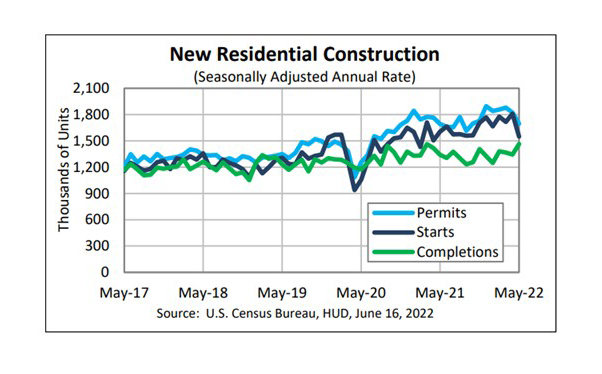

May Housing Starts Plunge Amid Market Volatility

Housing starts fell sharply in May, HUD and the Census Bureau reported Thursday, as continued market volatility and higher interest rates took a toll on both consumers and home builders.

The report said privately owned housing starts in May fell to a seasonally adjusted annual rate of 1,549,000, 14.4 percent below the revised April estimate of 1,810,000 and 3.5 lower than a year ago (1,605,000). Single‐family housing starts in May fell to a rate of 1,051,000, 9.2 percent below the revised April figure of 1,157,000. The May rate for units in buildings with five units or more fell to 469,000, down by nearly 27 percent from April and by 3.3 percent from a year ago.

Regionally, results were mixed. In the largest region, the South, starts fell by nearly 21 percent in May to 803,000 units, seasonally annually adjusted, from 1.013 million units in April and fell by 0.7 percent from a year ago. In the West, starts fell by nearly 18 percent to 356,000 units in May from 433,000 units in April and fell by 10.1 percent from a year ago.

In the Northeast, however, starts rose by nearly 15 percent in May to 173,000 units, seasonally annually adjusted, from 151,000 units in April and rose by 26.3 percent from a year ago. In the Midwest, starts rose by nearly 2 percent to 217,000 units in May from 213,000 units in April but fell by 17.5 percent from a year ago.

“Housing starts come in below consensus expectations,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The decline in housing starts mirrors the decline in homebuilder confidence.”

(The National Association of Home Builders on Wednesday reported its Housing Market Index fell for the sixth straight month to a two-year low.)

“Builders face supply chain disruptions, rising input costs and concerns that declining affordability is pricing out buyers,” Kushi said. “The new home market is particularly sensitive to rising rates, and builders want to ensure that if they build it, someone will buy it. Builders are responding to the decline in affordability and cooling demand by building less, but a slowdown in construction is concerning because the U.S. continues to face a housing shortage. We need more homes, not less.”

“The residential sector has been hit hard by a sharp increase in mortgage rates over the past few months,” said Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Higher borrowing costs as home prices continue to rise a fast pace have put a major dent in new home sales, which appear to be causing home builders to scale back production.”

Vitner said home building looks set to slow further in coming months, noting housing permits, which lead starts by a month or so, dropped by 7.0% during May, the second straight decline.

“We believe construction is clearly slowing but not free-falling,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Though significantly higher mortgage rates will undoubtedly weigh heavily on affordability and demand, continued above-normal profit margins reported by many builders suggests that they will likely have room going forward to increase incentives and make price concessions to sustain sales. Therefore, while this report is consistent with our view that residential construction will continue to slow, the near-term pace may demonstrate greater resilience, even in the face of rising mortgage rates.”

The report said privately owned housing units authorized by building permits in May fell to a seasonally adjusted annual rate of 1,695,000, 7.0 percent below the revised April rate of 1,823,000, but 0.2 percent higher than a year ago (1,691,000). Single‐family authorizations in May fell to 1,048,000; 5.5 percent below the revised April figure of 1,109,000. Authorizations of units in buildings with five units or more fell to 592,000 in May, down by 10 percent from April (658,000) and by nearly 20 percent from a year ago.

Privately owned housing completions in May were the only bright spot in the report, rising to a seasonally adjusted annual rate of 1,465,000, 9.1 percent higher than the revised April estimate of 1,343,000 and 9.3 percent higher than a year ago (1,340,000). Single‐family housing completions in May rose to 1,043,000, 2.8 percent higher than the revised April rate of 1,015,000. The May rate for units in buildings with five units or more jumped to 417,000, up by 33.2 percent from April and up by 11.5 percent from a year ago.