CoreLogic: Annual Home Price Gains Blast Past 20%

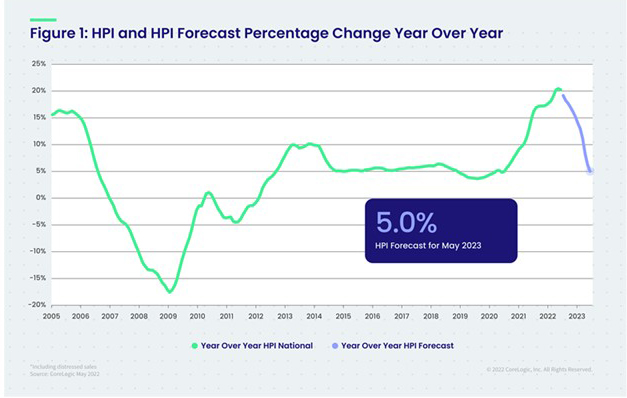

CoreLogic, Irvine, Calif., said year-over-year home price growth dipped slightly from April but still posted a 20.2% increase in May, the 124th consecutive month of gains.

The company’s monthly Home Price Index and HPI Forecast noted though U.S. home price growth relaxed slightly in May from April, it remained in double digits year over year for the 16th consecutive month. As in past months, all states and Washington, D.C. posted annual appreciation, with 13 states posting gains of more than 20%.

Selma Hepp, deputy chief economist at CoreLogic, said while rising interest rates cooled overheated demand this spring and are expected to contribute to slowing price growth over the next year, motivated buyers may have less competition and more opportunities moving forward.

“Slowing home price growth reflects the dampening consequence of higher mortgage rates on housing demand, which was the intention,” Hepp said. “With monthly mortgage expenses up about 50% from only a few months ago, fewer buyers are now competing for continually limited inventory. And while annual home price growth still exceeds 20%, we expect to see a rapid deceleration in the rate of growth over the coming year. Nevertheless, the normalization of overheated buying conditions should bring about more of a balance between buyers and sellers and a healthier overall housing market.”

Other report findings:

• U.S. home prices (including distressed sales) increased 20.2% in May from a year ago. Month-over-month, home prices increased by 1.8% from April.

• In May, annual appreciation of detached properties (20.9%) was 2.9 percentage points higher than that of attached properties (18%).

• Annual U.S. home price gains are forecast to slow to 5% by May 2023 as rising mortgage rates and affordability challenges are expected to cool buyer demand.

• Tampa, Fla., logged the highest year-over-year home price increase of the country’s 20 largest metro areas in May, at 33.4%, while Phoenix posted the second-largest hike, at 28.7%. These two metros also registered the largest gains in March and April.

• Florida and Tennessee posted the highest home price gains, a respective 33.2% and 27.4%. Arizona ranked third with a 27.3% year-over-year increase. Washington, D.C. ranked last for appreciation at 4.3%, but CoreLogic forecasts that the rate of price growth there will rise slightly by May 2023.