January Housing Starts Down 4.1%

Housing starts stumbled out the gate in January amid ongoing supply chain issues and labor shortages, HUD and the Census Bureau reported Thursday.

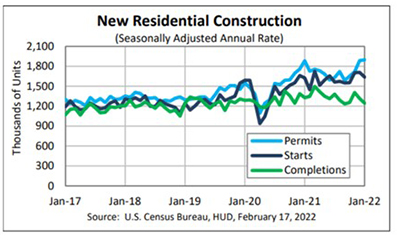

The report said privately owned housing starts in January fell to a seasonally adjusted annual rate of 1,638,000, 4.1 percent below the revised December estimate of 1,708,000, but 0.8 percent higher than a year ago (1,625,000).

Single‐family housing starts in January fell to 1,116,000; 5.6 percent below the revised December figure of 1,182,000. The January rate for units in buildings with five units or more fell to 510,000, down by 2.1 percent from December but up by 8.7 percent from a year ago.

Regionally, starts proved mixed. The largest region, the South, saw a 2 percent decline in starts in January to 880,000 units, seasonally annually adjusted, from 898,000 units in December. From a year ago, however, starts rose by 8.5 percent. In the West, starts jumped by nearly 18 percent to 438,000 units in January from 372,000 units in December and improved by 9.2 percent from a year ago.

In the Midwest, starts fell by nearly 26 percent in January to 200,000 units, seasonally annually adjusted, from 321,000 units in December and fell by 4.3 percent from a year ago. In the Northeast, starts rose by 2.6 percent in January to 120,000 units from 117,000 units in December but fell by 41.2 percent from a year ago.

“Starts and completions fell this month; both will need to increase to keep pace with rising demand from the largest generation, millennials, as they continue to age into their prime home-buying years and find little existing inventory,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif.

Kushi noted lumber prices are on the rise again amid supply chain disruptions and labor shortages at sawmills. “Another spike in prices may further delay new home completions and negatively impact affordability,” she said. “Demand for construction workers is robust, but hiring is difficult. The number of residential building workers has increased for seven straight months and surpassed pre-pandemic levels. Yet, construction hires per job opening in December dipped and remains below pre-pandemic levels. It is more difficult to hire now.”

Mark Vitner, Senior Economist with Wells Fargo Economics, Charlotte, N.C., noted starts for the prior two months revised modestly higher. “Home builders are selling virtually everything they can build,” he said. “In addition to strong demand from traditional buyers, several builders have recently inked deals with institutional buyers for build-to-rent communities. The biggest concerns for builders continue to be on the supply side, with shortages of building materials and labor extending completion times, which is causing many builders to limit sales.”

Vitner said despite the January drop, “home building remains strong across much of the country, particularly in the South and Mountain West, which continue to welcome waves of new residents fleeing higher-cost housing markets in the Northeast and along the West Coast.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., agreed. “Today’s new residential construction report from the Census Bureau pointed toward new home construction’s resiliency thus far in light of rising mortgage rates,” he said.