shortages of building materials and labor, which has resulted in long delays and higher costs. However, “a solid increase in completions shows builders are finding ways to navigate around supply constraints.”

“Given that homebuilders have continued to struggle to work through their order backlogs in light of materials and labor scarcity issues, there’s still strong near-term support for new housing construction,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Meanwhile, multifamily starts continued to impress as they rose above our expectations. This is more evidence of the ongoing interest in multifamily housing development due to strong rent gains and low vacancy rates.”

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said the strong housing starts report was a “welcome sign for housing supply” a spring home-buying season kicks off.

“More groundbreaking is welcome news for a supply starved housing market,” Kushi said. “It’s great to see both housing starts and completions up. Permits, a leading indicator of future starts, is down modestly month over month as builders grow concerned about affordability challenges ahead as rates continue to rise. But record low existing-home inventory and millennial demand is supportive of new construction. Of course, builders face persistent headwinds that make it difficult to bring more new homes to the market.”

Kushi noted while builders are continuing to push to meet demand, “supply-side headwinds slow the home-building momentum at a time when the housing market desperately needs more supply relief.”

Building Permits

The report said privately owned housing units authorized by building permits in February fell to a seasonally adjusted annual rate of 1,859,000, 1.9 percent below the revised January rate of 1,895,000, but 7.7 percent above the February 2021 rate of 1,726,000. Single‐family authorizations in February were at a rate of 1,207,000; 0.5 percent below the revised January figure of 1,213,000. Authorizations of units in buildings with five units or more fell to 597,000 in February, 4.5 percent lower than January (625,000) but 12 percent higher than a year ago.

Housing Completions

The report said privately owned housing completions in February rose to a seasonally adjusted annual rate of 1,309,000, 5.9 percent higher than the revised January estimate of 1,236,000, but 2.8 percent lower than a year ago (1,347,000). Single‐family housing completions in February rose to 1,034,000, 12.1 percent higher than the revised January rate of 922,000. The February rate for units in buildings with five units or more fell to 266,000, down by 11.3 percent from January (300,000 units) and down by nearly 17 percent from a year ago.