Murali Tirupati of Vaultedge: Leveraging Automation to Maximize ROI on MSR Transfers in a Hot Market

Murali Tirupati is co-founder & CEO of Vaultedge (www.vaultedge.com), Coppell, Texas, an AI automation platform that helps companies automate their loan production & servicing processes. He was also a presenter at the tech demo during MBA Tech Solutions Expo 2022. He has more than 20 years of enterprise software consulting and sales in the U.S.

It’s no secret that mortgage markets have been rocky since the beginning of 2022. With the Fed making a war-cry on inflation, interest rates have only ticked upwards. This has led to a precipitous fall in both refi & purchase originations.

However there’s a silver lining.

While back to back rate hikes have dampened origination volumes, they have had a reverse effect on the capital market – which is abuzz with MSR trade deals. In fact, by July 2022, Incenter Mortgage Advisors alone had clocked $180 billion in MSR trades.

Rising interest rates have been a shot in the arm for MSRs. Their valuation has increased manifold due to reduction in rate-related prepayment risk and overall delinquency rates. This in turn, prompted large banks & non-banks to hoard MSR assets in droves.

While MSR portfolio purchase drives asset growth for buyers, it also brings its fair share of risks and cost & quality challenges. The question is, how to leverage tech not only to eliminate these risks but also maximize ROI for the acquired MSR assets.

With the pandemic well behind us, it’s time to move away from the COVID era front-facing tech plays to areas that can give us quick wins, in line with current market realities.

One such quick win would be to automate the long ignored manual servicing processes that are inundated with costly & time consuming inefficiencies.

However, not all ‘automation’ initiatives are built equal. Some generate an ‘order of magnitude’ impact, compared to others.

One such initiative is loan boarding.

Loan boarding automation itself is capable of generating exceptional ROI on headcount, improving portfolio retention & compliance and bridging the valuation gap for secondary market operations.

In this article, we breakdown the exact ‘why’ & ‘how’ of loan boarding automation achieving all of this. Let’s dive in.

MSR transfers keeping mortgage market buoyant

The mortgage-servicing rights market has been clocking impressive trading volumes at unprecedented prices since the start of 2022.

Even today, deal volumes remain robust with mortgage advisory firms such as, Prestwick Mortgage Group , Incenter Mortgage Advisors; and MIAC Analytics coming out with MSR offerings collectively valued at $12.77 billion.

This buoyancy in the MSR market is driven by two factors:

First, originators are cashing in their chips & turning net sellers of servicing portfolios. This offsets revenue losses from dipping production volumes and helps them stay afloat.

Second, large lenders & servicers are turning net buyers, as MSR valuation rises in the current high rate environment. Successive bumps to interest rates, mean loan prepayments will be slower, as compared to refi days. Thus, loan assets are expected to pay out over a longer tenure – jacking up the valuation of servicing portfolios. For MSR buyers, it’s an unmissable opportunity to harvest economies of scale as servicing costs continue to remain high.

While MSR trade is naturally lucrative for both sellers and buyers, there are significant risks associated with servicing transfers that should not be overlooked by either party.

Risks associated with MSR transfers

As servicers load up on MSRs, it’s worth noting some of the prominent risks that come along with the trade:

Repurchase risk

One of the key risks for lenders & servicers is Repurchase / Indemnification risk. GSEs (Fannie Mae & Freddie Mac) and aggregators have strict quality requirements in terms of data integrity and compliance.

As such, they put every loan asset through a rigorous QC & due diligence process. According to STRATMOR’s data, nearly 20% to 30% of the loans offered to an aggregator are not immediately purchased due to ”issues” or areas that need further clarification.

With GSEs, this becomes further complicated. Their turnaround time with feedback on loan quality is much longer than aggregators. This puts servicers at a huge repurchase / indemnification risk, if GSEs were to discover that nearly 20% loan assets didn’t meet the required quality benchmarks.

Hence, MSR buyers & sellers should not only keep investor grade loans in their servicing portfolio but also ensure that loan files are complete, accurate & compliant

Portfolio retention risk

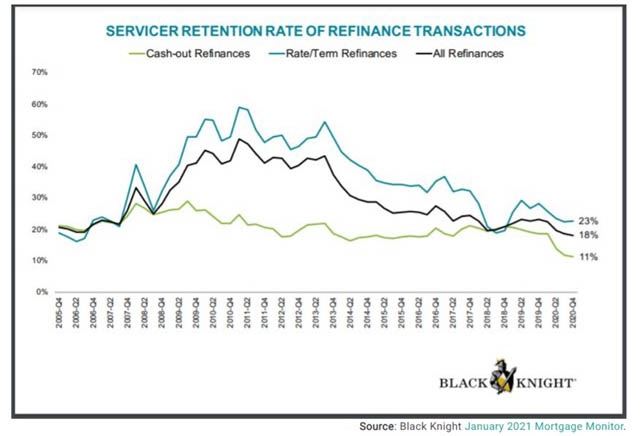

Another area of concern for servicers is portfolio retention risk. As per recent Black Knight data, the overall portfolio retention, recapturing borrowers in the portfolio, is only 18%.

This is because borrower satisfaction takes a massive blow during MSR transfers.

As per a recent survey by J.D. Power, loan transfers hurt consumer trust significantly.

When a loan is transferred from an originator to a servicer, consumer trust in both originator & servicer falls by as much as 20%.

The same survey also highlighted that MSR transfers create administrative headaches for the end consumer.

“More than 40% of mortgage customers, who had a loan transferred, say the transfer process was not “very easy.” – J.D. Power Survey, 2022

The woes for the borrower starts when the acquired MSRs are boarded into the buyer’s servicing platform.

In the absence of a robust loan boarding system, servicers often spend hours with human teams having to review documents and reconcile data. This makes MSR transfers not only slow & costly but also error prone. It soon spirals into a complete nightmare for both downstream teams & borrowers – with needless back & forth in clarifying missing documents & data.

Thus, an efficient loan boarding system enables the servicer to provide that first great experience for the borrower, by making loan transfer head-ache free from the get go.

In other words, how servicers board MSRs have a ripple effect on portfolio retention and feeds directly into improved MSR valuation & actual cash flows.

Compliance risk

The third major pitfall is compliance risk. With CFPB enforcement getting stringent by the day, it’s only prudent that servicers factor in compliance risks arising from sub-servicers, failing to treat the borrowers fairly.

In such a hot market, working with sub servicers becomes akin to walking a double edged sword.

In the absence of an effective inhouse loan boarding system, MSR buyers are compelled to rely on subservicers. Not only do the servicers have to incur hefty fees but also have to go through unnecessary supervisory headaches.

On the other hand, this exposes servicers to the risk of debilitating fines by CFPB, should the subservicer trigger an accidental foreclosure – due to wrongly captured data at the time of loan boarding.

Hence, servicers must have an inhouse system to perform MSR due diligence along with a rigorous oversight process to manage subservicers.

High quality MSR transfers – key to risk mitigation, valuation protection and reputation management

Given the risks yet undeniable benefits of MSR trades, servicers must look out for levers that not only mitigate these risks but also secure their portfolio valuations.

The first opportunity for servicers to mitigate repurchase risk, improve borrower satisfaction and ensure 100% CFPB compliance is by getting MSR boarding – right.

During bulk MSR transfers, documents & data are being received in so many different formats that buyers are unable to keep up with the incongruities.

This lack of standardization in document & data exchange means loan boarding becomes the first failure point for them. They often have to key in information and process documents manually when transferring loans into their servicing systems or delivering loan file packages to subservicers.

It creates extra costs & delays, which ultimately makes it challenging to kick-start loan servicing in a timely manner.

Poor quality transfers have another fall side. They limit trading opportunities for buyers.

Every time lenders & servicers buy loan assets, they end up with a huge pile of due diligence and document processing work on their hands.

This undesirable workload chokes their bandwidth & restricts them from taking up fresh trades.

Thus the key to high quality MSR exchange, lies in intelligent automation that can handle document & data transfer seamlessly between seller’s LOS & buyer’s servicing platform.

Loan boarding automation to optimize MSR transfers

In the current high rate environment, it is prudent to redirect technology investments from front-end transactions & e-closings to solutions that optimize MSR transfers.

One such investment could be around intelligent automation to accurately stack & index loan files, search missing documents, extract data and validate information at scale. It should be able to automatically cross-verify data & document quality irrespective of file format or source – with minimal manual intervention.

Unlike OCR solutions, machine learning based automated document recognition (ADR) technology and automated data extraction (ADE) platforms can achieve this – indexing up to 2 million documents per day & validating data across 2000+ field types. A feat impossible to achieve when processing documents manually.

Such intelligent automation solutions lend themselves well to loan boarding.

With automated data verification & validation capabilities, servicers can:

- Classify and index millions of seller documents without manual intervention

- Extract the data deemed important, compare it against sources and

- Deliver an accurately processed loan file back to the downstream team to upload into the servicing system.

Such a robust loan boarding system can unlock an order of magnitude impact for servicers.

Loan boarding automation – better ROI, compliance & trade opportunities

At a time when cost rationalization is a top most priority, what is the right framework to evaluate whether a solution can deliver ‘order of magnitude impact’ or not.

The answer lies in evaluating if a single tech implementation can drive a positive domino effect across multiple business functions.

Let’s take the case of loan boarding automation.

Loan boarding automation can generate an exceptional ROI on headcount. Servicers can automate up to 80%-90% of document processing & data verification without human touch. This leaves the FTEs to resolve only 10% exceptions manually.

This means servicers can significantly lower FTE costs or simply deploy their employees to other teams. For example, Ocwen was able to reduce its loan boarding headcount by 70% & re-assign to other teams, once they started using Vaultedge.

Additionally for some servicers, this could translate into savings in outsourcing & subservicing fees, as they will find spare bandwidth of FTEs to perform due diligence in-house.

Further, looking at compliance benefits, we see that due to minimal human intervention there’s fewer chances of errors while providing fully compliant loan files. This not only ensures that servicers stay in the good books of CFPB but also retain discrepancy-free MSR assets that conform to investor quality standards.

Lastly, by slashing the turnaround time for transfers to be completed, buyers can move on to the next MSR trade much faster.

However the sweetest fruit – is the lift in first time borrower experience.

An accurate loan boarding ensures that servicers are in a position to provide a warm yet context rich welcome to their newly onboarded customers. This not only improves portfolio retention but also gives consumers the confidence to freely communicate issues with repayment – making it easy for servicers to foresee delinquency & defaults ahead of time.

The current MSR market represents a golden opportunity for buyers and sellers to maximize returns. However, the risks associated with manual processes in a MSR trade could dampen those returns and potentially erode borrower trust. One of the easy routes to avoid this would be to implement high impact automation that improves MSR trade efficiency.

Having said that, if there’s an initiative that should be a part of every MSR buyer’s 2023 tech roadmap, then it should be AI based MSR boarding & due diligence automation.

This will ensure that accurate loan file data is automatically ingested to servicing systems not only for precise downstream processing & secondary market operations but also for a borrower experience that’s par excellence.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)