Consumer Prices Roar Ahead

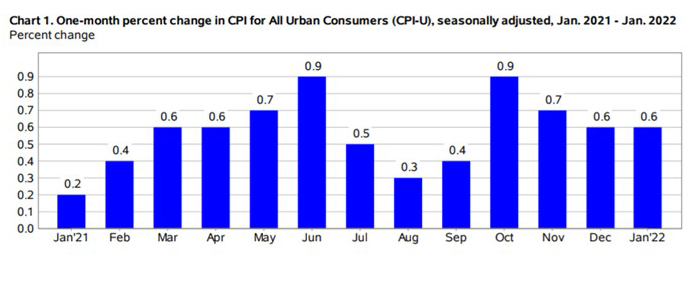

The Consumer Price Index rose by another 0.6 percent in January and by an eye-catching 7.5 percent from a year ago, the Bureau of Labor Statistics reported Thursday.

The report said increases in the indexes for food, electricity and shelter were the largest contributors to the seasonally adjusted all items increase. The food index rose by 0.9 percent in January following a 0.5-percent increase in December. The energy index also increased by 0.9 percent over the month, with an increase in the electricity index partially offset by declines in the gasoline index and the natural gas index.

The index for all items less food and energy rose by 0.6 percent in January, the same as in December and the seventh time in the past 10 months it has increased at least 0.5 percent. Along with the index for shelter, the indexes for household furnishings and operations, used cars and trucks, medical care, and apparel were among many indexes that increased over the month.

The all-items index rose 7.5 percent for the 12 months ending January, the largest 12-month increase since the period ending February 1982. The all-items less food and energy index rose by 6.0 percent, the largest 12-month change since the period ending August 1982. The energy index rose by 27.0 percent over the past year, while the food index increased by 7.0 percent.

“The upside surprise, even as areas like energy goods and autos cooled as expected, illustrates that inflation continues to carry plenty of momentum, and any meaningful slowdown remains elusive,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. The Federal Open Market Committee will get one more look at inflation before its March 15-16 meeting, but today’s CPI keeps the door open for a 50 bps hike out of the gate.”

House said the inertia in inflation looks increasingly difficult to break. “For months now it has been hard to chalk up gains to just a few select industries, even as areas like autos and energy continued to post outsized increases,” she said. “The widening breadth of inflation was on full display in January. Moreover, rising costs for life’s basic necessities, like food, energy and shelter were the largest drivers of inflation this month, pointing to an increasing pinch on real consumer spending.”

House also noted the expected strengthening in housing inflation continued to gather steam, with the primary rent index posting its largest monthly gain since 2001.