Mark P. Dangelo: A Vast Rebalancing–The ‘Dark Side’ of Digital Transformation

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

The operational complexities of financial services rivals most traditional industries. From regulatory compliance to political pressures to digital transformations to non-traditional competitors, the explosion of #FinTech and #RegTech have altered the trajectory of an industry that many thought would never change. The net loss of banking branches continues to be negative (i.e., losing nearly 2,500 locations per year for the last decade) underscored by over 85% of consumers embracing digitally native products and services.

Now with the rise of #Web3.0 and #metaverse solutions, the lines between physical and virtual continue to blur under a barrage of innovation advancements with technology lifecycles spanning months—not years. Analogous to sharks smelling wounded prey, the financial services verticals are about to witness vast rebalancings of their operations, importance, and influence over their customers.

The Beginning of Permanent Shifts

For a traditional industry steeped in customer loyalty, regulatory compliance, and “safe and soundness” the reverberations from innovation advancements of the last decade have been permanently altered as a result of banking “as a Service” (#aaS) functions now widely available. Additionally, financial services have been forced to alter their operational models as FinTech competing and supporting firms rose to 13,500 brands in the last decade introducing automation and integration capabilities that leveraged retail and social media models—all in the name of financial availability and outreach. For many bankers who embraced FinTech, this has been a “golden age” of advancements serving the digital consumer defined by Millennials and Gen Z customer behaviors.

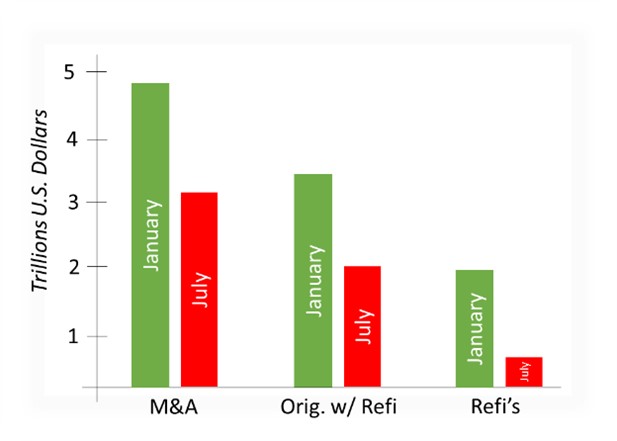

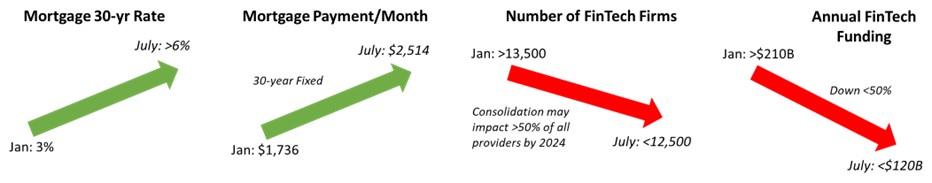

However, this “golden age” is now transmuting into a “Great Rebalancing” with investors in FinTech’s retracting their enthusiasm against declining lending markets, inflationary pressures, rising interest rates, and economic uncertainty. Outlier FinTech contraction projections indicate that perhaps up to a 50% loss of existing firms due to lack of funding and crowded, unprofitable offerings by the end of 2024. The result of this rebalancing, in the face of M&A activity declining by over 40%, may leave financial services leaders with embedded FinTech solution sets that will abruptly experience end-of-life.

To reinforce the pain undertaking the players of the markets, many of which who have not experienced an economic downturn or mortgage correction since 2007-2009, the last six months have also witnessed steep changes in the benchmarks that once were macro indicators of growth.

Further data points include a continual consolidation of digital capabilities across software and industry vendors. With the May 2022 announcement of #ICE acquiring of #BlackKnight, the strategic focus increasingly becomes about future digital fabrics (see Paradigm Shift: Data is the Material Value—Systems are Just Enablers) and data sovereignty to leverage cross-platform capabilities while improving customer experiences. With the focus on data rather than systems, finance and mortgage industries are candidates for not just consolidation, but disintermediation of commoditized products and services with the expansion of #AI an #ML operations against a cohesive financial fabric (e.g., secure digital wallets for customers and assets).

Opportunities and Obstacles of Rebalancing

What is underway within the mortgage and financial industries regarding volume reductions and subsequent industry layoffs is a cycle last experienced in 2007-2009. Yet, in the ensuing 13 years since the bottom of the last cycle, technology has revolutionized how financial products are utilized and stacked. Yet why have origination costs more than double during the last decade whereas the average timeframes still range from 45 to 75 days to close? Whereas the focus has been on customer contact and processing efficiencies as part of embracing digital transformation, the next set of adaptations likely will reimage the how, why, and what of adopting elements of digital mortgages from the start of prospecting to the securitization of assets.

The market rebalancing which has just begun will create numerous obstacles for traditional players unaccustomed to aaS integrations and the rapid cycles of operational restructurings that are required to just remain competitive. These aaS solutions over the last decade have allowed many independent and small finance enterprises to participate in consumer markets that were growing and highly competitive—there was much in the way of volume opportunity and “price-plus” lending for all members.

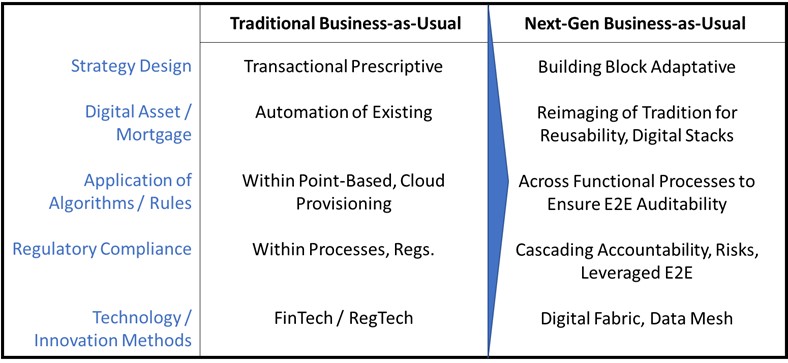

However, as the market transforms due to structural economic changes (e.g., WFH, gig-workers, supply chains, aging populations, vast digitization), the traditional business-as-usual mindsets, processes, and system approaches of the past are inhibitors for next-gen adaptation.

The next-gen business-as-usual revolves around the deployment of digital fabrics, which can link disjointed or overlapping FinTech targeted solutions. The opportunity for leverage of data across in-house or cloud systems can improve not just the efficiency and accuracy of financial products, but also offer improved risk analysis, regulatory compliance, and robust customer disclosures and communications.

Yet the rebalancing dilemma created by economic conditions, will further increase the loss of jobs and organizations who lack retooling investment capital. The options for many independent and small financial firms will be to partner with others (i.e., as part of a cooperative arrangement), identify innovative outsourcing solutions, or prepare for divesture (as part of mergers, acquisitions, and divestures or #MAD) of financial products (e.g., mortgage) to other firms better prepared for interconnected digital demands.

Distancing Tomorrow’s Digital Designs from the Past

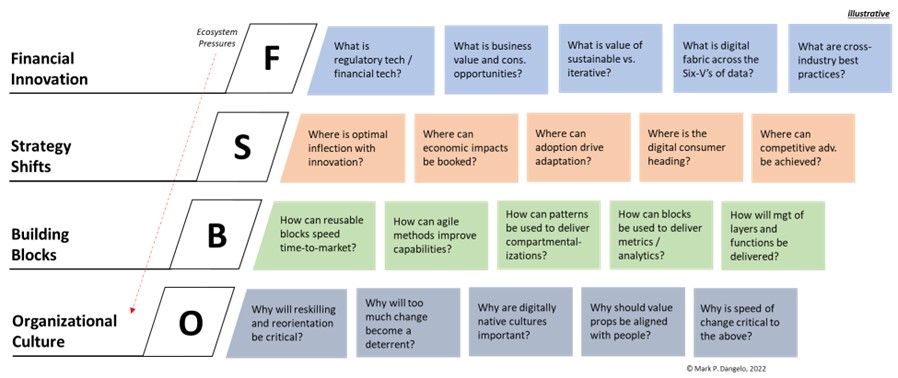

As firms shed “ability to compete” product lines, the challenges for industry leaders resides is where to focus efforts and limited resources. Though the incorporation of innovative ideas has been a driving force for customer channels since 2009, the metrics and questions of relevant application are frequently lost or missed under the urgency to adapt to external pressures. The rise and potential fall of FinTech brands will force enterprises to address innovation, strategy, reusable blocks of functions, and organizational impacts with unfamiliar timings, ROIs, and support demands.

In the graphic below, impacts of changing economies coupled with expanding digitally native financial alternatives will force FinTech solution providers and #ITO / #BPO outsourcers to transform their offerings from transactional lift-and-shifts into data fabrics that deliver fungible, curated elements. When digital fabrics are implemented the sourcing of data is irrefutable and traceable across the digital supply chains. From an audit and compliance perspective, information and decisioning can be precisely traced reducing discrepancies, errors, costs, and complexities.

To mitigate the catastrophic loss of a strategic vendor vital to the front or back-office infrastructure, fabric designs separate data from the enabling systems allowing for building block replacement—a #Lego analogy for assembling and disassembling solutions for the rapid adaptation of innovation.

As the mortgage and finance industry adopts to the next iteration of digital transformations, what will be evident is the realization that products and services need to be constructed like manufacturing supply chains. Using supply chain methods (e.g., digital twin solutions), institutions will be able to rapidly adjust to innovation advancements (i.e., stacks and modules that can be removed and substituted to improve the chain of delivery).

In summary, the vast adoption of digital solutions has paved the way for non-industry competitors to incorporate complex data solutions that bridge the silos of traditional of financial products and services. With the likely and prolonged downturn across the economies, the growth profits that drove cloud financial and lending solutions are dissipating.

As the importance of systems becomes secondary to the digital assets available to the institutions, industry leaders and their long-term software vendors will struggle to adapt to customer demands. The design and development of digital fabrics will create next-gen opportunities for industry participants to uniquely serve customers, investors, and regulators with predictive insights.

What we likely will experience as leaders and within our company, is a loss of one or more strategic relationships as the industry rebalances. Training, communication, and processes embedded around these once viable business solutions will be lost as these critical partnerships become null-and-void. It will create numerous fire-sale opportunities for firms unable to adapt to alternatives in a contracting market. Collectively, these unmet challenges will alter the risk and regulatory compliance algorithms resulting in more consolidation. What will be valuable is the commercialization or leverage of the digital information and how it is weaved into a customer focused fabric.

In the end, financial institutions will be lost along with the jobs and value they provided to the communities served. In the end, a reduction of market makers and the segmented solutions they provided, will give way to a disintermediation of commoditized products such as mortgages benefiting the consumer and driving down costs. In the end, it will be the development of digital fabrics and the data assets leveraged from unprofitable firms that will push the industry forward to less complexity, native digital, and improved accountability. In the end, there will be little we can do to stop the next-gen, customer driven mindsets from taking root and comprehensively transforming financial and mortgage business models. It now appears evident that those institutions who embrace digital fabrics and data meshes will likely have greater opportunities than challenges when facing an uncertain future. The fallout from the vast rebalancing has just begun.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)