Mark P. Dangelo: Paradigm Shift: Data is the Material Value—Systems are Just Enablers

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

The world of business, especially financial products and services, runs on data—structured, unstructured, machine, derived, dark, open and even high-dimensional—all fed by the six V’s of data (Variety, Velocity, Volume, Value, Variability and Validation). Data enabled augmented reality (#AR), machine learning (#ML), artificial intelligence (#AI) are defined, trained and made innovatively relevant all by a growing “fabric” of data sources and uses, which doubles every 20-22 months.

This web of data, or increasingly referred to as digital fabric, holds the genesis of answers, precision forecasting, and for happy (and profitable) customers—if it can be weaved together into a resilient and adaptable composition. It represents the next iteration of digital and culture transformations necessary to compete with non-traditional institutions and remain relevant for rapidly shifting consumer behaviors.

Digital fabrics represent the “next” value proposition for financial leaders seeking to leverage innovative investments, while preparing for unprecedented advancements in customized products and services beyond their silos of data. Indeed, systems while important (e.g., software, platforms, connected infrastructure), are increasingly enablers to create distinctive digital insights driven by the past five years of financial digital transformations.

Rationale: “So What? Who Cares?”

I usually avoid the phrase “Paradigm Shift[i]” due to it being used by every startup founder and tech executive to describe their “value add,” and why you should buy their solution or subscribe to their M&A outcomes. However, the monetization of data, when viewed as part of a fabric of interconnected and causality actions, resents an innovative and competitive distinction when architected for continuous adaptability (e.g., building blocks, layers, compartmentalization).

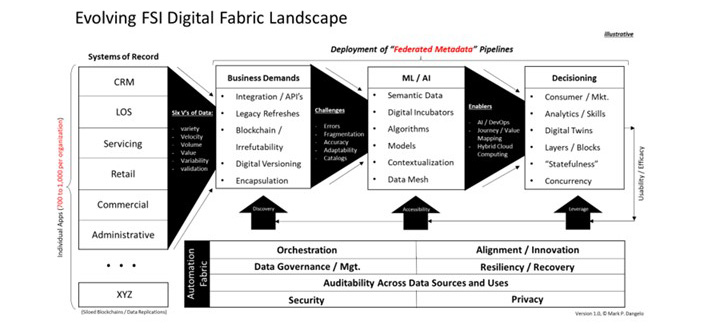

And, unlike solution providers (i.e., FinTech) seeking customers or investors, the paradigm shift with data has accelerated with mobile offerings, IoT (internet of things), ML/AI, big data expansions and most recently, the nascent financial metaverse. The average financial institution has between 700 to 1,000 individual applications across its products and services—the challenges are immense and the opportunity for leverage demand an evolutionary solution to tame of the complexity, fragmentation, and support requirements.

Traditionally, financial leaders viewed their systems and networks as competitive distinctions to conduct transactions with their customers. From loans to investments to commercial businesses, financial services institutions (#FSI) subscribed that the value delivered by software vendors and app developers was in the successful implementation of nearly identical solutions.

What ensued has been a commoditization of offerings (as viewed by consumers) creating “financial public utilities.” Recently with the rise of #BaaS (banking as a service and underpinned by rapid provisioning of native cloud capabilities, the distinction between institutions as viewed by the customer resides increasingly with their digital fabrics and the experiences customer derived from them.

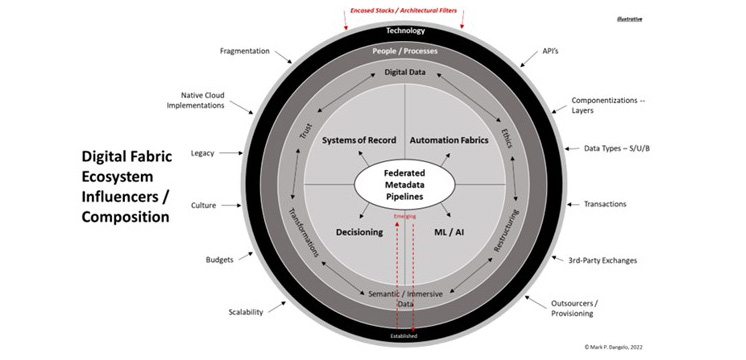

A macro digital fabric ecosystem model (refined later in this article) is presented below illustrating how the various pieces of tradition intersect and are linked via “federated metadata pipelines” that stitch together the Six-Vs, while delivering iterative, digital adaptability.

Data has always been valuable—it is an (overused) axiom. But, when it floods the business world with volumes and potential benefits that only highly skilled data scientists can marginally decode, then it becomes an unwelcome consumer of budgets, hardware, liabilities, risks, and regulatory oversight. Digital fabrics represent a demand imperative for digital transformations that continually leverage innovational advancements, while engaging consumers with financial advancements as part of their lifestyle.

Yet, the expense of securing scarce data science skills may be mitigated with the rise of new, user friendly tools and capabilities (e.g., no-code, low-code, open-source libraries, third-party aggregators). Digital fabrics can be used to not only understand the business and its operating models but employ advanced digital twin solutions that deliver virtual projections, which can be continuously improved and adapted to even more data.

Context: Data Innovation and Advancements “Meshing” Together

A failure to put into context how and why we have arrived at the dawn of digital fabrics is similar to the saying, “those who fail to understand history are destined to repeat it.” Therefore, before I introduce the decomposition of digital fabric(s) in the next section, a primer on how we arrived at this intersection of digital transformation meets cloud provision meets changing consumer behaviors is warranted.

This year marks thirty years since the term “big data” was adopted across computing platforms spurred on by the need for advanced business intelligence (#BI). Could computing was commercialized two decades ago by @Amazon and their #AWS solutions (fast approaching 200 discrete ala carte products) with estimates topping $80 billion in sales by EOY 2022. Across “as a Service” or #aaS offerings, consumers and users are now able to take the embryonic capabilities started decades ago and provision innovative solutions at time-to-market rates that are measured in weeks and months (cradle-to-grave) rather than years.

For financial leaders, the endless innovative advancements have become an earth-shattering background noise that is both freezing strategic investments, while simultaneously spurring additional digital transformation actions. There is a growing acceptance that the questions and prescriptions previously used lack efficacy moving forward—as competitors can quickly copy cloud and dynamic aaS offerings. So, what is the alternative or answer to leverage market forces?

The traditional paradigms of operations (i.e., the why) have been made obsolete by the 90% of current FSI’s leaders who state they have “mastered” continuous digital transformation (#CDT)—at least that is the mindset when it comes to huge investments in digitization and operational systems. However, when it comes to digital fabrics, will asking the same questions guarantee relevancy? Let ask a few follow-up questions—just a few.

- Has the complexity and advancements surrounding the six-Vs of data adjusted or terminated the prescriptive solutions advocated by consultants, outsourcers, and internal IT?

- What actions are the correct ones for our consumers and culture?

- What is consistent, the common threads, among these advancements as they impact business models and profit formulations?

- How can returns be generated when technology and skills are evolving so quickly?

- Where is the core competency of building blocks needed across new, digital capabilities (e.g., blockchain, NFTs, cryptocurrencies)?

- Who will establish the current and forward-looking roadmaps at the pace demanded by markets and competitive forces?

- Where will standards be as part of the digital fabric compositions?

- How will digital fabrics expand the use of digital twins?

It is of note that these questions are built on the foundation of digital transformations, which has been a watershed enabler for many FinTech’s during this last decade. However, for the next three years as technology investments and markets consolidate due to investment portfolio balancing, the rise of FinTech platforms and solutions will undergo a painful downsizing moving from the 13,500 providers today serving 4,700 FDIC institutions to M&A and closure forecasts with potentially over one-half ceasing operations. Moving forward, it will be digital fabrics linked using ‘federated metadata pipelines” which will garner attention and investments.

Indeed, there has been a permanent shift of how systems, functionality, processes, and investments are made—and retired. The context of how we have arrived at the demand for digital fabrics is logical when holistically assessed, but the path forward is where leaders will struggle. It begs the obvious starting question, “what is the conceptual model of how digital fabrics are created and linked?”

The Next Logical Step Leveraging Digital Iterations

When we postulate the implementation of digital fabrics, we are presented with complexity and opaqueness that is out-of-phase with FSI transactional mindsets. However, if we seek to approach the challenges in steps or iterations rather than comprehensive replacement (i.e., transactional COTS—commercial-off-the-shelf solutions), then we can engineer our digital fabric solutions to be a journey of benefit rather than a long-term, one-off budget drain. And by their very nature, digital fabrics are designed to be adapted to changing system of record sources. They can yield ROI and customer benefits as part of the “right now” and into the longer-term as part of CDT.

Digital fabrics are not about lift-and-shift replacements made famous by vendors who lock us into their platforms and charge us to move our data—no matter how many companies and brands they acquire and superficially bolt together. Moreover, the onslaught of data (note the “Six-Vs” in the diagram below) is a result of exploding data within our numerous siloed systems of records and the ancillary systems we use to surround and improve their basic outputs (e.g., analytics).

In the end, we shift the timing for extractions and analysis due to the rapidly changing mix of offerings serving customer, investors, and regulators (see diagram below) to deliver greater insight and at reduced total costs. By engineering our digital fabrics beyond the ETL and LTE of surrounding systems-of-records, we establish solid foundations for new technologies and processes involving blockchain, semantic or immersive data modeling and production adaptations for ML and AI (beyond FSI fraud detection).

Of note are the costs and errors created by maintaining the 700-1,000 independent systems within a typical FSI enterprise which will continue to consume larger portions of the budgets, and cascade into more systemic risks codified within the siloed systems-of-records.

As an example, LOS vendors may advocate the need for a common platform (getting you to purchase their offering), but when it comes to the API’s / handoffs, they have not roadmapped the downstream impacts of their solution beyond one-degree of separation. They do not approach their end-to-end within the concept of a FSI supply chain, therefore they ignore their own challenges when it comes to downstream or upstream data sources and uses now critically important within the digital fabric implementation. It is analogous to designing a railroad to operate within a given location only to find out that to ship beyond the borders, other logistical providers are using different gauge rails and spacing. To move cargo, you need to offload, repurpose, and restack just to move the “goods” from where they were originated to their end usage. The reverse is true for any goods moving into their borders from the outside—aka traversing the digital FSI supply chain in forward and reverse.

If you look at the costs (end-to-end) you can now see that by incorporating data from the start into a fabric (rather than distinctive, siloed threads) improvements in the overall accuracy, timing, consistency, and cost of the solution can be rapidly achieved while mitigating risks.

Additionally, underpinning the full consumer embrace of digital products and services, the treatment of digital fabric as part of non-financial partners and joint ventures expands the value of the digital data weaved into the fabric. It also offers digital accountability, auditability, reuse, and security as these features are accounted for within the “automation fabric” of implementation.

Closing Thoughts

The explanation of what, why and how of digital fabrics is evolving with the sciences of implementation—it is an agile design in fast-forward. For FSI leaders, many of your enterprises have reached diminishing returns when it comes to FinTech installations and customer experiences. The phase shift represented by digital fabrics will define not just traditional FSI enterprises, but non-traditional and NeoBanks as well. It at its core is a paradigm shift of strategy and technology made possible by what many assumed was the end-state—digital transformation. And when it comes to the cultural aspects of digital fabrics, it explodes the internal politics for what they are—non-value-added politics.

Moving forward, data is the material value—systems are just enablers. In the end, it will be the consumers who judge how well our enterprises executed against the principles—not the vendors who have dominated the discussions and directions for the prior two decades.

[i] Paradigm Shift has been an overused phrase since Don Tapscott and Art Caston published in 1991 their immensely popular management book of the same name. Tapscott and Caston borrowed the original concept from “Thomas Samuel Kuhn in his 1962 book The Structure of Scientific Revolutions.”

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)