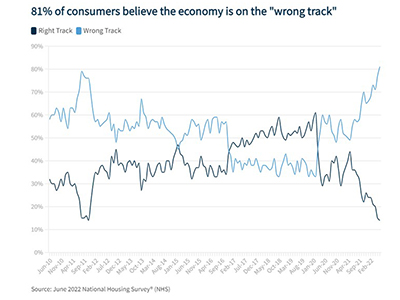

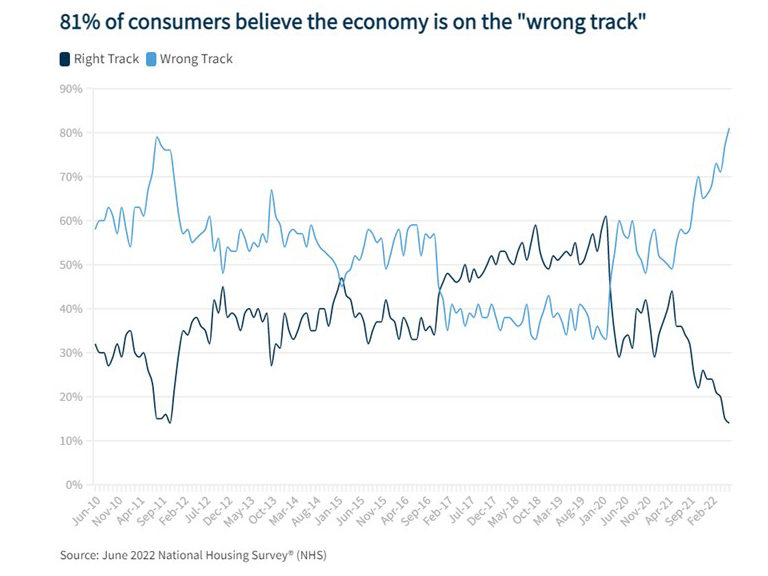

Fannie Mae: Survey-High 81% of Consumers Believe Economy on ‘Wrong Track’

Fannie Mae, Washington, D.C., said its Home Purchase Sentiment Index fell by 3.4 points in June to 64.8, its second-lowest reading in a decade.

Surveyed consumers continue to express pessimism about homebuying conditions, with only 20% of respondents reporting it’s a good time to buy a home, while the percentage of consumers who believe it’s a “Good Time to Sell” fell from 76% to 68% this month. Overall, four of the index’s six components decreased month over month, including the components associated with perceived job stability and household income.

Fannie Mae Chief Economist Doug Duncan said notably, a survey-high 81% of consumers believe the economy is on the “wrong track” and, for the first time in nearly seven years, a plurality of respondents said it would be difficult to get a mortgage, potentially a function of elevated home prices and higher mortgage rates. Year over year, the full index is down 14.9 points.

“People appear to be growing increasingly frustrated with inflation and the slowing economy,” Duncan said. Interestingly, consumers’ perceptions of home-selling conditions declined meaningfully in June, returning to pre-pandemic levels. This was particularly true for homeowner respondents. At the same time, consumers, especially those in prime homebuying groups, appear to be feeling the affordability pinch of higher mortgage rates: Approximately half of all respondents indicated that it would be ‘difficult’ to get a mortgage, the highest such percentage since 2014.”

Key report findings:

• Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home increased from 17% to 20%, while the percentage who say it is a bad time to buy decreased from 79% to 75%.

• Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home decreased from 76% to 68%, while the percentage who say it’s a bad time to sell increased from 19% to 26%.

• Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 47% to 44%, while the percentage who say home prices will go down increased from 23% to 27%. The share who think home prices will stay the same decreased from 25% to 23%.

• Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 4% to 5%, while the percentage who expect mortgage rates to go up decreased from 70% to 67%. The share who think mortgage rates will stay the same increased from 20% to 21%..

• Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months decreased from 81% to 78%, while the percentage who say they are concerned increased from 16% to 21%..

• Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 26% to 25%, while the percentage who say their household income is significantly lower remained unchanged at 16%. The percentage who say their household income is about the same increased from 54% to 58%.