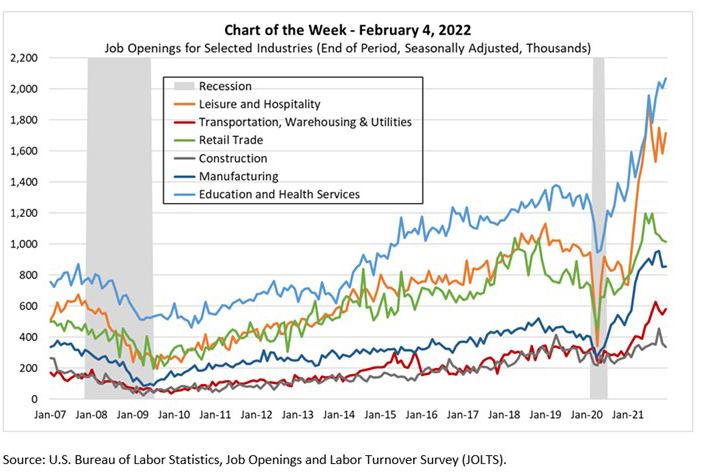

MBA Chart of the Week Feb. 4 2022: Job Openings for Selected Industries

Despite the job market recovery that is still chugging along two years after the start of the COVID-19 pandemic, many employers still face challenges in re-hiring and filling open positions. The most recent Job Openings and Labor Turnover Survey (JOLTS) data from the U.S. Bureau of Labor Statistics showed that there were 10.9 million job openings in December, close to the series high of over 11 million in July.

The number of workers quitting their jobs voluntarily stood at 4.3 million, more than double the pandemic low of 2.1 million quits. The JOLTS data also showed that labor supply remains constrained, and workers looking for jobs have options, with 1.7 job openings available per unemployed individual – almost triple the historical average.

In this week’s MBA Chart of the Week, we updated the JOLTS monthly data series on job openings for selected industries. For example, there were on average fewer than 1 million openings in leisure and hospitality in 2019 (orange line). This fell to 345,000 at the end of April 2020, peaked at 1.9 million in July 2021, and was still over 1.7 million in December. Similarly, education and health services had over 2 million openings in December, setting another record high. Pandemic-related closures, health concerns, and burnout are some possible reasons why these sectors continue to see labor shortages.

Construction openings did see a similar pattern as other sectors, but the number of openings has moderated and is closer to 2019 levels. While builders have reported labor shortages, they also face shortages and delays in obtaining building materials, which likely also limits how much labor they can hire at any given time.

The strong labor demand has fueled an increase in average hourly earnings for all employees on private nonfarm payrolls to $31.63 in January 2022 from $29.93 in January 2021 – a 5.7% increase. This was a pickup from the 4.95% growth in December 2021 and more than double the long run average of 2.80% (although, it lags December’s Consumer Price Index that rose by 7.0%). There is a struggle for employers across many sectors to both hire and retain their workers as the competition for skilled workers heats up. However, the January increase in labor force participation suggests that there is additional potential for more full-time workers to return to the labor force to ease some of these hiring pressures.

- Joel Kan (jkan@mba.org), Edward Seiler (eseiler@mba.org)