BREAKING NEWS

Applications Down Again in MBA Weekly Survey

Mortgage applications fell for the second straight week, albeit only slightly, and key interest rates were unchanged, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending July 8.

The Mortgage Bankers Association and a broad coalition of nearly 200 industry, trade and business groups sent a letter to Capitol Hill this week strongly opposing proposals that would increase taxes on small businesses.

MISMO®, the real estate finance industry standards organization, launched its new dataset standard that maps to a sample Adverse Action Notice form and accompanying XML file.

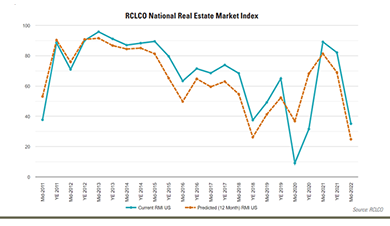

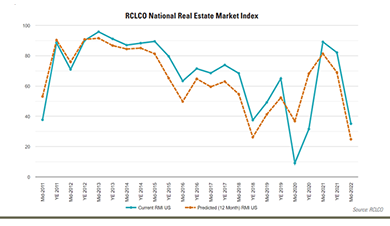

Commercial real estate executives’ market sentiment has dropped dramatically, reported RCLCO, Washington, D.C.

Fannie Mae and Freddie Mac have sold nearly 155,000 non-performing loans with a total unpaid principal balance of $28.7 billion since 2014, the Federal Housing Finance Agency reported on Tuesday.

Salesforce is the #1 CRM, bringing companies and customers together in the digital age.

Dwight Capital and its mortgage real estate investment trust affiliate Dwight Mortgage Trust closed $92.1 million for apartments and nursing facilities.

It is not surprising that the CFPB has increased its scrutiny of mortgage servicers, particularly as the industry moves from a COVID-19 pandemic-induced emergency state to a more normalized servicing environment.

Jeff Coles is Vice President of Institutional Client Services with Berkadia, Washington, D.C. He leads Berkadia’s Single-Family Rental & Built-for-Rent specialty.

Sales Boomerang, Owings Mill, Md., an automated borrower intelligence and retention system, and Mortgage Coach, Irvine, Calif., a platform enabling mortgage lenders to educate borrowers with interactive home loan presentations, announced their merger and appointed SaaS executive Richard Harris as CEO.

In a short six months, the runaways for business and technology transformation have changed markedly. Additionally, mortgage lending will shrink to just over $2T as inflation as interest rates rise. Profit margins must now be achieved by restructuring digitally transformed processes that were thought to be “complete.” To survive—and prosper—organizations must adapt to widespread industry rebalancing.

Rising interest rates and increased competition have loan officers scrambling for ways to win deals in today’s market. One tactic that has grown in popularity with borrowers and loan officers is rate lock renegotiations. However, these come at a high cost to lenders, and with margins already being squeezed, what seems prudent from a customer acquisition standpoint may actually work against lenders’ best interests.

MBA Director of Associate Membership Brad Padratzik discusses the competitive advantages of MBA Associate Membership.