BREAKING NEWS

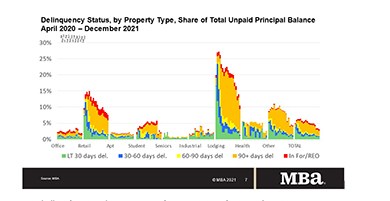

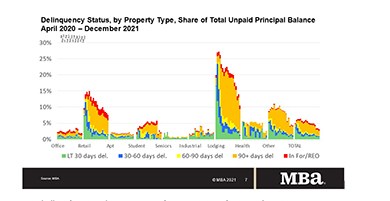

4th Quarter Commercial/Multifamily Delinquencies Continue to Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined during the last three months of 2021, the Mortgage Bankers Association's latest CREF Loan Performance Survey reported.

The House on Wednesday passed a bill opposed by the Mortgage Bankers Association and other industry trade groups that would expand eligibility for servicemember educational assistance, but also impose fees that would translate into higher costs for veterans.

The Consumer Price Index finished 2021 with a bang, the Bureau of Labor Statistics reported on Wednesday. Although overall prices slowed somewhat in December from its brisk pace in November, they continued to show no relief on an annual basis.

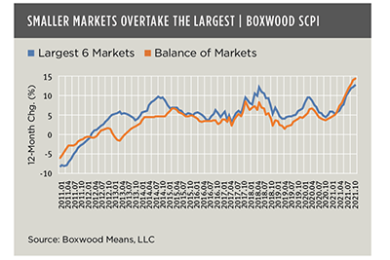

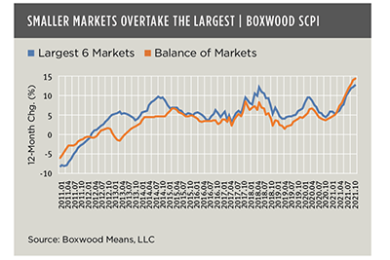

As the national economy rebounded last year, smaller markets outperformed larger markets in the small-cap space, reported Boxwood Means LLC, Stamford, Conn.

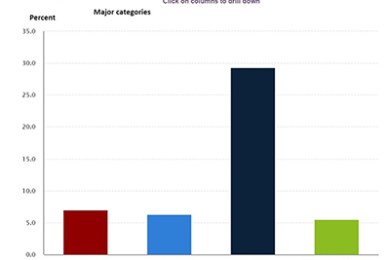

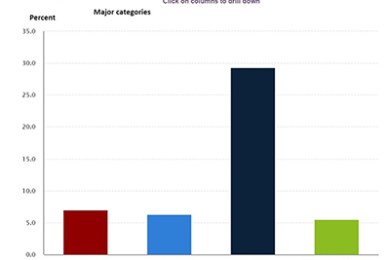

ATTOM, Irvine, Calif., released its Year-End 2021 U.S. Foreclosure Market Report, which shows foreclosure filings fell to their lowest level since 2005.

Commercial and multifamily mortgage originators anticipate 2022 will be another strong year of borrowing and lending, according to the Mortgage Bankers Association's 2022 Commercial Real Estate Finance Outlook Survey.

The nomination period for the MBA NewsLink 2022 Tech All-Star Awards is underway with a new, simplified entry form. Nominations will be accepted through Friday, Jan. 21.

You may have picked up on the change in the makeup of tomorrow’s borrower. The growth in home lending market demand is projected to come from traditionally underserved communities and households led by women over the next 20 years. That is not something that most of the lending world is prepared for.

Greystone, New York, provided $13.4 million in Fannie Mae Delegated Underwriting and Servicing loans to refinance two Baton Rouge, La., multifamily properties.

Castle Mortgage Corp., Newport Beach, Calif., doing business as Excelerate Capital, promoted Thomas Yoon to CEO; he will now serve as CEO and President. Mike Thompson will continue as Board Chairman.

nCino Inc., Wilmington, N.C., completed its acquisition of SimpleNexus, a cloud-based, mobile-first homeownership software company, for total consideration of 12.76 million shares of nCino common stock plus cash consideration of $270 million, on a cash-free, debt-free basis and excluding transaction expenses.

MISMO®, the real estate finance industry's standards organization, announced its 2022 Board of Directors.

The Mortgage Bankers Association's State and Local Workshop 2022 takes place Apr. 25-26 at the Renaissance Downtown Hotel in Washington, D.C., just ahead of the MBA National Advocacy Conference.