Biz2Credit: November Loan Approvals Drop at Banks, Credit Unions

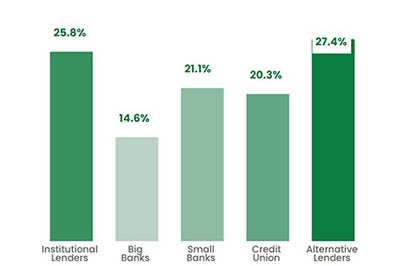

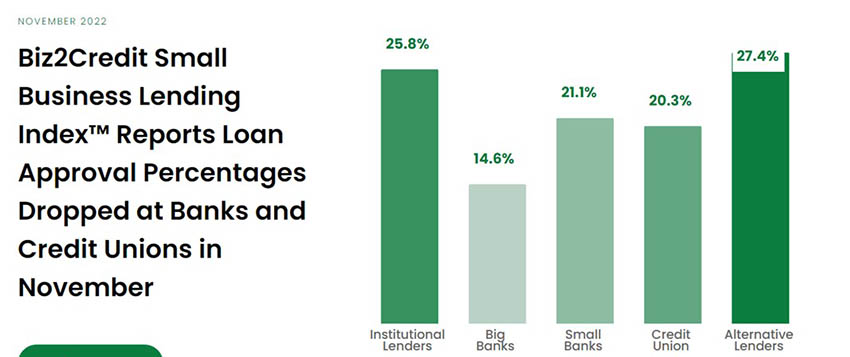

Biz2Credit, New York, said small business loan approval percentages at big banks dropped from 14.7% in October to 14.6% in November, the second lowest total in 2022.

The monthly Biz2Credit Small Business Lending Index also noted approval percentages of business loan applications at small banksdeclined from 21.2% in October to 21.1% in November. Similarly, credit unions approved 20.3% of loan requests in November, a decrease from 20.4% in October.

Among other non-bank lenders, approval percentages of alternative lenders rose from 27.3% in October to 27.4% in November. Institutional Investors also showed an increase in approval percentages, going from 25.7% in October to 25.8% in November.

“With seemingly ever rising interest rates, small businesses are taking a wait-and-see approach to borrowing,” said Rohit Arora, CEO of Biz2Credit. “All eyes will be on what the Federal Reserve announces at its next meeting on Dec. 14. Most experts anticipate another 25bps increase in interest rates. While rates continue to rise, the economy has not yet reaped the benefits of tighter monetary policy as a means to curb inflation.”

Arora said inflation and high cost of capital remain among the top concerns for small business owners. “There is a lot of uncertainty for small businesses in the current economy,” he said. “While we seem to have recovered well from the worst depths of the COVID pandemic, cost pressures — including rising wages, increasing costs of raw materials, and cost of capital — are putting a lot of pressure on small companies at this time.”

Biz2Credit analyzed loan requests from companies in business more than two years with credit scores above 680. The results are based on primary data submitted by more than 1,000 small business owners who applied for funding on Biz2Credit’s platform.