Mark P. Dangelo: Digital Transformations Meet the Metaverse

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

From data science financial missives to M&A events to innovational challenges, the mantra of all things digital has become ubiquitous as part of every board room, management meeting and investor review. The data are eager to tell a story, yet each storyteller with the same data tells a unique experience. Now the next business paradigm is already underway foundationally built on ML, AI, digitalization, no-code, FinTech and accepted approaches of Agile and DevOps glued together by a range of cloud and SaaS solutions that consume the alphabet (@Alphabet pun intended).

In late 2021, thrust into the conscience of every CIO, CINO, CTO and CEOs was a term which encompasses “immersive digital worlds.” Welcome to the #metaverse—and I’m not just referring to the @Meta rebranded @Facebook. Already in 2022, we have witnessed the fear of missing out (#FOMO) rocking boardrooms and executive offices with @Microsoft’s $69 billion acquisition of Activision Blizzard. And the metaverse cannot be discussed without discussing cryptocurrencies and the recent leadership from the U.S. Federal Reserve, “Money and Payments: The U.S. Dollar in the Age of Digital Transformation.” The changes are happening, and the impacts are just not for retailers or those who deal with B2C models.

These actions represent an opening salvo of metaverse FOMO that will reach into every corner of financial services, technology, and consume the estimated 13,000 fintech vendors providing solutions to consumers and their accelerating digital lives. M&A efforts to secure metaverse viability will rapidly expand and the innovational pace of technologies underpinned by the last decade of digital transformations will be just the entry fee for business viability.

The potential of the metaverse is exactly why @Walmart has started a fintech portfolio along with their new cybercurrency and non-fungible tokens (#NFT’s)—all within the past 60 days covering more than seven patent filings. Moreover, we have watched filings over the past 90 days from major corporations including Urban Outfitters, Ralph Lauren, Nike, Abercrombie, Gucci and dozens of others all seeking to create their footholds in the next frontier labeled the metaverse.

Why is this digital experience important to financial firms and their products and services? What digital advancements could possibly sound the death knell of brick-and-mortar branch networks (which continue to lose 1,500 locations per year for the last decade underpinned by the loss of 2,000 FDIC banking brands in the same period)? How will this embryonic metaverse impact future offerings with loans, customer service, investing, and payments? In an era of workers rights, work-from home, and work-life balance, does the metaverse hold gems that will change the efficiency ratios and performance criteria that allows smaller financial institutions to compete with larger ones?

To help place perspective on the potential and expectations developing across the metaverse for financial institutions, we can start with an definition found in @Investopedia.

“The metaverse is a digital reality that combines aspects of social media, online gaming, augmented reality (AR), virtual reality (VR) and cryptocurrencies to allow users to interact virtually. Augmented reality overlays visual elements, sound, and other sensory input onto real-world settings to enhance the user experience.”

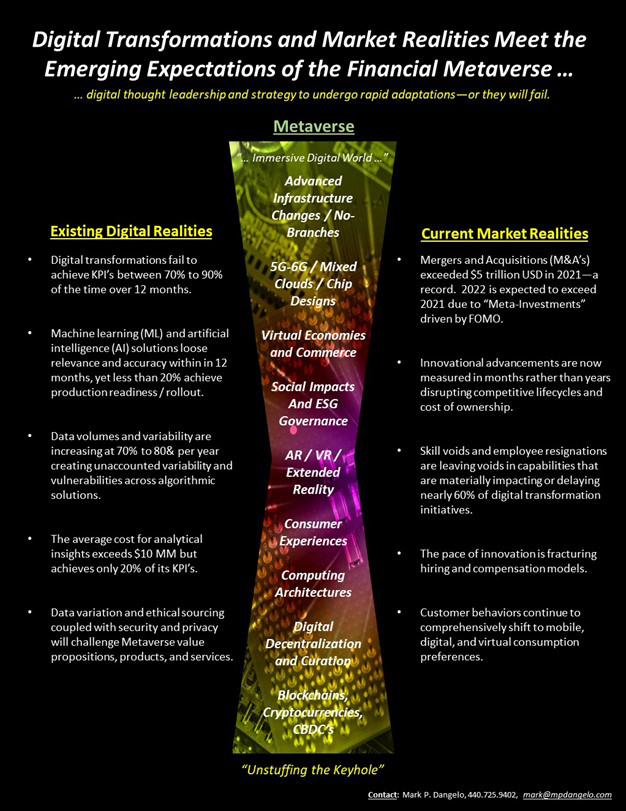

As financial institutions increase their presence within and across cloud solutions, the accumulated digital information requirements, successes, and failures all since 2015 paint a picture of what is to come and the challenges that will be faced (see below).

C-levels continue to embrace the constructs of digital transformation across processes and with deployed technologies all wrapped in cloud and SaaS offerings—the spend is estimated to exceed $1.8 trillion in 2022 rising to nearly $3 trillion by 2025 (see @Statista). @Gartner adds its perspective on what is coming, “The metaverse is a collective virtual open space, created by the convergence of virtually enhanced physical and digital reality. It is physically persistent and provides enhanced immersive experiences.” The metaverse is a merging of worlds where digital assets, information compiled, and emerging technologies converge to deliver a customer experience that expands the real world (as if we didn’t have enough to deal with already).

To level set the metaverse, we need to assess—take stock if you will—how we arrive at this doorstep of a next level of customer engagement and business processes. Data volumes are increasing at more than 80% per year across every industry including financial services. Nine out of ten industry leaders believe that the rapid escalation of innovation and the ensuing digital transformations will comprehensively disrupt existing products and services. Furthermore, with the rapid shift of consumers towards digital solutions including the acceptance of cryptocurrencies, the value solutions of today and tomorrow are comprehensively digital and iterative using architectural building block constructs (e.g., see @BBVA’s recent announcement of enterprise software and data consolidation).

Yet, an estimated 70% to 85% of all digital transformation initiatives historically fail to be sustainable after 12 months, including highly valued machine learning (ML) and artificial intelligence (AI) processes and algorithms. Why? What can be done to mitigate the risks? Where are the priorities and solution sequences that can be adopted to create competitive distinctions? How will measurements and key indicators be used to ensure consistency and growth? Who are the leaders which can adapt to innovational progressions and ecosystem expansions?

There are eight pillars for digital transformation that must be internalized by delivery teams as they prepare for what is yet to come.

- Digital transformation, unlike digitization, is now a continuous process that encompasses the entire enterprise, across financial supply chains, and includes every partner, process, and technology. The norm of program initiatives that encapsulate one-and-done objectives represents only a transient building block of the past business offerings and customer acceptance.

- Digital transformation efforts must be not only adaptable, but also agile in their timeboxing and for the achievement of key performance indicators (#KPI’s) which will evolve with their underlying, rapid-cycle innovations.

- Digital transformation represents the foundational success factors and organizational core competencies to leverage machine learning and artificial intelligence. If digital transformation fails to be sustainable and adaptable, it is highly likely that ML and AI solutions will also fail once introduced into production due to the changing digital ecosystems and their variability.

- The accelerated pace of innovation is disrupting the concentration of industry leaders—many advancements and impacts to their business models and solutions. Additionally, the execution of digital transformation represents hundreds of technological, process, and data advances occurring on a yearly basis thereby straining skills needed within the timeframes demanded.

- Fragmentation of solutions coupled with scarce skills is forcing corporate leadership into unfamiliar and consequential decisions that will have material downstream impacts not limited to establishing and adhering to clear delivery priorities, leadership excellence, and sustainability of digital transformation objectives.

- Digital transformation will be accelerated by the embryonic metaverse as enthusiasm and expectations fuel an “arms-race.” M&A events will reach premium valuations as FOMO pushes forced integrations—where history suggests they are under 15% successful after just 18 months.

- Exemplary innovation leadership leveraging emerging digital technologies is materially contributing to digital transformation failures underpinned by out-of-sync organizational culture requirements—or simply stated the technologies have out run the organization’s ability to sustain them.

- Leaders must not only set the vision, but they also must demonstrate tactical realities and risk mitigation moving the enterprise from legacy processes and technologies to encapsulated building blocks of digital functionality (as utilized within layers of transformative, compartmentalized solutions).

Being more than a bit cheeky, it’s as simple and as complicated as that. Financial leaders and innovation teams seeking to “cash-in” on the morphing metaverse, need to embrace their digital transformation results and assess their processes and capabilities when applied to emerging future requirements. It is also worth noting that to believe the metaverse will be a plug-and-play series of solutions (at this time) would be a fatal mistake. Buying metaverse “solutions” in today’s environment should be viewed through a lens of caveat emptor

In closing, I am reminded of a song made famous by the Rolling Stones—”Sympathy for the Devil.” Digital transformation during the next few years of metaverse’s growing expectations and emerging realities might resemble a skit where the hubris of digital achievements meets the collection of unknowns represented by the merging of physical and virtual ecosystems.

Indeed, for the one-and-done beliefs common across digital transformations where corporate cultures advocate “we have got this,” their confidence in capabilities and situational assessments will likely be misplaced. As a line in the song echoes, “Please allow me to introduce myself …” my name is the financial metaverse, and you are not prepared for what is coming. It is time to be frightened as this is not the Devil we know.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)